THE value of Australian crop production is forecast to remain unchanged from 2018–19 at $30 billion, weighed down by lower prices compared to the high domestic grain prices 2018–19, according to ABARES’ June quarter Agricultural Commodities Report released today.

Average to above average rainfall and an improvement in soil moisture levels across large areas of south-eastern Australia and the cropping region of central Queensland have provided a better start to this season’s winter crop compared with the same period last year.

ABARES predicts that, assuming adequate rainfall, Australia’s grain production will increase by 20 per cent to 36.4 million tonnes (Mt) this season. That will be 10pc below the 10-year average.

ABARES predicts that, assuming adequate rainfall, Australia’s grain production will increase by 20 per cent to 36.4 million tonnes (Mt) this season. That will be 10pc below the 10-year average.

Crop export earnings are forecast to increase by 3pc, driven by increased grain, oilseed and pulse exports.

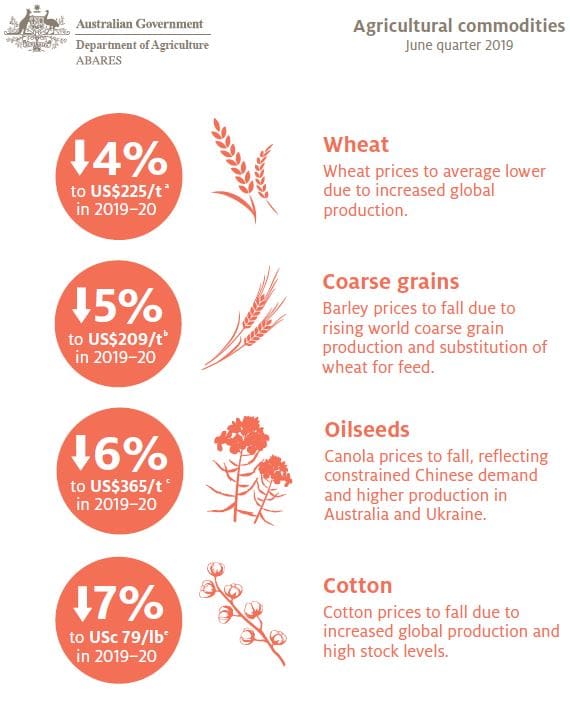

However, world prices are forecast to decline for most major crops, including wheat and barley.

China–US trade dispute

ABARES says the China–US trade dispute is a key downside risk to 2019–20 export forecasts. High import tariffs introduced by China on US agricultural goods are providing some Australian exporters with a competitive advantage over the United States.

Beyond 2019–20, these benefits are likely to be offset by reduced export demand as incomes of affected consumers grow more slowly over the long term.

The trade dispute could reduce import demand for agricultural goods in China and other markets important to Australia.

Crop production concerns

Low winter crop production across Australia’s eastern states in 2018–19 has reduced the availability of grain for domestic consumption and led to increased prices.

This has raised concerns over the availability of grains in 2019–20 if seasonal conditions remain unfavourable for crop production.

The 2019–20 winter cropping season has had a mixed start and the chance of a positive Indian Ocean Dipole (IOD) event developing has increased.

A positive IOD often results in below average winter–spring rainfall particularly in central and south-eastern Australia.

This represents a significant downside risk to final winter crop production levels in 2019–20.

Wheat production to recover

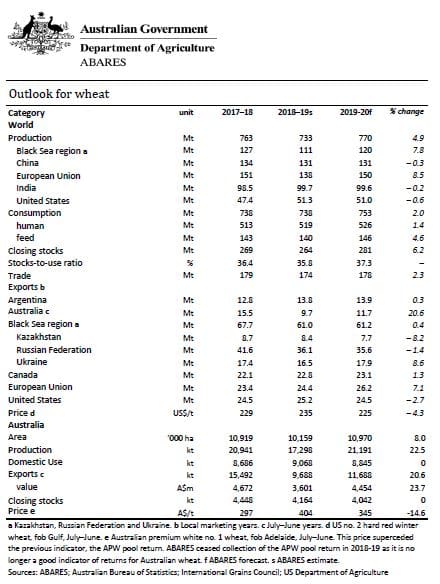

ABARES forecasts Australian wheat production to increase 22pc over the drought affected 2018–19 crop.

Although planting conditions have been below average in parts of New South Wales, southern Queensland and Western Australia, production is expected to increase to around 21 million tonnes.

Australian wheat exports in 2018–19 are estimated to be 45pc below the five-year average, at around 9.7 million tonnes.

Australian wheat has been less competitive on world wheat markets due to high domestic prices.

In 2019–20 wheat exports are forecast to increase in value and volume due to increased production and lower domestic demand as drought conditions ease.

Continued growth in world food, feed and industrial consumption is expected to support demand for Australia’s exports.

However, increased supply from all major exporters will make global trade very competitive.

Opportunities and challenges

As a result of high domestic feed grain prices due to the eastern Australia drought, wheat usually exported to global markets is being shipped from Western Australia and South Australia to Australia’s eastern states.

The probability of the 2019–20 winter cropping season being affected by equally adverse seasonal conditions is low.

