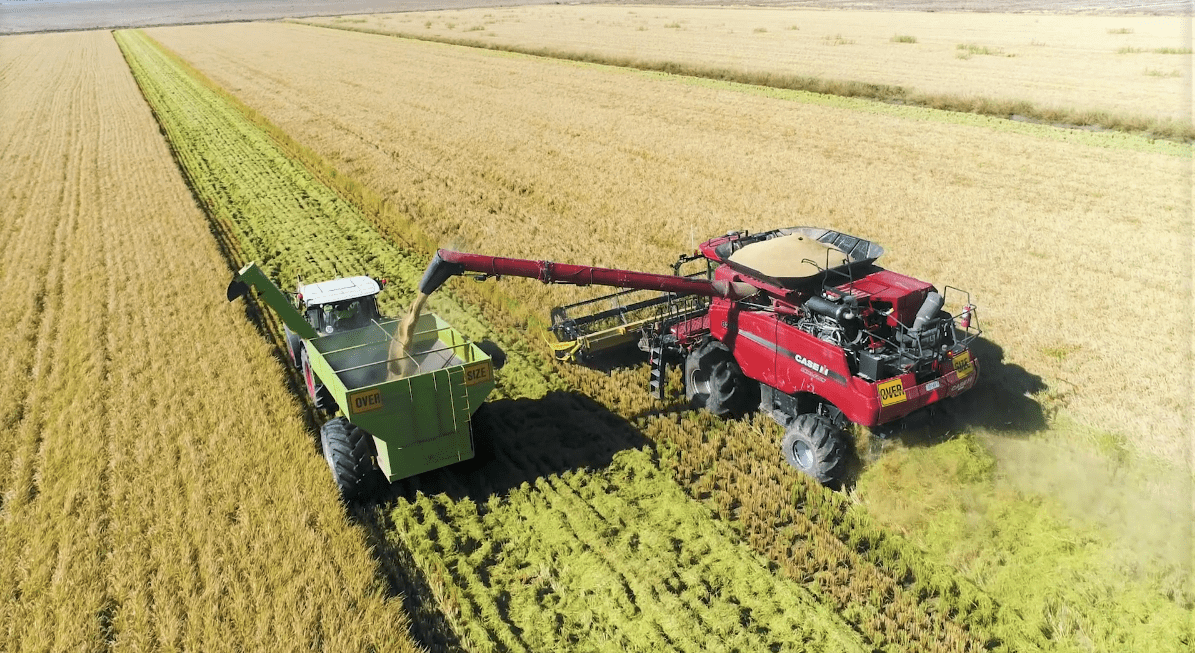

The large CY22 harvest is a key factor behind the revenue and earnings growth for SunRice. Photo: SunRice

AUSTRALIA’S single-desk rice marketer, SunRice Group, has posted revenue of $758 million for the half year ending October 31, a 34 percent increase on previous corresponding period, according to the half year 2023 (HY23) results released today.

The group also reported strong earnings before interest, taxes, depreciation, and amortisation of $42.6M, up 16pc on last year, and a net profit after tax of $19.6M, up 17pc.

SunRice Group chairman Laurie Arthur said in a letter to shareholders and growers that the earnings were in part driven by the increased crop size for 2022 (CY22).

He said the CY22 result of approximately 688,000 paddy tonnes was more than 50pc larger than the CY21 crop.

“This primarily benefited the rice pool business, supporting strong sales volumes in premium markets both domestically and internationally (including the Middle East), and enabled the group to supply new markets which have been affected by drought,” Mr Arthur said.

There were also favourable changes in product mix in some markets, particularly the United States, which complemented financial results in global markets.

Mr Arthur said sales price increases, the positive early results from the January 2022 acquisition of the Pryde’s EasiFeed and the improved outcomes for the CopRice business also contributed to the reported financial gains.

SunRice Group CEO Rob Gordon said the company was able to achieve these results despite ongoing inflationary and supply chain pressures.

“The SunRice Group delivered a strong financial performance in [HY23], with improvements in both revenue and profitability reflecting the strength of the group’s brands and market positioning, especially as consumer spending is currently impacted by the high inflationary environment,” Mr Gordan said in a statement.

“The various investments in strategic and organic growth initiatives across the group over the last few years are delivering benefits and enabled us to withstand some of the challenges that are affecting other industries and companies.”

SunRice has also updated the estimated paddy price range for CY22 crop currently being processed and marketed to $435-470 per tonne for medium grain Reiziq, representing a naturally earned record.

FY23 outlook

Mr Gordan said the company expects these results will flow through to the second half of the financial year.

“We expect the revenue growth achieved in [HY23] to continue into the second half of the year, supporting strong paddy returns in the rice pool business and profitability in the profit businesses, despite underlying operational and inflationary pressures continuing in the near term.”

He said the sales price increases implemented during the first half are expected to be fully realised in the FY23 results, subject to sales volumes not being adversely affected.

The company is predicting that underlying operational and inflationary pressures are expected to continue in the near term, although there could be some relief from freight and distribution costs heading into the back end of the financial year and into FY24.

The combination of the increased availability of Australian rice stemming from the large CY22 crop and secured global supply sources will also position SunRice favourably in FY23 to take advantage of any under supply in key markets currently impacted by drought, including the United States.

The group should also be able to extend its participation in global tenders in the second half of the year, which will support returns for both the rice pool business and international rice segment

CY23 predictions

Despite widespread rain and flooding in key rice-growing regions in southern New South Wales, SunRice group is still anticipating a large crop will be harvested in 2023.

“The planting window for the CY23 crop has now closed, and while it has been disrupted by heavy rain falls and flooding activity across the Riverina, the group is expecting ample Riverina rice supply in CY23,” Mr Arthur said.

“The current water outlook is pointing towards positive growing conditions into CY24.”

SunRice CEO Rob Gordon is expected to retire next year. Photo: SunRice

CEO announces retirement

Mr Gordon today also announced to shareholders his intension to retire as CEO in August 2023.

The SunRice Group is now conducting a process for a coordinated and effective transition to a new CEO.

Mr Arthur paid tribute to Mr Gordon, thanking him for his leadership and contribution to the SunRice Group.

“Rob has led the SunRice Group through a period of significant change and growth and will leave the SunRice Group in a strong financial and operational position, well positioned to deliver on its long-term growth objectives.

While Rob will remain CEO until the AGM in August 2023, I would today like to thank him on behalf of the Board for his leadership during a period of major challenges and global change for our company and the industries in which we operate.”

Source: SunRice

HAVE YOUR SAY