The 2023-24 harvest in WA was one of good quality, but it produced significantly less grain than the previous two seasons. Photo: Bunge WA

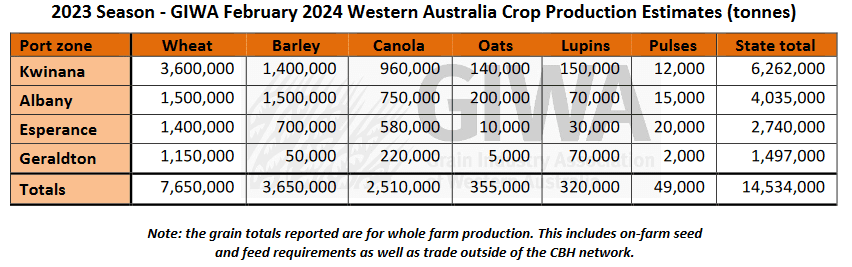

WESTERN Australia’s latest winter-crop harvest has weighed in at 14.53 million tonnes (Mt), according to the Grain Industry Association of WA’s final estimates for the season released this week in its 2023-24 harvest summary.

The estimate is up 2 per cent from 14.28Mt seen in GIWA’s December Crop Report, but is close to half the production seen in the record years of 2021-22 and 2022-23 at 24.01Mt and 26.06Mt respectively.

“For many growers, total rainfall received in 2023 was well down on 2019 rainfall, when 11.3Mt was produced on a similar area of crop sown,” GIWA report author Michael Lamond said.

“Subtle improvements in production systems are tending to buffer the downside of these poor years and push grain yields well beyond previous records in good seasons.”

GIWA puts WA’s five-year grain production average to 2023 at 18Mt, up 18pc from the five-year average to 2018 of 15.2Mt.

“Whilst there is more area of crop being sown now than 10 years ago, the increased variability of

rainfall events has forced growers to change their production systems to adapt to the changing weather

patterns, and this is clearly showing up in the production figures,” Mr Lamond said.

“Grain production in Western Australia is still on a linear trajectory upwards despite increased variability in a drying, warming climate.”

Quality stands up

Mr Lamond said the contrast in quality between 2022 and 2023 could not have been starker.

“In 2022, about 3pc of wheat deliveries were high protein that made Hard grades of one sort or another, whereas in 2023, 47pc made Hard, a reflection of the tough growing conditions and blunt finish.

“In years like this, you would normally expect a high proportion of cereal production to fall out of the higher grades due to screenings, although in 2023 only 18pc of wheat fell into utility or feed grades due to high screenings.”

Mr Lamond said while seed size was generally small, screenings did not blow out as much as expected.

“As a result, overall grain quality was very good and enabled growers to make up some ground in dollar returns in a lower-production year.”

WA crop area in recent years has been around 9 million hectares (Mha), with just under 8.5Mha sown last season, less than in 2022 due to the lack of subsoil moisture in many regions heading into the season, a late break, and a below-average outlook for rainfall.

Questions around sheep

Mr Lamond said WA’s livestock production has flatlined over the past decade, and area dedicated to grazing in mixed-farming enterprises may trend down.

“The ongoing dramas with the live sheep export trade are certainly going to have an influence on driving crop area up in 2024 in the regions where sheep are still prevalent.

“Less sheep will require less pasture, with this pasture area being substituted for crops.”

In a higher-rainfall areas, there may be a slight increase in cropped areas due to the current low sheep prices driving turnoff if a home can be found for the excess livestock.

Watching the weather

Mr Lamond said many growers in the north and eastern parts of the state’s grain-growing regions in 2023 lost some of the gains made from in the 2021 and 2022 seasons, and budgets for them are tight heading into 2024.

“If the very dry and hot summer continues, a reduction in crop area will be seen in the lower-rainfall areas of the state as more country is turned over to fallow, reducing the crop area in these regions where most of the reduction in area from 2022 to 2023 occurred.”

“Unless autumn rainfall is significant, a contraction back to wheat from crops such as canola which have higher input costs is likely right across the state.

“Good autumn rains are needed to minimise the risk of not achieving breakeven canola yields.”

Canola area was just under 1.9Mha in 2023, down 14pc on the area planted in 2022.

“Canola has been the go-to crop in recent years, although with growers maintaining a more risk-averse approach heading into 2024, it is unlikely area will go up unless there is good subsoil moisture and an early general break to the season.”

Mr Lamond said significant changes to cropping plans were unlikely this year, but if hot and dry conditions continue, area planted and input costs will be pared back.

“Subsoil-moisture levels are very low in most regions, and there have been record maximum temperatures in January and the start of February that have burnt off the few weeds that did germinate in some of the areas that had the storms in January.

“There are no summer weeds worth speaking of and no reason to get out in the paddocks other than for deep ripping and lime spreading.”

For the low-rainfall areas, there will certainly be more fallow on the heavy country, unless there is significant autumn rain to top up the soil-moisture profiles.

Decision time nears for crop mix

Mr Lamond said the quick finish to the season did not allow the wheat crops to fill their potential, but barley performed well in 2023.

“The newer barley varieties have more robust disease packages and require less reliance on fungicides, particularly in the higher-rainfall regions, which was in part driving down area planted.

“This looks to have stabilised, and barley is back in favour in most of the southern regions of the state.”

The next two and a half months will determine the change in canola area and from then on, the wheat-barley split.

This will be largely dependent on the timing of the break to the season and how much autumn rain we receive.

For the higher-rainfall areas, there will be more of an enterprise shift rather than a significant change in area cropped.

Barley is back in favour due to its relative grain-yield performance compared to wheat recently, and the re-opening of the China export market.

Canola area could swing with a drop back to around 1.5Mha from 1.87Mha in 2023 if there is a late break, to over 2Mha if conditions are favourable at optimum planting times.

Although the continuing slide in canola prices will put a cap on the area sown to some degree, and even with good early rains, it is unlikely we will see a return to the record area planted in 2022.

In 2023, lupin area was down to about 4.9pc of the total crop area sown in the state, and is unlikely to increase significantly in 2024, even at the current high prices.

The majority of the lupin area is no longer within the Geraldton port zone, where very dry conditions at seeding time last year saw plantings drop from being 32pc of the WA total to 25pc.

“Whilst this will likely go back up with a good start to the season, that isn’t going to change the statewide

picture much because in the remainder of the state, lupins comprise only a small percentage of the rotation on soil types that suit them, and plantings are influenced by reasons other than price.”

Mr Lamond said oats were still a minor crop and accounted for only 2.3pc of the cropped area in 2023.

“Some growers who currently grow oats may increase the area sown due to the current high prices offered.”

Despite the sustained increasing demand for milling oats, Mr Lamond said its grain yield being lower than other cereals, and the risk of not hitting specs meant a big swing into grain oats was not expected.

“The oat grain/hay swap area is also unlikely to alter greatly as many growers exited the hay game recently when markets collapsed, and are unlikely to return overnight.”

Mr Lamond said the combined total area of all field pea, faba bean, lentil and chickpea crops in WA year was less than 1pc of WA’s total crop area, and the outlook for a change in pulse area was again subdued.

“Whilst growers continue to dabble, erratic prices and limited marketing options continue to be more of a deterrent than the obvious benefits to the rotation.”

Source: GIWA

Further detail on crop conditions in individual WA port zones can be found as part of the full report on the GIWA website.

HAVE YOUR SAY