Cotton Australia is predicting the 2022 crop will be the second largest on record. Photo: CRDC

EXPORTERS are bracing for the impact of a container shortage and difficulties in securing ocean freight to target markets as ginning of Australia’s second-largest cotton crop gets under way.

The crop is forecast by Cotton Australia to produce more than 5 million bales (Mb), up from 2.6Mb in 2021, and workforce constraints including labour shortages could also prove challenging this season.

Reliance on containers

The shortage of containers has become a long-term problem for Australian exporters, and cotton is a 100-per-cent containerised export.

RainAg director Ian Grellman said this could pose a major problem for the cotton industry, especially off the back of a huge grain crop.

He said the shortage of containers to pack has inflated the cost of shipping them to some markets, and made it more attractive for some shipping lines to reposition empty boxes to other countries rather than have them export Australian commodities.

Mr Grellman said some shipping lines can earn US$6000-$10,000 for shipping a 40-foot container out of China to other destinations, while the revenue they would get from servicing Australia would be a fraction of that.

He said it was more economical for some to move containers to these high-priced markets as quickly as possible, and shipping raw product, like cotton, only added time that could not be recovered by the prices paid to shipping companies.

“We are hearing reports that some of the shipping lines are shipping empty containers back to China because if they fill them up full of cotton or any other commodity in Australia, it then takes 14 days to get that container back,” Mr Grellman said.

“Some of the merchants now are saying they are not going to buy any more (cotton) until we feel like we execute the bales to the destination.

“As a merchant, any bales you buy now might be the last you deliver.”

Industry pivots after China’s soft ban

Australian Cotton Shippers Association (ACSA) chair Roger Tomkins said this situation will be compounded by the “soft ban” imposed by China in recent in years.

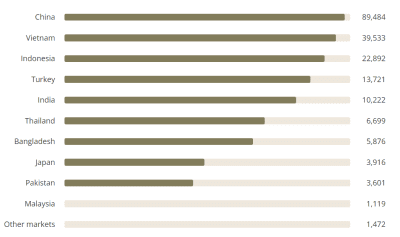

Currently around 5pc of Australia’s production is exported to China, down from 65pc in the 2019-20 season (figure 1).

Australian imports of Chinese goods continues to grow, but most of the 40-foot containers entering the country will not be heading back to China filled with local cotton.

Australia’s major cotton markets are Vietnam, Indonesia, Turkey and Thailand which are not the destination of most shipping lines looking to relocate their containers.

“The difficulty in securing reasonable and reliable freight rates, containers and space on vessels departing Australia, especially to the Indian Sub-continent markets, is restricting our ability to fully diversify into new markets for Australian cotton,” Mr Tomkins said.

“That said Australia does produce a product that this is in high demand and each year all of our production is sold.

“With no significant domestic spinning industry every one of these bales then needs to be, and will be, exported.”

Figure 1. Australia raw cotton exports by selected destination. March 2019 to February 2020. Tonnes. The proportion exported to China has significantly reduced since that time. Source: ABARES published by ACSA.

No end in sight to shipping challenges

Mr Tomkins said the cotton industry was hopeful that the ocean-freight market will reach an equilibrium as soon as possible.

“It would be overly optimistic, however, to think that the market can achieve this in the short term, nor even this year.

“Pundits in the industry believe it may take another few years for global ocean freight to stabilise; let’s hope it’s sooner rather than later for everybody’s sanity.”

Mr Grellman said it was unknown when these pressures would reduce and the supply chain return to pre-COVID conditions.

“We are not going to see much relief this season.

“There is talk that the world’s supply of containers and container vessels is supposed to improve over the next two to three years, but it is difficult to tell at this stage.”

Domestic challenges

Mr Tomkins said ginners also faced challenges securing skilled staff, trucks and warehouse space.

“The cotton industry, like all industries, is being challenged by a general lack of available local resources – be it skilled labour, available trucks or warehouse space.

“Each segment of the supply chain relies implicitly on each other to ensure the bale moves seamlessly from grower to spinner.

“No cotton producing county in the world achieves this with the same speed and efficiency as we do in Australia.

“The cotton industry is a united, collaborative, and resourceful industry and we will need every bit of this ingenuity to seamlessly disperse this crop.

“We are quietly confident that we will, although come Christmas there will surely be many a tired operator.”

Ginning is already under way in the northern cotton regions of Emerald and Moura.

A number of gins are expected to come on line after Easter as harvest accelerates in the central and northern NSW growing regions and in southern Queensland.

It will likely not be until mid to late May that ginning will reach full capacity, with many facilities expected to remain in operation for most of the year.

Grain Central: Get our free news straight to your inbox – Click here

HAVE YOUR SAY