Qube operates a rail fleet which hauls commodities including grain. Photo: Qube Holdings

DIVERSIFIED logistics heavyweight Qube Holdings has recorded an underlying net profit after tax and amortisation of $159.6 million in the year to June 30, up 32 per cent from its FY20 result, and a record for underlying earnings.

In releasing its figures yesterday, the company said earnings growth came primarily from its operating division, which includes its Quattro bulk grain terminal at Port Kembla and assets previously owned by Agrigrain, and its joint ownership of Patrick.

However, it said the NSW Government’s granting of A-double∗ truck access to Sydney’s Port Botany has been seen as a major inhibitor of growth in throughput for its rail-linked terminals at Moorebank Logistics Park (MPL).

Grain grows in bumper year

Agrigrain was purchased in September 2020 ahead of the bumper New South Wales grain harvest, and was rebranded as Qube Agri.

The Coonamble site abuts the rail line, which Qube said enabled efficient rail movement of stock to Port Botany, the Quattro terminal and the Port of Newcastle.

“This acquisition allows Qube to expand its regional logistics services with the entry into the agriculture storage and handling sector,” Qube said in its announcement to the ASX.

Qube saw an increased revenue contribution from grain-related activities comprising bulk and containerised haulage, and grain storage and loading.

It said benefits had flowed from Qube’s s buy-out of other Quattro stakeholders in FY20, as well as volume coming from the big 2020-21 grain harvest.

In Queensland, an increase in shipping and terminal-related revenue from container volume growth and new contract wins was seen.

“We saw growth in the agri space, and full acquisition of the Quattro terminal,” Qube managing director Paul Digney said.

Qube’s other acquisitions in FY21 included two in March: Les Walkden at Portland in Victoria, and Bluewood in the Albany region of Western Australia.

Les Walkden and Bluewood provide timber harvesting, chipping and haulages services, with the Victorian operation sitting in Qube’s ports division, and Bluewood in the WA bulk division.

Grain contributed to Qube’s strong performance in NSW, but the company had a decrease in Victorian revenue due to multiple COVID lockdowns and temporary closures of some of its manufacturing customers’ operations in the first half of the year.

Rail lags in Sydney

Qube operates both intermodal facilities, the Interstate Terminal and the Import Export (IMEX) Terminal, which make up the MPL, jointly seen as having an annual capacity of around 1 million twenty-foot equivalent units (TEU).

MPL is connected to Port Botany by the IMEX rail shuttle, which was designed as a dedicated non-stop service to ferry containers between Port Botany and MPL.

In its presentation, Qube said volumes through the IMEX Terminal have been modest, with only around 18,300 TEU through the terminal during FY21.

It said the ability of A-Double trucks to operate at Port Botany has reduced the competitiveness of rail relative to road to the Moorebank catchment area.

“We didn’t understand the magnitude of it,” Qube managing director Paul Digney said.

“We think it’s inconsistent with policy in moving to more rail modal share out of Port Botany.”

