IT SEEMS that government intervention in markets is in vogue at the moment.

The free market is becoming decidedly less free. Argentina banned beef exports; China banned coal imports from Australia and exports of fertilizer.

Last week, Russia has placed a quota on the exports of fertilizer for the next six months. You could say they are Putin a lid on exports.

They will only permit 5.9 million tonnes (Mt) of nitrogen fertilizer and 5.35Mt of ‘complex’ fertilizers during this period.

The Russian government is doing this to keep a lid on increasing fertilizer pricing to keep prices lower for the domestic market (farmers). What this does is increase further scarcity into the fertilizer market.

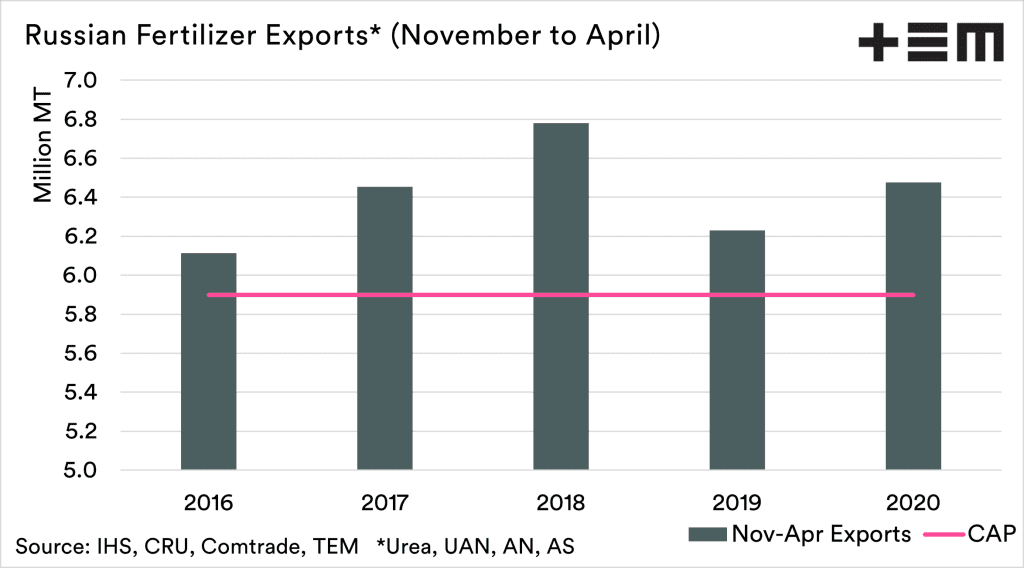

The first chart below shows the exports for the November – April period since 2016. Along with the cap.

This chart is currently a work in progress as the industry awaits confirmation of how the permits will be provided and how they will be split across the different subtypes.

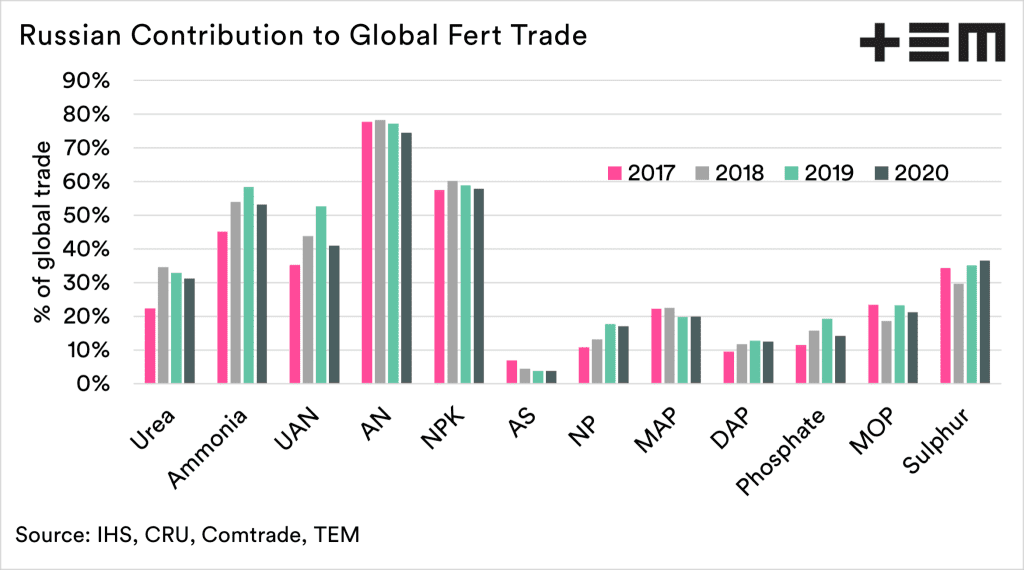

The second chart has been created to show the Russian contribution to the global fertilizer trade.

This chart uses the data from the main exporters who represent the majority of export flows. As we can see, they are a significant export player.

The fertilizer space is very scary at the moment, as it becomes more scarce, especially as governments get in the way.

We are operating in a free trade environment where not everyone is playing by the same rules.

At present, this cap for six months and the Chinese bans both coincide with the period that the average Australian farmer will be paying for their fertilizer.

Our biggest concern is on whether grain prices hold. Let’s hope they do (see here).

This article was originally published on the Thomas Elder Markets website: https://www.thomaseldermarkets.com.au/

To view original article click here

HAVE YOUR SAY