RaboResearch general manager Australia and New Zealand Stefan Vogel. Photo: Rabobank

DESPITE expected rising global geopolitical tensions, an underperforming Asian economy resulting in low consumer confidence and a volatile energy market, Australia’s agricultural sector is well placed for the year ahead, according to Rabobank’s Australia Agribusiness Outlook 2025.

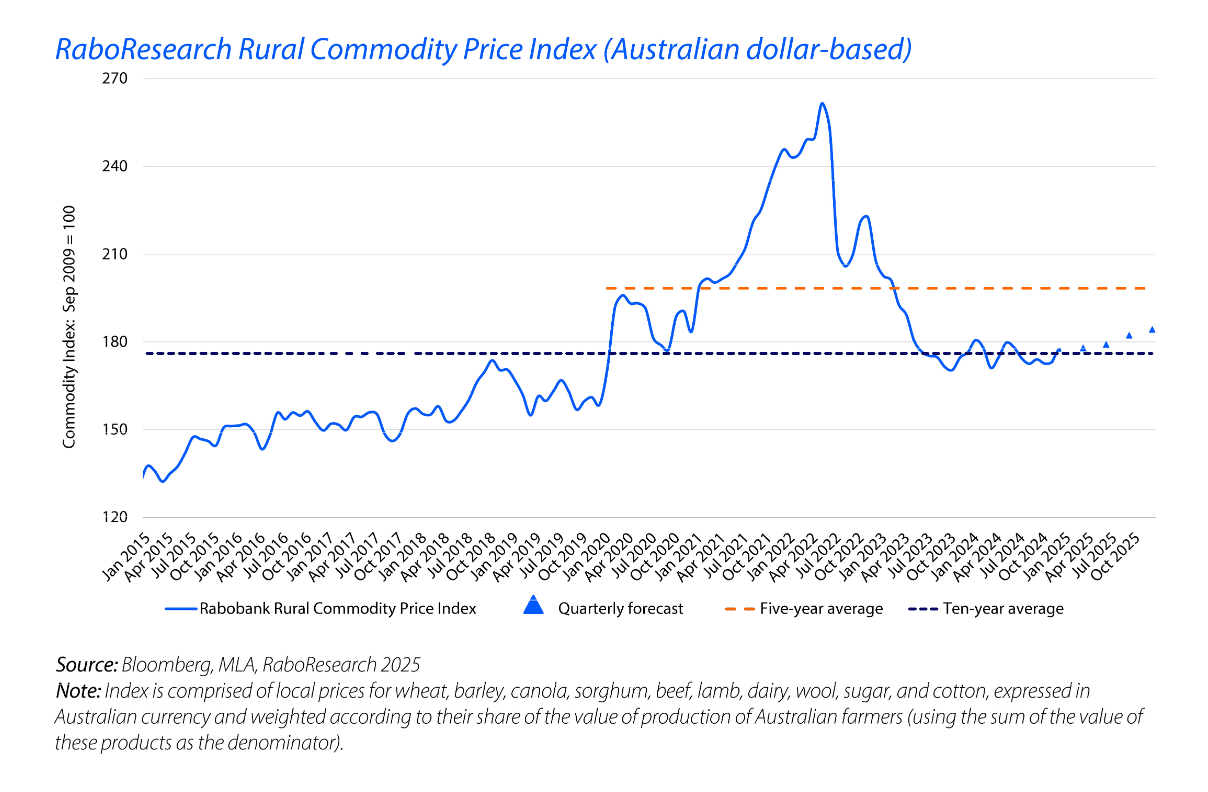

The agribusiness banking specialist has forecast a rise in its RaboResearch Australia Commodity Price Index for 2025, supported by livestock commodity prices, and potential upside for grain prices.

Tempering optimism is soil moisture in many regions being below where it was 12 months ago.

“Most cropping and dairy areas along the south coast of Australia are too dry, although many of the country’s sheep and cattle areas received rains over the past two months, supporting feed availability,” the report said.

Report lead author, RaboResearch general manager Australia and New Zealand Stefan Vogel said the weather forecast for the next three months “painted a similar picture that hopefully can still be offset if rains arrive during the growing season”.