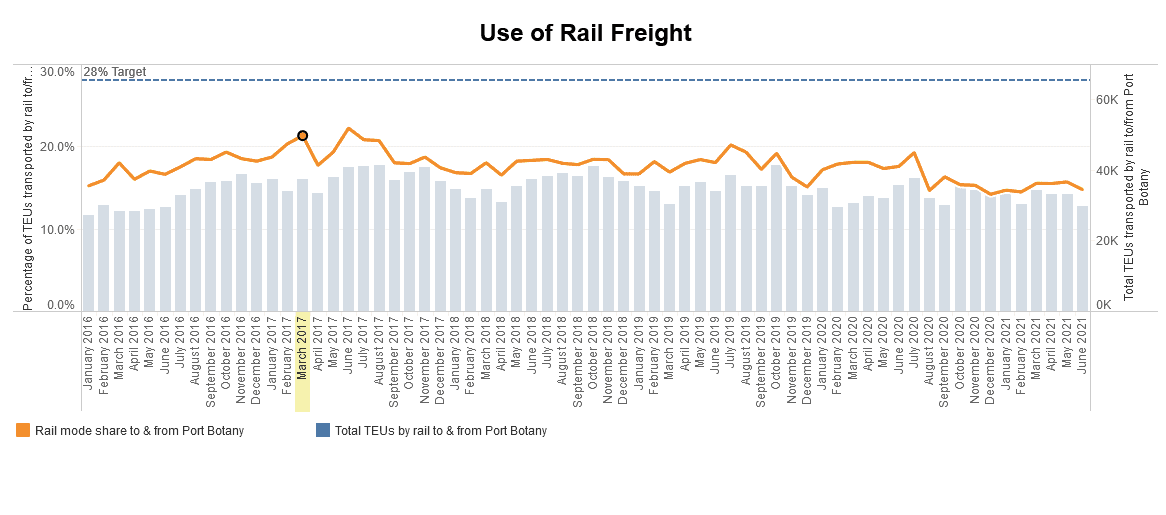

The policy was introduced by the NSW Government to reduce road traffic and associated carbon emissions, and set a target of 28pc of total rail container movements at Port Botany, but Transport for NSW figures show the figure has hit a low of 14-15pc for five of the 12 months to June 2021.

“The biggest issue for us is that 80-90pc was catchment volume while all the warehouses got built.”

Those warehouses, with tenants including Target at IMEX and Woolworths in the interstate facility, are now being occupied.

“In 4-5 years we’ll be seeing more volume through the IMEX.”

Mr Digney said he expected rail to become more competitive in coming years because labour, tolls and other costs would increase for road, but rail with more fixed costs would come into its own.

“Over time rail becomes more superior over road.”

Mr Digney said reduced road traffic as caused by COVID restrictions had masked the impact of increased use of trucks on roads going in and out of Sydney freight precincts.

“The rail perspective is getting better and better, and once we get back to normal, roads are going to become more congested.”

Graph 1: Use of rail freight as a percentage of total landside freight at Port Botany. Source: Transport for NSW

The NSW drought, which drastically reduced the movement of containerised agricultural freight from 2017 to 2020, is widely seen as a contributing factor to road having more modal share than was expected in FY21.

This is because the use of rail slots was maintained through the drought by exporters of mainly mineral commodities, and the surge in containerised grain volumes seen since harvest late last year has had problems fitting in to reduced direct-to-port rail slots.

These have been further limited by industrial action, and Patrick’s Phase 1 automation of its Port Botany terminal, as well as congestion at container parks and a nationwide shortage of empty containers.

Botany developments coming

The second and final phase of automation of Patrick’s Port Botany terminal is now under way, and Mr Digney said this would benefit Patrick, Qube and MPL.

“When it’s fully complete, Port Botany will realise a much larger rail-window capacity.”

Mr Digney said expanded capacity at Patrick’s Port Botany terminal and its neighbours should be available by 2023, and this should boost rail traffic into and out of IMEX.

Qube’s 50pc share of Patrick’s underlying NPAT was $41.3M, up 58.8pc from FY20.

In addition to Port Botany, Patrick operates container terminals in Brisbane, Melbourne and Fremantle.

Patrick is Australia’s largest container-terminal operator, and Qube said stevedoring activities across its mostly east coast sites were strong, with bulk and break-bulk movements up on FY20, mainly because of increased steel imports and grain exports.

“Patrick benefitted from growth in market volumes and increased landside and ancillary charges, although (it) was adversely impacted by industrial action in the period,” the statement said.

Bulk, boxes provide flexibility

Mr Digney said Qube’s bulk logistics capabilities including those for grain were the ideal complement to containers.

“We’re set up to be able to move between both.

“We’ve got the ability to switch if container shipping price get too high and there’s more bulk and bulk gets a better lick of the revenue and…it can switch the other way.

“We’re seeing strong continued volumes with the grain side and the mining side.

“Who knows with the pandemic what the next twist is.

“Most of our markets look pretty positive at this point in time.”

Landbridging seen

Reduced services from shipping lines servicing Australian container ports have become a major problem for grain and other exporters.

This was touched on in the post presentation Q&A session when Mr Digney was asked if reduced servicing had resulted in logistics companies including Qube picking up extra road and rail work through landbridging.

This occurs when exporters shuffle boxes from one port to another to ensure they catch the ships they need to in order to meet their contractual obligations.

“There has been a bit of cutting and running by shipping lines.”

Mr Digney said there had been “a fair bit” of landbridging done.

“The global shipping lines have done well by rationalising services.

“It may settle down in two years’ time.

“It’s a watching space for us.”

Qube also announced it had fully repaid FY21 JobKeeper payments from the Federal Government applied for and received when COVID hit last year.

Source: Qube

∗ The truck designated A-double, according to the National Heavy Vehicle Regulator, is sometimes called double road train.

Grain Central: Get our free daily cropping news straight to your inbox – Click here

HAVE YOUR SAY