WHILE Australian oats have not experienced the level of demand that has caused wheat and barley prices to skyrocket, industry members say this should not deter growers from producing the highly desired commodity.

ABARES estimates the national oat crop dropped from 1.67 million tonnes (Mt) in 2020-21 to 1.62Mt in 2021-22.

Western Australia is by far the largest producer, growing an estimated 800,000 tonnes in 2021-22; followed by New South Wales with 406,000t and Victoria with 270,000t.

According to the USDA’s April 2022 Global Market Analysis, 600,000t of the 2021-22 crop was exported, making Australia the second-largest oat exporter behind world leader, Canada, which exported 1.3Mt in the same trade year.

Although still dominant, Canada’s 2021-22 export total was the lowest in recent years, with drought hampering the countries’ ability to service global and domestic demand.

With Canada and Australia not primarily servicing the same markets, the reduction in the leader’s production has not made a big impact on the global demand for local oats.

This, alongside shipping constraints and another large Australian crop, has had a negative impact on oat prices to growers which went from the mid-to-low $300s in 2021 to under $300 this year.

Prices in 2022 have also sat as low as the mid-$200s.

Oats behind wheat, barley

Based at Geelong, Unigrain is a producer of oat-cereal, pulse and animal-nutrition products.

Unigrain’s Andrew May said factors that drove up the wheat and barley price, including the Russia-Ukraine conflict, have not impacted oats.

Despite the price stagnation, he said Unigrain remained confident about the long-term outlook for oats.

“It is important to look at the oat industry in terms of the longer period cycle rather than simply that oats have underperformed price-wise relative to wheat and barley in the last 18 months,” Mr May said.

“It is just really that the factors that have driven the price of those cereals haven’t been seen in the oat industry, but that doesn’t mean the outlook for the oat industry isn’t positive.

“We will go through cycles where oats are more expensive than wheat and barley and other cycles where wheat and barley is more expensive.

“However, the reality is that the market keeps growing, and we are very bullish in terms of the outlook for the agriculture industry.

“The message we provide to growers is as we progress forward, we will need to set a price that can compete with [wheat and barley] to make sure the country delivers enough oats to the market.”

CBH Group’s chief marketing and trading officer Jason Craig agrees export demand for Australian oats, especially milling oats, needs to be seen as a long-term opportunity for growers.

WA’s CBH Group receives and exports about 90 per cent of the state’s grain harvest, including both milling and feed oats.

Just this month CBH sent 40,000t of bulk oats to Mexico, and a further 8000t to the United Arab Emirates.

“Demand for Western Australian milling oats has been consistent with existing long-term market demand,” Mr Craig said.

“Both UAE and Mexico are long-term markets.”

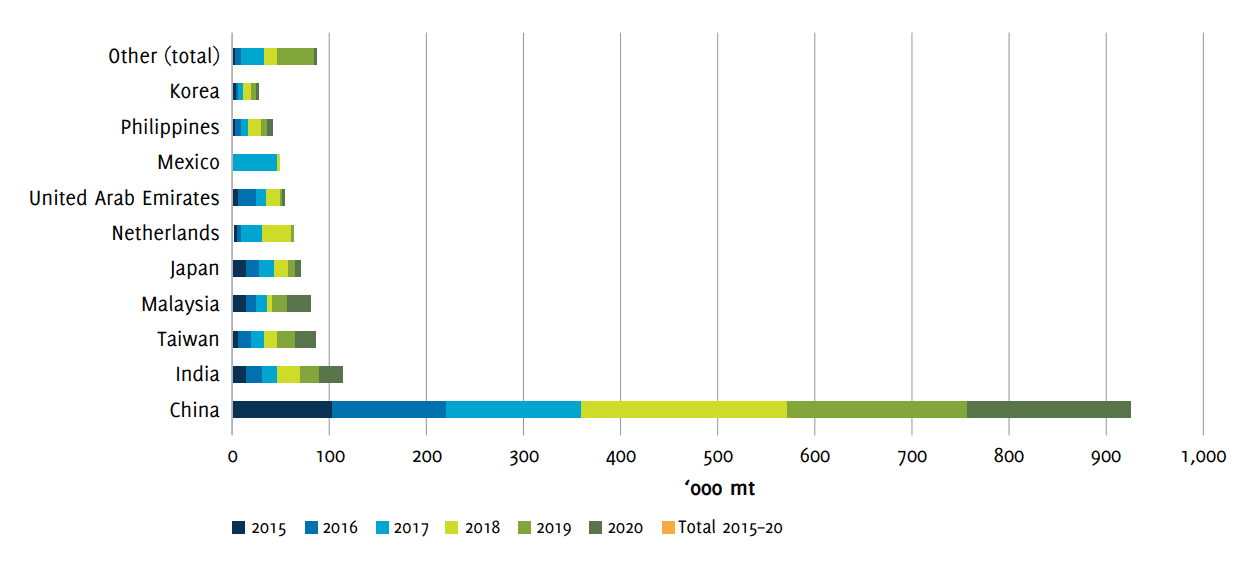

He said China remains one of WA’s largest milling-oat markets.

