AUSTRALIAN wheat production is forecast to increase by 76 per cent in 2020–21 to 26.7 million tonnes (Mt) – the biggest wheat crop since the record high of 2016–17, according to ABARES’ June Agriculture Commodities report released today.

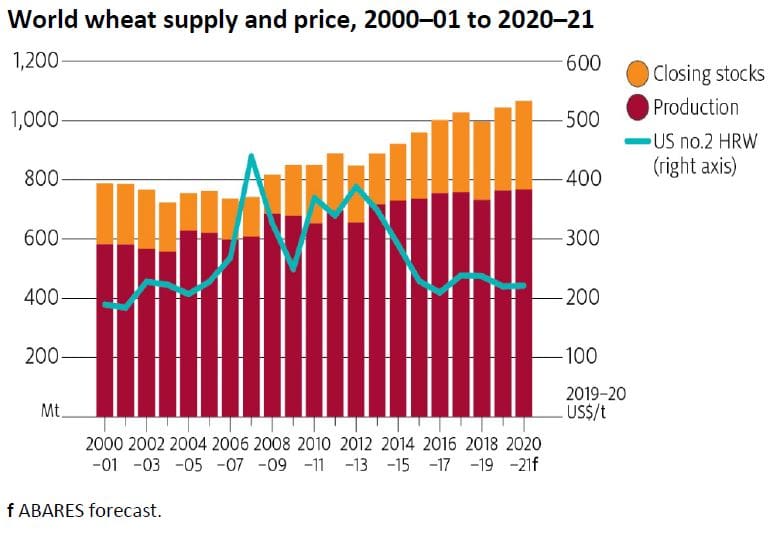

At the same time, abundant world wheat supplies are expected to keep global prices low.

ABARES’ acting executive director Peter Gooday said that while the COVID-19 pandemic would continue to present challenges, the overall outlook for Australian agriculture would be dominated by recovery from drought.

He said an improvement in seasonal conditions was expected to see the value of farm production increase modestly to $61 billion in 2020–21, the third straight year over $60 billion.

“This is driven by a strong forecast rebound in grain production, up 15 per cent to $30.8 billion,” Mr Gooday said.

Mr Gooday said a global economic slowdown combined with higher agricultural production was going to weigh on prices with price falls forecast for most major commodities.

“As we recover from drought, the value of farm exports is forecast to fall by around $2.7 billion to $44.4 billion in 2020–21, driven by falling meat exports and the rebuilding of domestic grain stocks.

“While domestic grains stocks are sufficient to see us through to the winter harvest, this investment in grain stocks will be important in improving resilience in our supply.”

Wheat

- Abundant world wheat supplies are expected to keep global prices low. The world wheat indicator price is forecast to remain low in 2020–21, at an average of US$222 per tonne.

- A forecast fall in production in some major exporting countries will be offset by weaker world demand for discretionary foods due to restrictions introduced to slow the spread of COVID-19.

- Mostly favourable seasonal conditions in major wheat-producing countries are forecast to result in record high world wheat production of around 767 million tonnes (Mt), a marginal increase from 2019–20.

