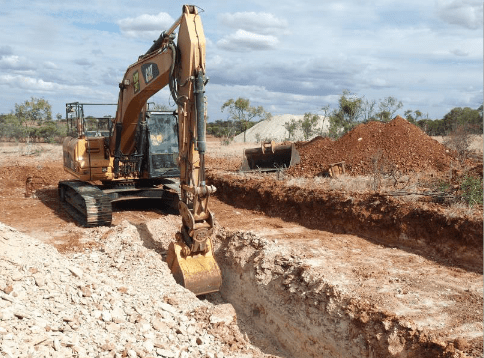

Free digging shallow phosphate rock at Ardmore in 2018. Photo: Centrex

AUSTRALIA’S reliance on imported rock phosphate looks set to reduce thanks to Centrex’s Ardmore project now coming on stream in north-west Queensland’s Georgina Basin, and Chatham Rock Phosphate’s nearby Korella project.

They will supplement product already coming from the region’s long-running Phosphate Hill mine, which is owned by Incitec Pivot Limited and produces DAP and MAP on site.

With global fertiliser supply chains already disrupted by COVID, and impacted further by sanctions against Russia, both developments are seen as timely for Australian farmers and graziers.

In addition, the Korella project is expected to reduce Australia’s dependence on China for dicalcium phosphate (DCP), an important source of phosphorus in cattle rations and supplements.

Cloncurry mayor Greg Campbell said as cropping expands to supplement the region’s reliance on the cattle and resources sectors, the prospect of having three phosphate mines in the Cloncurry Shire presented a great opportunity for further development.

“Phosphate Hill has been around for many many years, and is the largest fertiliser production site in the Southern Hemisphere,” Mr Campbell said.

“It producers 1 million tonnes of MAP and DAP per year for use internationally and domestically, and it’s the main project in the Cloncurry Shire.”

Mr Campbell said Ardmore was already mining phosphate, and both the Ardmore and the planned Korella project will produce rock low in cadmium as an added marketing bonus.

“Because of the need for phosphate in agriculture, and because of strong prices, they’re looking at the production of phosphate rock you can use directly in paddocks.”

“It’s great news for our region.”

Ardmore rising

Australia currently imports around 400,000t of phosphate rock per annum, while New Zealand imports roughly 600,000t.

The Ardmore Phosphate Project is expected to displace a chunk of Australian and New Zealand imports currently sourced primarily from North Africa.

Located around 110 kilometres south of Mt. Isa, production at Ardmore is ramping up, and is on track to produce 800,000 tonnes per annum (tpa) of phosphate rock from 2024.

The majority of the mine’s product is intended for the phosphatic fertiliser production market, and the company is in discussion with several Australian and overseas potential customers.

However, a 25,000t parcel has been mined which is available on the open market to farmers, graziers, resellers, traders and others in Australia and New Zealand.

Centrex’s Agriflex division recently employed Adelaide-based agronomist Walter van Leeuwen to help build the company’s customer base for its Direct Application Phosphate Rock (DAPR).

“We’ve crushed it down to 4 millimetres so you can put it straight into a fertiliser spreader,” Mr van Leeuwen said.

The finely crushed phosphate rock is described as a slow-release and cost-effective organic fertiliser.

“Many farmers are unfamiliar with DAPR, but we encourage them to talk to us about its benefits.”

IPL’s Southern Cross Fertilizer holds a 30pc right of first refusal over Ardmore’s available annual production of phosphate rock which will potentially be used to make single superphosphate at IPL’s Geelong facility.

Peak demand for Ardmore product is expected during March-April, and Centrex has already negotiated competitive freight rates with Dubbo-based company Rod Pilon Transport to cart product to domestic customers.

“This provides a cost-effective freight solution as far south as Naracoorte, South Australia,” Centrex said in a statement.

In October last year, Centrex signed a three-year marketing agreement with one of the world’s largest fertiliser traders, Samsung, for the provision of its phosphate.

Samsung will act as Centrex’s exclusive marketing representative for sales into South Korea, Japan, Indonesia, India and Mexico.

Korella chases cattle

Korella is located east of Dajarra, and adjacent to Phosphate Hill.

It covers around 1600ha within Chatsworth Station, which is owned by the McDonald family’s MDH Pty Ltd.

Korella’s owner is New Zealand-based CRP.

It merged last year with Avenir Makatea, which started as a phosphate-mining company in French Polynesia.

CRP and Avenir Makatea executive director Colin Randall has recently moved to Cloncurry to help oversee the development of Korella’s projects.

Mr Randall said the Korella mine was on track to produce 250,000t of DAPR starting this year, solely for the Australian market.

“We say our market is from Kununurra to Wangaratta.

“In three years, I want to have 1000 different customers, and I want them to be so well distributed that if it rains in one place and there’s drought somewhere else, we still have a market.”

The Korella team on site: executive director Colin Randall, geologist Garry Edser and field manager Maurice March. Photo: CRP

Mr Randall said Korella would primarily be selling DAPR for use as is, or to go into standard fertiliser blends.

“It’s 13pc P…so it will be very competitive on a percentage basis, even against MAP, DAP, single super and triple super.”

Mr Randall said manufacturers of cattle lick blocks were already shaping up as buyers of a portion of Korella phosphate.

“We believe that is important for Far North Queensland and Far Western Queensland, and we will be working with a number of block makers to put our phosphate into their blocks.

“The important point is it is low in cadmium and heavy minerals, so it is suitable for organic production systems.”

Australia imports around 30,000tpa of DCP, mostly from China, and Mr Randall said 60pc of that is used in Queensland.

“That primarily goes into feedlots, and our plant will produce exactly what the Australian market would consume, although we recognise that it’s not necessarily going to meet everyone’s needs.

“You can never set up a facility that will stop all imports.”

Mr Randall said some Korella DCP was likely to be exported to New Zealand, where it is an important additive in dairy rations.

CRP is now in the process of identifying a site in Cloncurry to turn rock phosphate into DCP with the addition of limestone sourced within Queensland, and also sulfuric acid.

“The plan would be to have that plant up and running by 2024.”

Both Ardmore and Korella see options for their phosphate in forming a backload for trucks bringing freight to or through north-west Queensland.

“In one respect we are geographically challenged, and in another, we are beautifully situated for back haul.”

HAVE YOUR SAY