Dry conditions and reduced prices for some agricultural commodities will result in reduced farm incomes for 2023-24. Photo: ABARES

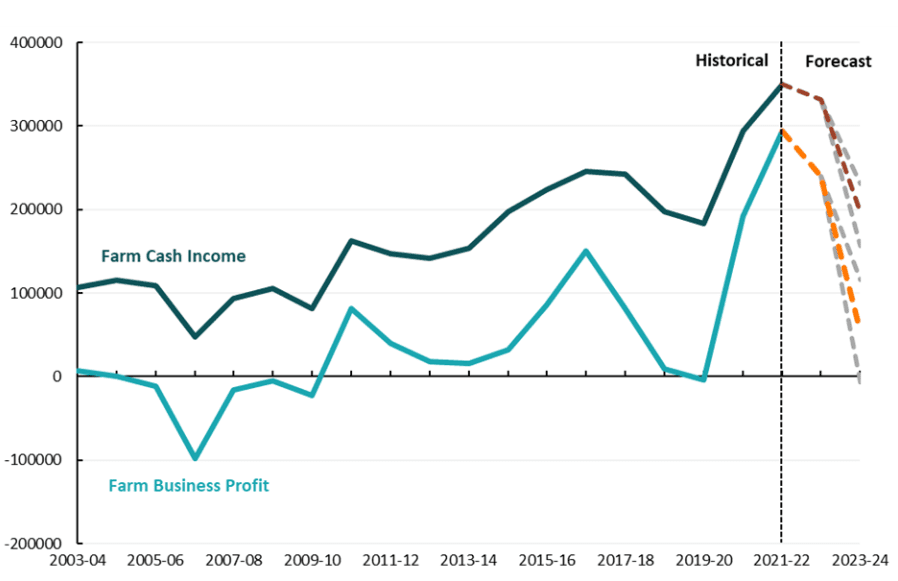

AFTER two record years, broadacre farm incomes are forecast to fall significantly in 2023-24 due to drier conditions and lower prices for agricultural commodities, according to new modelling released by ABARES.

Incomes for cropping farms are forecast to decline by 45 percent to average around $627,000 nationally in 2023-24.

This is not surprising, considering 2021-22 and 2022-23 were two of the best years on record for cropping farm incomes, with favourable climate conditions and commodity prices.

Due to drier conditions, production for major winter crops is forecast to fall significantly in 2023-24, with declines in national production of wheat, down 36pc, barley, down 26pc, and oilseeds. down 38pc, driving reduced crop revenue.

ABARES executive director Jared Greenville said at a national level, average farm cash income for broadacre farms is expected to decrease 41pc to $197,000 per farm in 2023-24, representing a fall in incomes back to levels seen three years ago.

“We are expecting incomes well below the long-term average in parts of northern New South Wales and southern Queensland and the northern parts of the Western Australian cropping zone, mainly due to drier conditions resulting in lower crop yields,” Dr Greenville said.

“Incomes are also forecast to be well below average in parts of southern Victoria and South Australia, as well as parts of Tasmania and Western Australia, due to a combination of dry conditions and declining sheep, lamb, and wool prices.

“Livestock farms will be affected by large decreases in prices for beef cattle and sheep, with sheep farm incomes forecast to be well below average.

“It’s important to note these numbers are based on price and weather forecasts from early September.

“Prices for cattle and sheep have fallen further in recent weeks so there is likely more downside risk to these forecasts than upside at present.”

Average farm cash income and farm business profit for broadacre farms. Source: ABARES

Little benefit from falling input costs

While costs for major farm inputs such as fertilisers, chemicals and fuel are forecast to fall in 2023-24, this will be more than offset by reductions in receipts from the sale of all major farm outputs, leading to an overall decrease in farm cash income, according to ABARES.

Considerably higher fertiliser prices were one of the biggest contributors to higher farm input costs during this period.

However, in 2023-24, fertiliser prices are forecast to ease, contributing to a reduction in farm input costs as supply chains stabilise post-COVID.

Additionally, anticipated drier conditions are projected to lead to reduced use of inputs and consequently lower overall costs.

While total farm costs are forecast to decrease, some input costs will increase, including fodder due to drier conditions, and interest payments due to rising interest rates.

Source: ABARES

HAVE YOUR SAY