Key points:

- Australian farm confidence has rebounded strongly and is now back at historically-high levels

- Improved farm incomes push business viability reading to all-time high

- Confidence strongest among cotton producers, followed by mixed-livestock and grain farmers

- Sentiment up in all states and sectors

- Seasonal conditions and commodity prices major drivers of confidence

- International markets and global economy reported as biggest concern, along with increasing unease about trade tensions

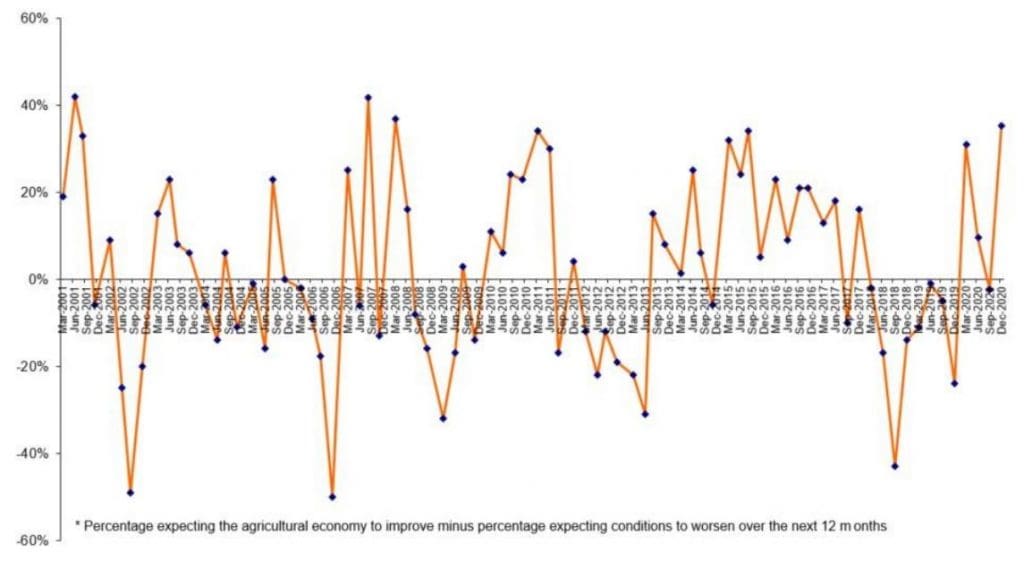

CONFIDENCE among Australian farmers has rallied to above pre-COVID levels, with the latest Rabobank Rural Confidence Survey revealing exceptional seasonal conditions and stellar commodity prices are behind one of the highest rural sentiment readings in two decades.

Despite a year of major disruption and uncertainty in agricultural markets, the quarter four survey, released today, revealed a significant rebound in farm business sentiment, with exceptional spring conditions across much of the country, record-breaking winter grains receivals and high livestock prices all effectively outweighing concerns about the impact of COVID-19 and ongoing trade tensions with China.

And in one of the strongest signs of the strength of commodity prices and farm business performance, the Rural Confidence Survey’s farm viability index – measuring farmers’ assessment of their own business viability – is now at its highest level in the survey’s history, while forecasts for farm incomes over the year ahead have also rebounded considerably.

The latest survey, completed last month, found 43 per cent of farmers nationally expect conditions in the agricultural economy to improve over the coming year, up from 24pc with that view in the September quarter.

The number with a pessimistic outlook also fell sharply – from 27pc last quarter to 8pc – while 46pc of farmers were expecting conditions to remain the same.

Positive outlook across all sectors

Confidence is up in all sectors, but particularly strong among grain, cotton, mixed beef and sheep producers.

Positive sentiment among cotton producers skyrocketed, with a boost to water allocations and a great start to the planting season reassuring many growers for the summer growing period ahead.

Overall, good seasonal conditions and unprecedented commodity prices were overwhelmingly the drivers of improved farmer sentiment this quarter, cited respectively by 72pc and 54pc of respondents with a positive outlook on the coming 12 months as the main reasons for their optimism.

Concern about overseas markets/economies was the dominant factor for those farmers expecting business conditions to worsen over the year ahead – cited by 47pc with a negative outlook, while 16pc nominated concerns about trade with China specifically.

COVID-19 was shown to be less of a worry for farmers this quarter – registering lower on the list as cause for concern for those farmers with a pessimistic outlook. While 10 per cent of the farmers expecting conditions to improve listed the easing of COVID-19 restrictions as a positive influence.

Seasonal turnaround

Rabobank Australia chief executive officer Peter Knoblanche said exceptional seasonal conditions across most of the agricultural regions in the eastern states had enabled farmers to dramatically increase production and profits after years of drought for many.

“While 2020 has been a year of great uncertainty and challenge for everyone in the community, for farmers the extraordinary turnaround in the season has also made it one to remember,” he said.

“After years of drought, and low or no returns for some, the tables have well and truly turned.