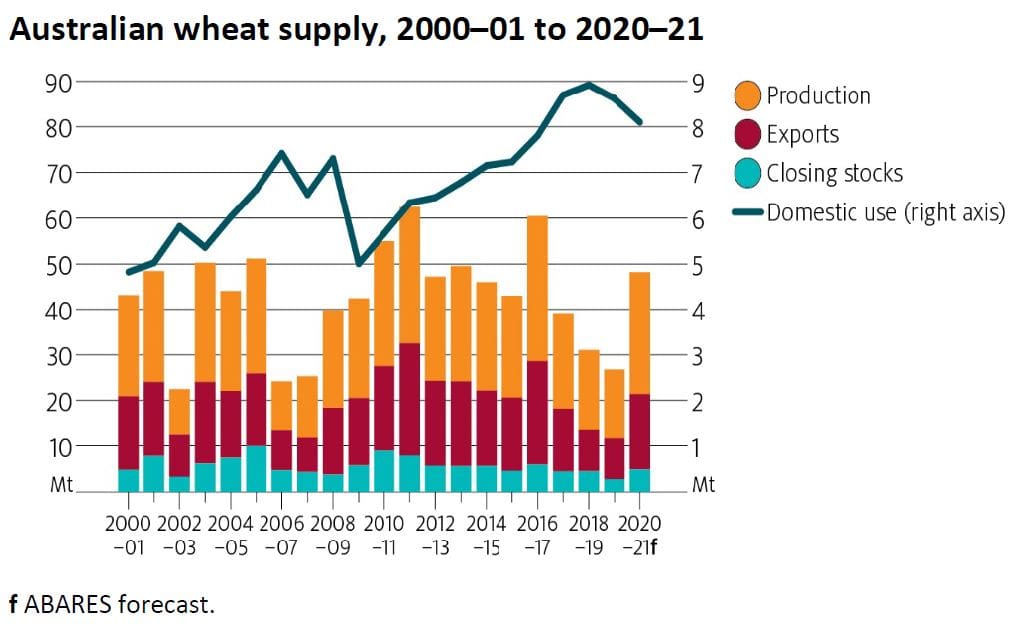

- Australian wheat production is forecast to increase by 76pc in 2020–21 to 26.7Mt. If realised, this will be the biggest wheat crop Australia has produced since the record high of 2016–17.

- Australian wheat supply has been adversely affected by three consecutive years of below average production. Additionally, supplementary on-farm feeding since late 2017–18 due to poor pasture growth and the continued expansion of intensive livestock industries resulted in a significant increase in domestic feed demand. The increase in demand and lower supply has led to a significant drawdown in domestic wheat stocks, which are forecast to fall to 2.8Mt by the end of the 2019–20 marketing year (end of September). This is the lowest level of stocks since 1998–99.

Coarse grains

- World barley prices are expected to fall in 2020–21 to US$176/t as a result of near record global production and growing competition from other grains in feed markets. The world barley indicator price is expected to remain at around US$181/t for the rest of 2019–20.

- Australian barley prices are expected to fall over the remainder of the 2019–20 marketing year (1 November to 31 October) and into 2020–21.

- World coarse grain production is expected to increase in 2019–20 due to near record corn production in North America, and record barley production in the European Union.

- Improved seasonal conditions are expected to result in a 17pc increase in Australian barley production in 2020–21 to around 11Mt, 18.5pc above the pre-drought 10-year average to 2017–18.

- Australian domestic demand for coarse grains is expected to fall in 2019–20. Improved seasonal conditions have already resulted in a decline in drought-related supplementary feeding of livestock.

- Australian coarse grain exports are expected to reach 10-year lows in 2019–20, but are then expected to rebound in 2020–21 to 6.6Mt.

Oilseeds

- Global canola prices are forecast to fall in 2020–21 due to constrained global import demand. The world canola price is forecast to average US$362/t in 2020–21, 9pc below the 5-year average of US$397/t.

- Global canola production is forecast to increase marginally in 2020–21, assuming production increases in Australia and Ukraine.

- Australian canola production is forecast to rise in 2020–21 to 3.2Mt.

- Following a small Australian crop in 2019–20, domestic stocks are significantly lower than average in the lead-up to the next harvest. In 2020–21 Australian canola stocks are forecast to increase to average levels.

Cotton

- The world cotton indicator price is forecast to average US63 cents per pound in 2020–21, down by 12pc from 2019–20.

- World cotton stocks are forecast to rise to 22Mt by the end of 2020–21, up 4.7Mt since the start of 2019–20.

- World cotton consumption is forecast to increase by 8.4pc in 2020–21 to 24.4Mt, although remaining 7pc below 2018–19 levels.

- World cotton production is forecast to fall by 2.8pc in 2020–21, largely driven by an expected 5.5pc decrease in planted area in response to an anticipated fall in the price of cotton.

- Australian cotton production in 2020–21 is forecast to rise to 1.7 million bales, after falling to a 12-year low of 590,000 bales in 2019–20.

Source: ABARES

Read the ABARES Agriculture Commodities June quarter report here.

HAVE YOUR SAY