A RETURN to favourable seasonal conditions has given producers in many regions of Australia one of the best starts to a farming year, despite summer bushfires and the unprecedented disruption caused by COVID-19.

The good news looks set to continue, with good rainfall across much of eastern Australia forecast to continue for the remainder of the year, according to Rural Bank’s ‘Australian agriculture mid-year outlook 2020’.

Rural Bank’s chief operating officer, Will Rayner, said the agricultural outlook was broadly positive for the second half of the year.

Rural Bank’s chief operating officer, Will Rayner, said the agricultural outlook was broadly positive for the second half of the year.

“Australian agriculture has generally proven resilient to the economic devastation caused by COVID-19, but the sector needs to be wary of volatility and trade disruptions,” Mr Rayner said.

Looking at global markets, escalating trade tensions with China are an area of concern, particularly for broadacre croppers. On the flip side, the ongoing protein shortage in China caused by African Swine Fever has led to an increase in demand for Australian red meat.

“Australia’s reliance on China as an export market means that any change will significantly affect producers – both positively and negatively. These trade tensions are causing some to look at alternative export markets. The development of these alternative markets has the potential to reduce market concentration risk for Australian farmers,” he said.

“The improved seasonal conditions will help boost supply levels for nearly all commodities and while no one could have predicted a global pandemic, the back end of the year should prove increasingly positive despite continued global instability.”

Tariff pressures

Rural Bank Victoria’s Greg Kuchel said winter cropping areas had enjoyed their best start to the season in several years, buoying hopes of a turnaround in the cropping sector’s fortunes.

“As a result, grain markets are pricing in a much lower level of production risk, compared to recent years resulting in a softer price outlook year-on-year. The largest unknown looks to be how grain markets will deal with an expected reduction in China’s demand for Australian barley.”

Increased tariffs on barley exports to China have effectively priced out Australian barley from this critical market.

While there are now opportunities to trade with other markets such as Japan and Saudi Arabia, these markets are more price sensitive and this will likely flow through to values at the farm gate.

These escalating trade tensions have drawn focus to Australia’s reliance on a single market with emphasis now on exploring options with alternative countries.

Increased cereal production

The Rural Bank report predicts winter cereal production in Australia will return to average, if not above average production this year.

At present, wheat production is expected to increase by 59 per cent, year-on-year and 6pc above five-year averages.

Australian barley production is forecast to rise 2pc year-on-year, however, remain 2pc below five-year averages.

Favourable weather is forecast for spring. If this eventuates, it is possible that current production estimates will be exceeded.

Globally, Rural Bank said another year of record wheat production was again forecast for the coming season, driven by Australian production.

European Union (EU) wheat production is expected to decrease 7pc year-on-year due to dry conditions across most EU cropping regions.

The Black Sea area is expecting mixed fortunes. Production in Russia and Kazakhstan is tipped to increase by 4pc and 15pc respectively, whilst the Ukraine looking at a 4pc decline.

An expected uptick in world wheat end stocks indicates that global supply is again expected to out strip demand this season which, combined with other factors, points to softer overall demand for cereals over the coming period.

Cereal prices

After successive years of poor production, Rural Bank said a return to average conditions would see Australian wheat prices more closely align with world markets this coming season.

The impact of this is local prices will show a much smaller premium, if any, over offshore prices, adding downward pressure to domestic values.

Barley values on the other hand are expected to remain flat and are already trading at a significant discount to wheat.

Oilseeds

Rural Bank expects Australian canola production to rebound, up 26pc year-on-year, with current production forecasts showing a minimal 1pc variation from the five-year average.

In Australian canola’s largest export market, the European Union, dry conditions are expected to see canola production come in 14pc below the five-year average.

The world’s largest canola producer, Canada, is currently looking at production in line with the five-year average.

Australian canola prices have already come off the highs seen earlier this year. Given the rebound in domestic production, Rural Bank expects prices to hover between flat and 10pc lower over the coming six months.

In terms of global oilseed markets more broadly, United States soybean values continue to come under pressure as a result of ongoing tensions between the US and China.

A sustained uplift in US/China soybean trade is required for sustained support for soybean values to flow into other oilseed markets.

Pulses

Year-on-year, production is forecast to increase 10pc for faba beans, field peas 13pc, lentils 15pc and lupins 7pc, however the size of these increases will all be dwarfed by chickpeas, with production set to more than triple.

With Queensland having had a drier start to the winter cropping season than other states, chickpeas have been the preferred crop in many rotations, given their taproot systems giving crops the ability to take advantage of lower level soil moisture.

A decline in planted area in Canada and the US may open up some additional opportunities for Australian chickpeas.

The announcement that India will lower import tariffs on Australian lentils from 33pc to 10pc will help new crop exports, with prices having already picked up accordingly.

Canadian planted area to lentils is steady to a touch higher, year-on-year, and current forecasts point to an average to above average monsoon season in the subcontinent.

In the absence of a deterioration in conditions in either of these areas, it will be difficult for lentil prices to move too far beyond current levels.

Resilient land values

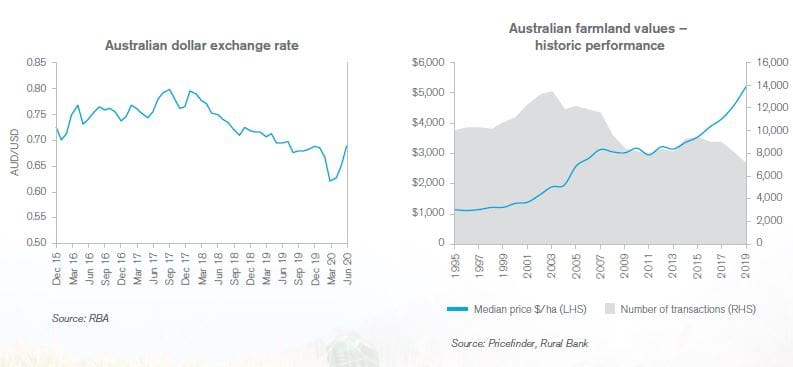

Farmland values have been resilient following several years of challenging seasonal conditions.

Rural Bank expects growth in the value of Australian farmland to continue over the long-term as ongoing improvements in Australian agricultural productivity and profitability fuel strong demand for agricultural assets.

Source: Rural Bank

To view the full ‘Australian agriculture mid-year outlook 2020’ visit: https://www.ruralbank.com.au/knowledge-and-insights/publications/agriculture-outlook/australian-agriculture-mid-year-outlook-2020/

HAVE YOUR SAY