WHEAT and barley prices are expected to rise due to low global supplies while canola prices are likely to remain unchanged, according to ABARES’ latest agricultural commodities outlook.

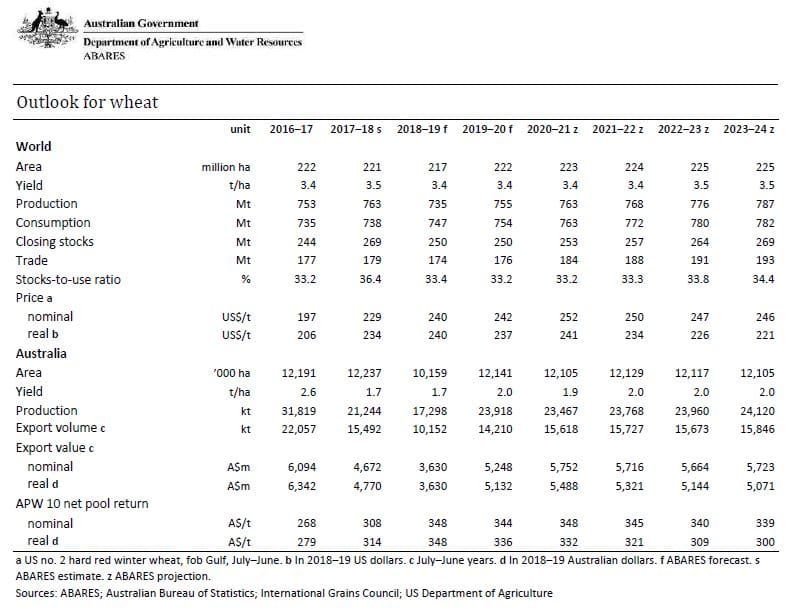

In its March quarter report released today, ABARES predicts wheat prices will rise marginally before falling over the medium term.

The world wheat indicator price (US No.2 hard red winter, fob Gulf) is forecast to average US$242 per tonne in 2019–20—largely unchanged from the 2018–19 price.

Despite a slight rise in global production, a decrease in stocks in major wheat-exporting countries is forecast to reduce tradeable supplies.

Over the medium term to 2023–24, world import demand for wheat is expected to continue increasing in line with population growth, changing diets and rising incomes.

However, prices are projected to fall gradually in real terms because of expected production increases in Argentina, the Black Sea region and India. This is likely to result in world supply growing faster than demand.

In 2019–20 world wheat production is forecast to increase by 3 per cent to 755 million tonnes (Mt), assuming average seasonal conditions in major wheat-producing countries.

It also reflects small increases in areas planted and average yields in Australia, northern Europe and parts of the Russian Federation that were affected by dry conditions in 2018– 19.

World wheat consumption is forecast to increase in 2019–20 and over the medium term due to increases in consumption of milling wheat and feed wheat.

Global demand for all feed grains, including wheat, is projected to rise in the medium term because of projected higher meat and dairy production.

Coarse grains

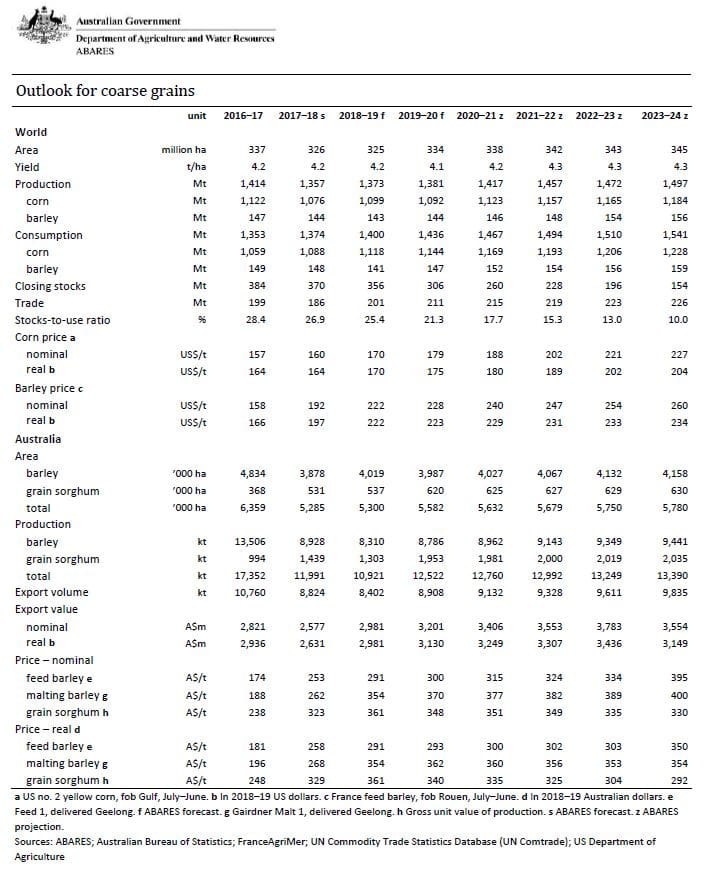

The world indicator price for barley (France feed barley, fob Rouen) is forecast to average higher in 2019–20 and continue to increase over the medium term to 2023–24.