However, if this does occur, grain stocks will be expected to fall to record low levels and already high domestic grain prices would increase as would the demand for bulk grain imports.

Australia importing wheat

For the first time since 2006, a number of bulk grain import permits for high-protein Canadian milling wheat were issued in May 2019.

The applications for the permits reflect a significant fall in supplies of high protein milling wheat following consecutive years of low production in the eastern states.

In a normal season, importing grain from Canada would not be economically viable.

Coarse grain production increase

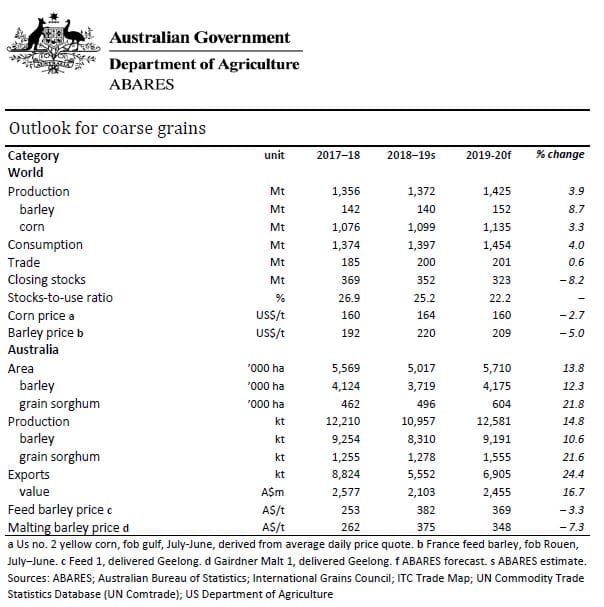

The area planted to Australian coarse grains is forecast to increase by 14pc in 2019–20 to 5.7million hectares, due to an expansion in plantings of barley, oats and grain sorghum.

The forecast reflects average to above average autumn rains in Victoria, SA and southern NSW, and relatively high prices for barley and oats compared with alternatives.

Barley production is forecast to rise to around 9.2Mt, 3pc higher than the 10-year average to 2018–19.

Oats production is forecast to rise to 1.3Mt, slightly above the 10-year average.

Assuming average seasonal conditions during spring and summer in NSW and Queensland, the area planted to grain sorghum is forecast to rise by 15pc in 2019–20 to 604,000 hectares.

Growing demand for grain sorghum for feed and ethanol use and forecast lower cotton prices are expected to encourage a shift from cultivation of dryland cotton to grain sorghum.

Despite strong domestic demand for feed grain, Australian coarse grain exports are expected to increase to 6.8Mt in 2019–20.

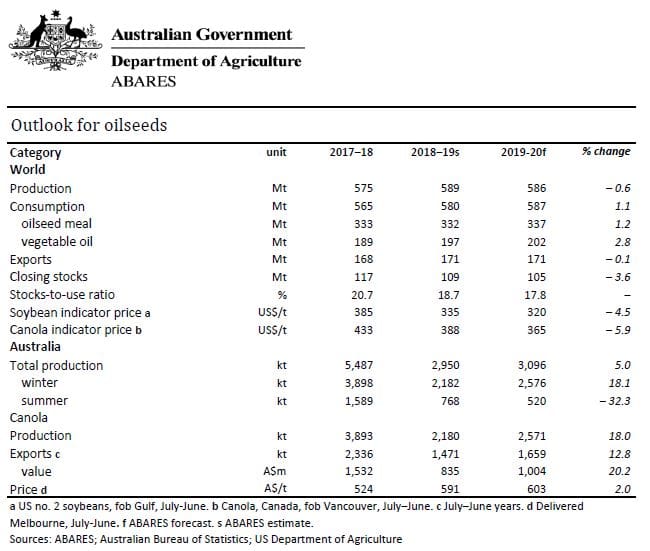

Canola to remain below average

Australian canola production is forecast to rise in 2019–20 due to better forecast growing conditions than last year, when significant abandonment occurred.

However, production is still expected to remain well below the five-year average to 2017–18.

This is due to below average planted area, reflecting lower expected returns for canola relative to wheat and barley.

Export volumes are forecast to increase in line with production.

Cotton price drop

World cotton prices are expected to fall in 2019–20 as a result of increased world production, high prevailing stock levels, and competition from synthetic fibres.

This fall comes from high price levels in 2018–19 supported by strong demand and lower than expected production.

Australian cotton production is forecast to decline further in 2019–20 after a significant decline in 2018–19.

Low dam storage and soil moisture levels have resulted in a decline in Australian cotton planting.

Any recovery in production levels from 2019–20 is likely to be constrained by the availability of irrigation water following two years of dry seasonal conditions in eastern Australia.

The last three recharge events for irrigation dams in the main cotton-producing regions occurred during a La Niña.

La Niña conditions are not expected for the coming winter when significant dam recharge usually occurs.

Source: ABARES

Agricultural Commodities Report: http://www.agriculture.gov.au/abares/research-topics/agricultural-commodities/jun-2019

HAVE YOUR SAY