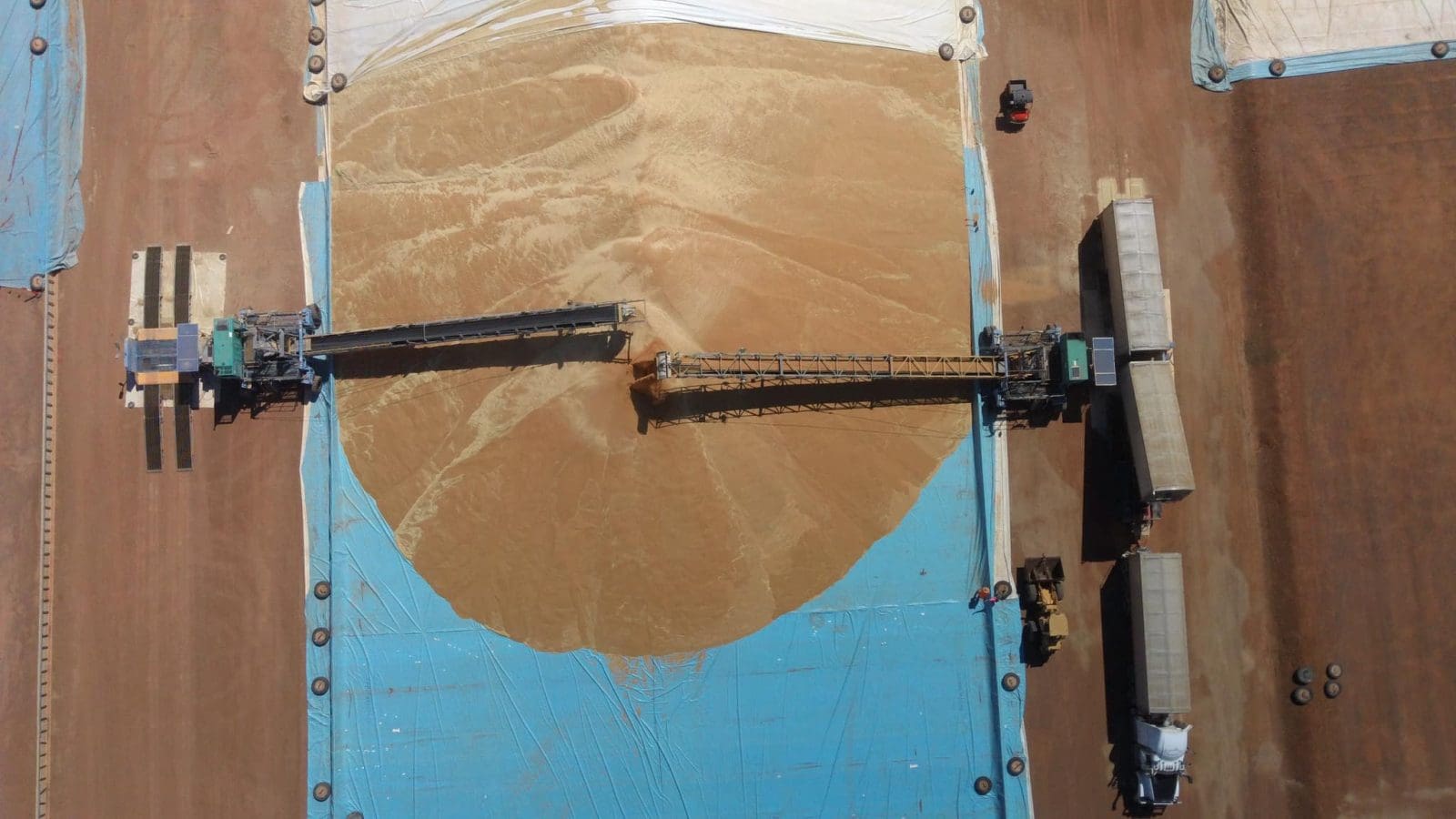

Wheat bunkers building in November at GrainCorp’s Yamala site in Central Qld. Photo: Mat Samin, GrainCorp national quality manager

GRAINCORP expects to report a drop in earnings of about 50pc for its financial year ending September 30, reflecting the smaller eastern Australian crop, and tighter margins.

In a release to the ASX, GrainCorp’s FY24 earnings before interest, taxes, depreciation, and amortisation is predicted to be in the range of $270-$310 million, down from $565M in FY23 and a further drop from the record FY22 outcome of $703M.

Net profit after tax for FY24 is expected to be $65-$95M, a significant drop from the $250M outcome of FY23.

GrainCorp managing director and CEO Robert Spurway said the guidance reflects the normalisation of east coast Australia’s (ECA) growing conditions.

“In FY24, we are seeing a return to more normalised crop volumes and a moderation of margins from historically high levels across our business,” Mr Spurway told the company’s AGM on Wednesday.

“ABARES is currently estimating a 2023-24 ECA winter crop of 21.7 million tonnes (Mt), in line with the 10-year average of 21.6Mt.

Mr Spurway said GrainCorp’s receivals year to date at 8.5Mt, against the February 2023 figure of 11.9Mt, have been supported by GrainCorp opening carry-in position of 3.9Mt.

“It was pleasing to see several of GrainCorp’s up-country sites in Victoria achieve new grain-receival records over the harvest period.”

Mr Spurway said ABARES has forecast an ECA sorghum crop of 1.5Mt, in line with the 10-year historical average.

“[W]e acknowledge some areas faced dry conditions in the northern half of New South Wales, and growers will be pleased to see recent weather conditions have improved the soil-moisture profile across much of the ECA.

“These conditions have boosted the sorghum crop harvest prospects, as well as planting conditions for the 2024-25 winter-crop harvest.”

GrainCorp expects receivals of 10-11Mt in FY24, a slight drop from the FY23 result of 13.9Mt, and exports of 4.5-5.5Mt, down from 8.3Mt in FY23.

Year-to-date exports are 1.7Mt, almost half the February 2023 figure of 3Mt.

Crush remains strong

Mr Spurway said GrainCorp expects oilseed-crush volumes to strengthen in FY24.

“In our Nutrition and Energy businesses, we expect to see further incremental improvements in our oilseed crush volumes through extracting efficiencies from our processing facilities, while crush margins have moderated from FY23 levels.”

He said the company continues to have confidence in the segment as well as the potential to enter the biofuels industry.

“We continue to progress our work to build sustainable fuel production capability in Australia, including through our recently announced collaboration with IFM Investors.

“The development of a domestic biofuels industry presents an exciting opportunity for Australian growers, who produce excess supply of valuable feedstocks like canola for crop-based oils.

“As a leading biofuel feedstock supplier, GrainCorp is briefing the Federal Government on the role that agriculture can play and supporting policy development in respect of onshore sustainable fuel refining capability for the aviation sector.”

WA opportunities

Mr Spurway said Western Australia will “play an important role” in GrainCorp’s strategy to develop this new domestic market.

“We also continue to progress our proposed new crush facility in Western Australia, working closely with supply chain participants and stakeholders.”

He said GrainCorp had also commenced a “business and systems transformation program” to unlock efficiencies in the company’s operations.

“The initial design phase is expected to be completed in the coming months, and we anticipate first half total spend on the program to be $10M-$12M.

“The finalisation and approval of the business/benefits case is expected to occur early in the second half.”

GrainCorp’s FY24 guidance remains subject to a range of variables, including: second-half grain volumes, including sorghum receivals; timing and volume of grain exports; supply chain and oilseed crush margins; and new-season opportunities in Q4.

Source: GrainCorp

HAVE YOUR SAY