This is because growth in world supply is expected to be lower than growth in demand for feed and industrial use.

The world corn indicator price (US no. 2 yellow corn, fob Gulf) is also forecast to rise over the medium term, underpinned by strong demand growth in China.

World production of coarse grains is forecast to remain largely unchanged in 2019–20. Falling Chinese corn production will be offset by increases in barley production in Australia, the European Union and the Russian Federation.

The drought affecting eastern Australia has reduced coarse grain production substantially and increased livestock feed use.

In 2018–19 Australian production is forecast to fall by 9pc and exports of coarse grains by 5pc.

Barley production is estimated to have fallen by 7pc to 8.3Mt.

In 2019–20 Australian coarse grain production is forecast to rise by 15pc to around 13Mt, driven by an expansion in grain sorghum planting. Assuming improved seasonal conditions, barley

production is forecast to increase by 6pc to 8.8Mt and grain sorghum by 50pc to 2.0Mt.

Over the medium term, Australian coarse grain production is projected to increase by 1.7pc per year to reach 13.4Mt by 2023–24.

Barley production is projected to reach 9.4Mt and grain sorghum 2Mt by 2023–24. Exports of barley and grain sorghum are expected to increase, in line with production.

Oilseeds

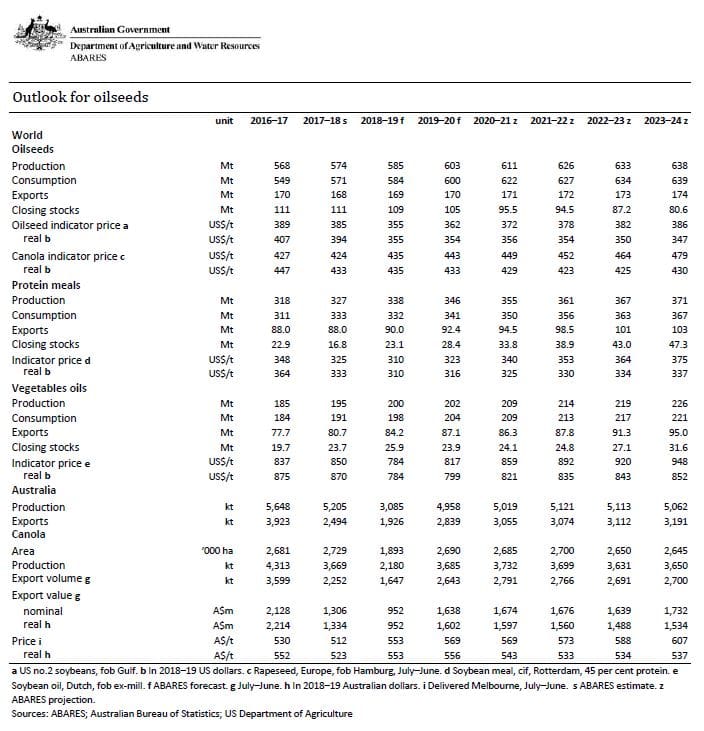

In 2019–20 growth in the world supply of canola is expected to broadly align with demand, with world canola prices forecast to remain largely unchanged.

Higher production is forecast in Australia, Canada and the European Union due to an expected expansion in area planted and some improvement in yields following hot and dry weather in 2018–19.

Over the medium term, canola prices are projected to fall until 2021–22 before rising moderately to US$430 per tonne in real terms in 2023–24.

Global oilseed production is forecast to rise in 2018–19 to a record 585Mt and a further 603Mt in 2019–20.

This increase will be dominated by expected increases in production in Argentina and Brazil.

In contrast, world canola and rapeseed production are forecast to fall in 2018–19, following record production in 2017–18.

Falling production is expected in Australia, Canada and the European Union because of reduced planted area and lower yields resulting from hot and dry conditions.

In 2018–19 canola production in Australia is estimated to have fallen by 41pc to 2.2Mt, largely driven by an estimated 31pc reduction in area planted to 1.9 million hectares.

In 2019–20 canola production is forecast to increase to around 3.7Mt because area planted and yields expected to return to more average levels.

Australian canola exports are forecast to increase in line with production.

Over the medium term, Australian production is projected to remain at roughly 3.7Mt.

Cotton

World cotton stocks remain high following an accumulation of stocks between 2009–10 and 2013–14 and again in 2016–17 when production rose in almost all major cotton-producing countries.

In 2018–19 world cotton production is expected to fall due to declines in China, India, Pakistan and the United States more than offsetting higher production in Brazil.

World cotton prices are relatively high compared with recent years and are expected to remain high for the remainder of 2018–19 as a result of strong demand.

However, high stock levels and competition from synthetic fibres are forecast to lead to a softening of prices between 2019–20 and 2020–21 before prices recover.

Total Australian cotton production is forecast to decrease significantly in 2018–19, driven by a decline in the area planted to cotton as a result of significantly reduced water levels in irrigation dams and very low levels of stored soil moisture.

HAVE YOUR SAY