Mr Vogel said the recently-harvested winter grain crop had “notably exceeded that of last year”, although soil-moisture levels in South Australia, southern Western Australia, and western Victoria need to be watched for the upcoming season’s planting.

“For beef and sheep producers, the outlook for farm-grown feed in the first half of 2025 overall once again looks promising,” Mr Vogel said.

He said limited price moves were expected for farm inputs such as fertiliser and plant-protection chemicals, but there was some “upside price risk”, and crude oil prices were likely to come off their recent five-month high.

The expected easing of the official cash rate by the Reserve Bank of Australia this year would also be welcome relief for the sector, Mr Vogel said, with Rabobank now forecasting a likelihood of three 0.25 basis point reductions from as early as February.

“The global economic outlook for 2025 in many regions of the world is subdued and Australia’s GDP growth recovery to 2.3 percent in 2025 is almost an exception as major economies like the US (2pc growth versus 2.7pc in 2024) and China (at 4.7pc, down from 4.8pc) are expected to struggle, which hurts consumer confidence and demand in those regions,” he said.

The bank expects the Australian dollar to remain weak, near US60 cents, which benefits Australian exports, but makes imports more expensive.

Commodity price outlook

RaboResearch’s Rural Commodity Price Index is expected to rise above the 10-year average in 2025, amid anticipated positive price developments for key sectors and solid production volumes.

Mr Vogel said price dynamics are likely to vary per sector.

“The beef price outlook is one of modest optimism, given fundamentals leave some room for minor upside movement.

“RaboResearch holds the view that in 2025, we may see stronger demand from feedlots for feeder cattle; the other positive factor for the sector is that we anticipate higher live-export volumes in 2025.”

Mr Vogel said for grains, there are also some signs of positivity on the horizon.

“What should help provide support for wheat prices in 2025 is falling global stock levels.

“In addition, the world’s largest wheat exporter, Russia, is unlikely to have large volumes to export in the second half of this year, contrary to the past two seasons.

“Global canola stocks are also being pressured; however, improving soybean stocks, which are raising price competition within the vegetable oil sector, will likely prevent upside.”

For dairy commodity markets, Mr Vogel said, RaboResearch anticipates upside in 2025.

“China’s dairy-import volumes appear likely to improve marginally in comparison to 2024, as its domestic production volumes are anticipated to contract; a weaker AUD should also be beneficial for exports in 2025.”

Geopolitics and shipping

Mr Vogel said geopolitics and shipping are to remain areas of concern for Australia’s agricultural sector.

“Trump 2.0 and his return as US president is expected to keep markets volatile.

“Threatened trade duties, if imposed, are likely to be met with retaliation, and agri commodities might not be immune.

“And the question remains – will US beef imports, a key destination for Australia, face duties.”

Mr Vogel said the Middle East tensions, including the rerouting of ships away from Red Sea piracy attacks, are likely to remain factors of volatility in 2025 as the recently imposed ceasefire in the Israel-Hamas war and the halt in Houthi attacks on vessels could end without significant notice.

“And the war in Ukraine can still impact grain markets if Russia is able to progress further west and limit Ukraine’s grain exports.”

Farm inputs

Farm input prices globally, both for fertilisers and plant protection products, are forecast to move sideways to slightly higher, the report said.

Global urea and phosphate prices in Australian dollar terms have moved upwards from their Q2 2024 lows and, as Australia imports most of its fertilisers, the weaker AUD was a key driver in this move, Mr Vogel said.

“Looking into 2025, we don’t expect very big price swings but see more upside than downside price risk and costs on Australian farms are expected to remain still well above the levels seen before COVID.

“Geopolitics and a potential escalation of conflicts can result in big energy price swings and also affect freight costs, which would also impact the cost of those products in Australia,” Mr Vogel said.

“Our global crude oil price outlook calls for Brent to drop below USD 70/bbl as we expect an oversupply, while the early 2025 price rally is heavily driven by fear of escalation in the Middle East.”

Biosecurity

The bank expects biosecurity will remain key and the recent foot-and-mouth disease (FMD) outbreak in Germany, the first in almost 40 years, shows the importance of controlling incidents and conveying confidence to trade partners, as “the likes of the UK and South Korea quickly limited their livestock or livestock products trade with Germany”.

HAVE YOUR SAY