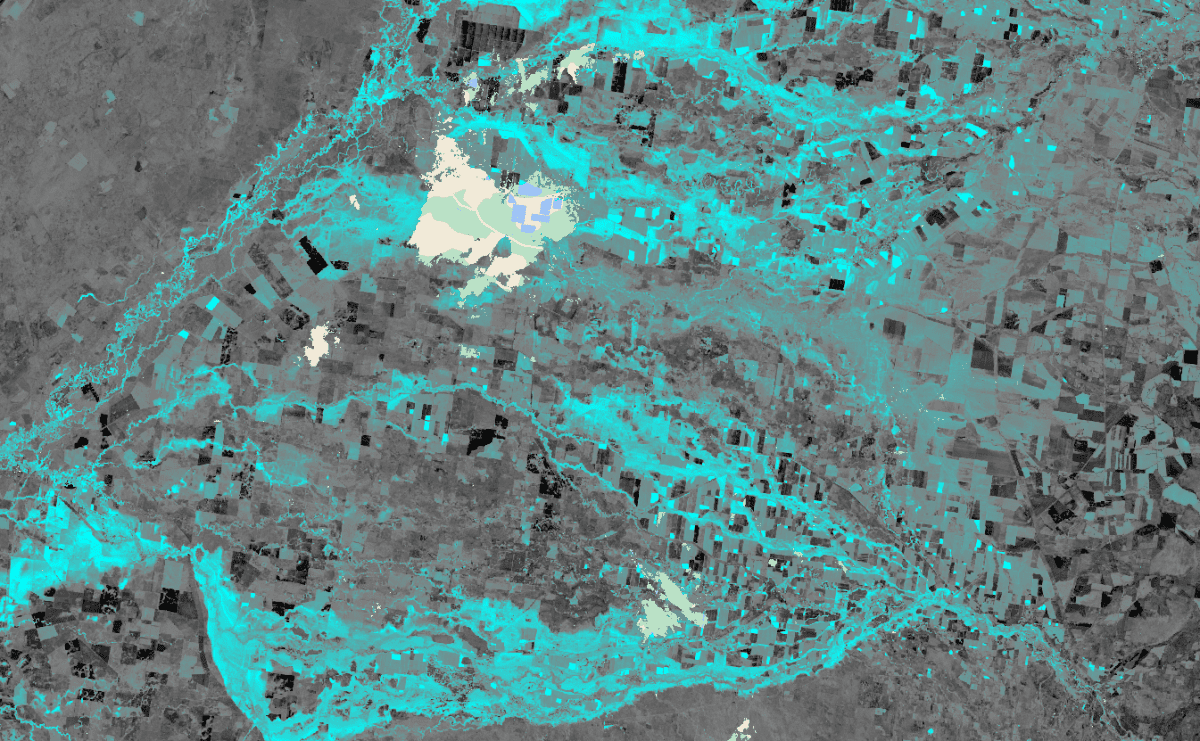

A satellite image of flooding in the Walgett, Moree and Narrabri regions taken on October 29, one week after the flood started. Image: DAS

THE scope of flood damage in south-eastern Australia is coming to light in Digital Agricultural Services (DAS) data.

Relying on data collected via satellite, the business has already estimated flood losses in the Goondiwindi, Gwydir, Moree Plains, Narrabri ,and Walgett Local Government areas in north-west New South Wales and far southern Queensland at nearly 20 per cent of crop.

However, persisting cloud cover and submerged areas of farmland make it too early to similarly assess the impact of the continuing flood event in the Lachlan and Macquarie valleys.

In addition, the impact of waterlogging in Victoria is yet to come to light.

In the Moree Plains LGA alone, DAS estimates NSW floods have destroyed 322,000 tonnes of wheat production, or 25 per cent of what was expected pre-flood.

“The impact on neighbouring areas and other crops is also significant,” DAS co-founder and CEO Anthony Wilmott said.

“For example, Narrabri Shire has lost 78pc of its faba bean crop and 79,000t of wheat.”

Mr Willmott said DAS had adjusted its crop estimates in response to significant rainfall events and associated flooding in Victoria and NSW in mid-October.

“Our approach is to quantify and remove from our estimates plantings which we are confident have been directly lost through flooding.

“This is likely a significant underestimate of grain production loss, but it is a data-driven estimate of certain loss.”

Mr Willmott said DAS analysis focused solely on quantifying the area of crops destroyed by flood through the canopy being submerged or displaced.

“It is not possible to fully quantify the loss of production from these rainfall events because there are many potential causes of loss, and the amount of loss in any given paddock will vary from total loss to minor loss.”

Mr Willmott said potential causes of loss include:

- Destruction of plants such as flattening or removal by floodwater;

- Loss of flowers from heavy rainfall;

- Plant death, or decline in yield potential due to waterlogging;

- Inability to harvest without getting bogged.

Victorian losses could mount

While last month’s flooding in central and northern Victoria has devastated some dairying and fodder-cropping areas, its impact on cash-cropping areas to date appears limited to only 0.4pc, of the state’s total.

DAS earth observations lead Sam Atkinson said losses attributable to waterlogging in the Wimmera and pockets of the Mallee could show up in coming weeks in cereal, canola, and pulse areas.

“The bigger issue in Victoria is the waterlogging; it is going to be significant.”

On the flipside, Mr Atkinson said some parts of the Australian grainbelt, including the Mallee, had rosy prospects.

“Some yields are looking spectacular.”

Foundation in CSIRO

DAS started in 2017, with CSIRO as its initial investor.

The company has commercialised CSIRO’s yield-estimating capabilities, and now has additional stakeholders.

Its subscribers include Rabobank and Nutrien, as well as commodity traders, local and global bulk-grain handlers, and grower owners.

Since 2019, DAS has been producing crop estimates twice monthly from mid-July to late October.

“Our map shows what’s growing and where.”

Its estimates are based on data from the European Space Agency’s Sentinel 2 satellite, which transmits photographs at five-day intervals, and radar data every 12 days.

“It fires out microwave, or radio beams, which can go through cloud and vegetation.”

The radar data provides textural information about the crops, which coupled with the imagery, allows DAS to determine what is growing in Australia’s 1.3 million cropping paddocks.

DAS’ team of 10 developers is constantly refining its machine-learning model to better identify crops and forecast yields based on aspects such as soil types and how they are farmed.

“It relies on knowledge of agronomic practices and gets baked into our design.”

That design makes DAS a uniquely Australian proposition.

Mr Atkinson said changes in cropping practices mean service providers, including input suppliers and grain handlers, need to be ready for increased variables each season.

“There’s a real step change in the way growers are operating their businesses.”

It includes variable-rate applications within paddocks and year-on-year variations across farms as growers factor in rainfall probabilities to guide nitrogen expenditure.

A departure from growers applying median rates means fertiliser companies are among the input suppliers having to respond quickly to changing levels of demand within the growing season.

“Once upon a time, they could forecast fertiliser use; now growers are being much more dynamic.”

HAVE YOUR SAY