Western Australia oat exports, 2016-2020, showing China as overwhelmingly the largest market. Source: AEGIC

Canadian drought has minimal impact

Mr Craig said it has been feed oats rather than milling that has seen increased global interest due to drought in some countries.

“On a comparative basis, feed oats are becoming competitive against other grains due to drought conditions in the northern hemisphere, which has increased some interest in non-traditional markets for WA oats.”

Although CBH has seen this added interest, Mr May said the drought and reduction of production coming out of countries such as Canada and Chile has not resulted in price increases for WA growers.

“Over the last 12 months, what we have seen is a reduction of the supply of products from Canada, and the reduction of the supply of product from Chile, and that has assisted in creating demand in some Asian countries where we compete with those exporters.

“Ultimately those two markets have not necessarily been big importers into Asia, so therefore, the challenges in those markets have made as bigger change in Asia as one might imagine.”

The global oat trade data from April 2022 with Canada still a major exporter of oats. TY = trade year. Source: Foreign Agricultural Service/USDA Global Market Analysis.

Dietary changes observed

Mr May said he has witnessed an increased demand for Australian oats from Asian markets due to changing diets and desire for healthy, sustainable product.

He said countries like China, Taiwan, Japan, and Vietnam continue to lead as importers of Australian oats.

“All the South-east Asian markets are continuing to consume more and more oat product, for conventional cereals and, more increasingly, for the production of oat milk.

“What we can do in Australia is deliver a product that is sustainably grown and that comes from farms where crops are finished naturally.

“That is particularly a big advantage over North America, where oat crops continue to be desiccated by glyphosate.

“Into Asia, we have very strong connections where there is a broader perception amongst consumers that Australia is the premium country for oat inputs.”

India still hindered by tariffs

Mr May said India is another market which is increasing its consumption of oats.

However, growth in this market has been impeded by tariffs.

The Australia-India Economic Cooperation and Trade Agreement offers some hope by saying tariffs on oats from the second half of this year will be bound at zero, meaning India will not be able to raise them in the future.

According to an Australian Export Grains Innovation Centre presentation earlier this year, India’s tariff on processed oats is currently set at 30pc.

“Over the last 12 months, product from Australia to India has increased materially as some of that was to the detriment of Chile in particular.

“Oats have been excluded from the Indian free trade agreement, and that was definitely disappointing.

“I think it is fair to say that if tariffs had come off both oat flakes and from oats into India that would have been of material benefit to the Australian oat industry.”

Independent Grain Handlers, Rob Proud, said despite theses challenges, he sees further growth for the Indian market as Indian consumers increasingly looked to oat products for their health benefits.

“India is a growing consumer of Australian oats and that market is growing and looks to continue to grow,” Mr Proud said.

“It is a great opportunity for us, assuming we meet the weed seed requirements.”

Exports to Asian manufacturers which produce oat milk is becoming a growing market for the Australian commodity. Photo: Oatside

Oat milk demand grows

Australia’s key export markets are also experiencing a marked increase in oat-milk consumption, with brands using the health and environmental benefits of the local commodity to market new products.

Earlier this year, Singaporean-based company Oatside launched a product line of oat milk manufactured entirely from Australian oats.

According to the company’s website, Australian oat inputs have a “creamier texture and nuttier notes” than other countries product.

Mr May said the growth in oat-milk consumption across Asian, as well as globally, was one of the biggest opportunities for the industry into the future.

“We are continuing to see more and more Asian markets consume oats for conventional breakfast cereal purposes, but the oat-milk market is creating demand for oat products that didn’t originally exist.

“The demand for that is material, and we are of the view that it will provide the Australian oat industry a lot of opportunities going forward.

“The feedback we get from customers is that the same attributes that drive positive views of Australian oats in standard breakfast cereals are the similar attributes that are working well in oat milk.”

Grain Central: Get our free news straight to your inbox – Click here

HAVE YOUR SAY