“Some of the regions which had been hardest hit by drought are seeing grain receival records smashed, with the highest harvest tonnages in at least 20 years, and in some places ever, being delivered across the NSW grain zone. Grain quality also is excellent in many areas. This harvest will deliver a huge boost to incomes and cash flow for many.”

China concerns

Mr Knoblanche noted though that there was general concern in the agricultural sector about international markets, particularly for some commodities – such as wool, wine, cotton and seafood – due to escalating trade tensions with China.

“And this was evidenced in the survey with concern about relations with China nominated by 16pc of farmers as a reason for taking a pessimistic outlook on the year ahead, compared with just 6pc in the previous quarter,” he said.

Confidence across all states

Farm confidence was up across all states.

In New South Wales, rural sentiment has soared to levels not seen since March 2008 and is the strongest in the country, with 57pc of farmers surveyed in the state having a positive outlook on farm business conditions in the coming year (up from 39pc in September).

Only 3pc of NSW farmers reported having a pessimistic view (down from 20pc in the September survey).

In Victoria, previously-held concerns about the impact of COVID-19 have all-but dissipated thanks to regular rainfall during spring aligning with high commodity prices, pushing farm business sentiment in the state to its highest level since mid-2014.

The number of Victorian farmers expecting business conditions to improve over the coming 12 months has more than doubled since the September survey, with sentiment up across all sectors, driving investment intentions among Victorian farmers to its highest level in six years.

An “almost perfect” spring across Tasmania has bolstered confidence in that state, with rural sentiment in the state rebounding to a 15-month high, and very few farmers expecting a deterioration in business conditions.

South Australian farm sentiment surged this quarter, with the biggest upswing in confidence in almost 15 years – 46pc of the state’s farmers reporting an optimistic outlook, up considerably from just 11pc last quarter. The survey also revealed SA farmers were reporting the highest viability levels in Australia, with 98pc of surveyed farmers in the state saying their farm businesses were viable.

Expectations of a “good average grain harvest” this year have helped rural sentiment recover in Western Australia, reaching a two-year high this quarter.

For Queensland, rural sentiment has made a strong comeback in all sectors this quarter, with cotton and grain producers in particular recording the largest upswing in optimism. While seasonal conditions are still varied, and not all areas have received good rainfall or harvesting conditions, 37pc of Queensland producers now expect agricultural economic conditions to improve over the coming year – up from 23pc last quarter.

Cotton, grain optimistic

Cotton growers were shown to be the most optimistic of all farmers this quarter, with 81pc nationally tipping an improvement in business conditions in the year ahead – a huge lift from the 33pc with that view in September, prior to crops being planted.

Mr Knoblanche said for cotton growers, planting conditions had been greatly improved while increased water allocations mean production levels will be much higher than past years.

Mixed livestock producers are the next most optimistic, with excellent pasture growth in many regions during spring – coupled with stellar prices – boosting income projections in the meat sector for the year ahead. Sentiment in mixed livestock farmers had increased dramatically this quarter and was also above levels recorded in the March survey before the full onset of COVID-19.

Grain grower confidence also rebounded strongly, with 44pc surveyed forecasting an improved outlook on the 12 months ahead compared with 28pc last quarter.

While significant uncertainty hung over wool and some lamb markets last quarter – mostly due to depressed wool prices and concerns about the impact of COVID-19 restrictions on a number of lamb processing facilities in Victoria – the sector’s confidence has recovered to levels now above where they were in March.

This quarter 40pc of sheep producers said they were confident business conditions would improve over the coming year compared with just 10pc with that view in September. The number expecting conditions to worsen is now just nine per cent, compared with 38pc last quarter.

Record farm business viability

The survey’s farm viability index showed 97pc of farmers surveyed reporting their businesses to be viable – the highest level in the survey’s history.

The outlook for farm incomes for the year ahead improved significantly in the latest survey, with 42pc expecting a higher gross farm income, up from 31pc last quarter.

NSW producers were the most bullish in terms of improved income expectations – 56pc of those surveyed expecting incomes to be greater than in the previous 12 months.

Of the sectors, cotton, mixed beef and sheep, grain and dairy all reported strong income expectations for the year ahead.

Mr Knoblanche said farmers’ improved financial positions were feeding into greater investment and expansionary plans across all sectors.

One third of all the farmers surveyed intended to increase total investment in their farm business over the coming year (33pc, from 25pc last quarter). This was greatest in NSW where 43pc intend to increase investment – a sign, Mr Knoblanche said, of drought recovery and investment in ongoing resilience.

On-farm infrastructure and improvements were listed as the investment priority nationally and in most states, while property purchase to expand farming operations was planned by 24pc of those increasing investment nationally, and 33pc in Victoria.

Mr Knoblanche said the continuing strength of the Australian rural property market “hadn’t ceased to amaze”.

“A good season and low interest rates is continuing to support significant investment in rural property across Australia,” he said.

Source: Rabobank

Grain Central: Get our free cropping news straight to your inbox – Click here

HAVE YOUR SAY