NAMOI Cotton has advised shareholders to accept the off-market takeover bid from Olam Agri, parent company of Queensland Cotton, to acquire all Namoi shares for 70 cents.

This announcement comes over one week after Namoi’s independent directors recommended shareholders reject Louis Dreyfus Company’s competing offer of 67c.

In a release to the ASX on Friday, Namoi’s indepdent directors, Tim Watson, Robert Green, Juanita Hamparsum, Ian Wilton and James Davies unanimously put their support behind Olam’s bid “in the absence of a superior proposal”, and subject to the offer remaining “fair and reasonable”.

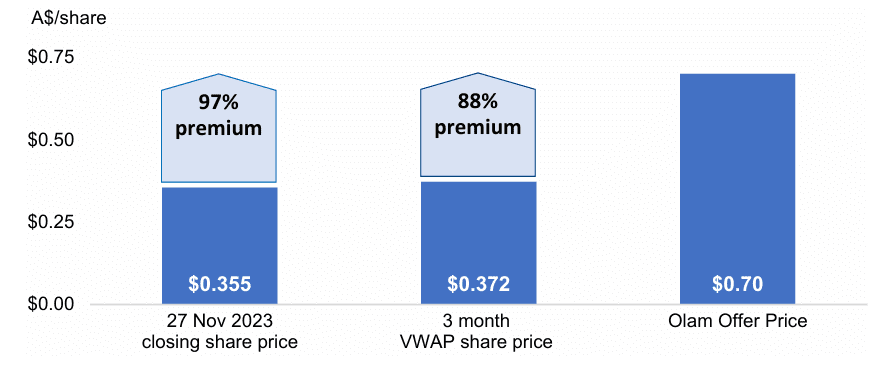

The statement said the bid “values Namoi at a substantial premium” to historic market prices and “provides cash certainty” to shareholders.

Namoi’s largest shareholder, Samuel Terry Asset Management, holds a 25 percent stake in the company, and has also indicated it supports the offer.

The advice comes after independent expert, BDO Corporate Finance, “estimated the fair market value of the Namoi Shares to be in the range of 42c to 78c per Namoi Share” putting Olam’s offer at the higher end of the scale.

Shareholders have until 7pm on June 18 to accept the offer from Olam.

The offer remains conditional on the takeover receiving FIRB approvals and clearance from the Australian Competition and Consumer Commission as well as Olam acquiring at least 50.1pc of all Namoi shares.

The ACCC is expected to release its findings following an informal review into Olam’s takeover proposal on July 4.

Namoi’s independent directors said the offer was well above the 2023 price and the three-month volume-weighted average price. Source: Namoi

LDC offer future

In a release to the ASX, Namoi’s independent directors said they considered LDC’s offer “to be an inferior proposal”, but reminded shareholders that if they were to accept Olam’s bid, this could not be withdrawn.

“This means that if LDC were to increase the LDC Takeover Offer Price such that it were to become a superior offer…that Namoi Shareholder would not be able to accept the LDC Takeover Offer,” the statement said.

LDC’s current off-market takeover bid for 67c was set to expire on June 7.

However, lawyers acting for LDC, Arnold Bloch Leiber, on Friday, announced an extension to the closing date until June 21.

Last Monday, LDC also revealed it had increased its stake in Namoi from 16.99pc to 18.02pc or an increase of 2.12 million shares.

This came after some shareholders opted to accept LDC’s 67c offer between May 7 and May 24.

Compulsory takeover option

Both Olam and LDC have indicated that they would exercise the option to compulsorily acquire all outstanding Namoi shares if either reached the threshold, namely of holding at least a 90pc stake in the company.

Olam appears unlikely to reach this threshold, with LDC previously advising its intention not to accept the competing bid.

Olam currently has only a 0.42pc interest in Namoi, arising out of shareholders accepting the company’s offer.

If neither offer succeeds

If Olam acquires less than 90pc interest but more than the minimum offer acceptance condition of 50.1pc, all remaining Namoi shareholders will become “minority shareholders in Namoi”.

The ASX release warns implications of this result could include a reduction in share value due to a reduction in share traded and the risk that Namoi could be removed from the market due to “lack of free float and/or liquidity”.

In this scenario, majority shareholder Olam could potentially make changes to Namoi’s board, constitution, strategic direction and capital management.

Takeover timeline

Olam first made a non-binding offer to acquire all Namoi shares on March 21 for 59c per share, or 57c off-market.

The bid came in response to Namoi, on January 19, entering into a binding agreement with LDC, which would acquire all Namoi shares at 51c.

LDC further upped its offer on April 29, before Olam countered on May 2.

LDC’s last bid of 67c was received on May 7.

The company on May 16 received an unfavourable response from ACCC, with the competition watchdog raising concerns about LDC’s proposed acquisition of Namoi.

The Statement of Issues report cited a possible reduction in competition for the burgeoning northern Australian industry if the sale progresses.

Source: Namoi Cotton

HAVE YOUR SAY