Panellists at the GIWA forum: Outgoing GIWA chair Ashley Wiese; WA Minister for Agriculture Alannah MacTiernan; Rabobank head of sustainable business development Crawford Taylor; PepsiCo’s Indonesia-based sustainable ag manager Reuben Blackie (via videolink); and CBH Group quality and sustainability manager – marketing and trading Jane Wardle.

GRAIN growers and supply chain operators need to recognise that sustainability is the new global market driver which will increasingly impact their businesses unless they take steps to address a range of environmental, social and governance issues.

That was the message from a Grain Industry Association of Western Australia (GIWA) forum in Perth this week where speakers addressed the question of what an increasingly sustainability-conscious world means for the Australian grain industry.

They explored the increasing importance being placed by grain buyers, processors and consumers on the need for food to be sustainably produced and for the agricultural sector to demonstrate its sustainability credentials.

Rabobank head of sustainable business development, Crawford Taylor, told the forum the financial sector was already factoring sustainability into its funding and loan activities.

“Currently the top four banks, plus Macquarie Bank, are going through a climate change assessment where APRA (Australian Prudential Regulation Authority) has listed a number of criteria. They are wanting to know and understand the impact of climate change on the performance of their loan portfolios,” he said.

“In addition, globally there is a common reporting mechanism within the financial reports of all leading financial institutions and companies about reporting on their climate-related financial disclosures.

“As you can see, this is starting to get very real. What is coming is being in a position where we not only have to do climate-related financial disclosures, but also nature-related financial disclosures. This is when we start stepping into the world of natural capital.”

…..the financial sector is already factoring sustainability into its funding and loan activities

Mr Taylor said the financial sector was seeing a move towards sustainability-linked and ‘green’ loans.

“The amount of funding allocated to these loans has been increasing significantly, particularly in 2021,” he said.

“The market is growing significantly from funders wanting to know that the money they give is linked to improved performance around sustainability.”

Greenhouse gas reduction

On the issue of climate change, Mr Taylor said most of the countries Australia did business with had made commitments to reach greenhouse gas neutral positions by 2050.

That was set to have a growing impact on Australia’s supply chains.

“In the context of grain, over 50 per cent of countries have agreed to (the lower threshold of greenhouse gas neutral by 2050),” he said.

“In terms of exports, 60pc of the countries involved in exports have made commitments to lower greenhouse gas emissions.

“In terms of the countries that Australia provides wheat to, 30pc of those countries have made commitments.

“So, the decision is being made for us. We have to be on board, we can’t ignore it.”

Sustainability credentials

Mr Taylor said Rabobank had initiated a measure to track sustainability within its client base.

“It is benchmarked on clients with exposures greater than $1 million. We have benchmarked 3000 clients and have another 2000 to go,” he said.

“We are doing it over a number of categories from land management, energy efficiency through to animal welfare. We need to have this information so we can show funders in the future what our ‘book’ looks like. Also that we can show regulators.”

He said farmers needed to prepare for factoring sustainability into their business management and reporting.

“From a producer point of view, one of the first steps is to get an understanding of what your emissions are within the business. With that information you can start to make potential future decisions,” he said.

“The second component is how do you start measuring the other forms of non-financial capital within your business.”

Carbon credits

Mr Taylor said growers should think carefully about what they did with their carbon offset credits which would become an increasingly valuable tool going forward.

“If you are in a position to participate in the market by generating carbon credits, as a producer you should retain ownership of those credits. They should be in your account,” he said.

“The reason is that once you retain ownership of those credits then you have the capability to make decisions down the track. You can demonstrate that you have a carbon neutral business. The moment you sell the credit you can’t claim it. It is gone.”

Sustainably-resourced products

PepsiCo’s Indonesia-based sustainable ag manager, Reuben Blackie, told the forum the company, which spends US$7 billion a year on agricultural commodities and sources oats from WA, regarded assurance of the supply of sustainably-produced product as a fundamental requirement.

“We see sustainability as something that will help us ensure that by improving farm resilience by helping farmers adapt to existing risk and emerging risk such as climate change,” he said.

“We need to make sure we maximise our reputation. One or the ways we do that is through working on sustainability and demonstrating to consumers and regulators that we are proactively working on the issues that are of concern.”

Mr Blackie said PepsiCo had recently launched a new sustainability policy called PepsiCo Positive.

“It is trying to transform the way we do business and inspire change. It means sustainably sourced ingredients, regenerative practices to produce those ingredients, and strengthened livelihoods in the production systems,” he said.

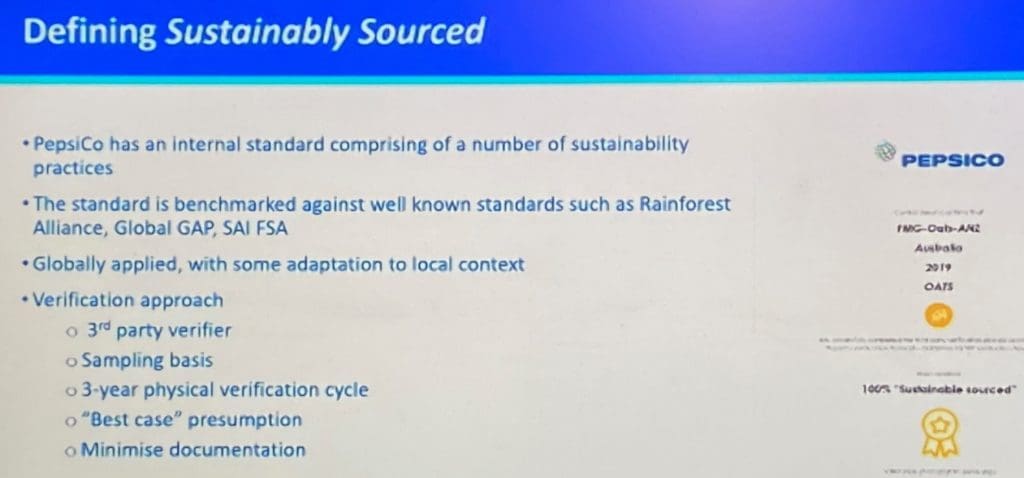

Figure 1: PepsiCo’s criteria for sustainably-sourced products.

Consumer, investor driven

CBH Group quality and sustainability manager – marketing and trading, Jane Wardle, said the push towards more sustainable production was being driven mainly by consumers.

“The average global consumer wants food that is more sustainable. It is not the angry activist any more, it is the standard, run-of-the-mill consumers who just want more sustainable food that has less environmental impact and will help them lead more socially-responsible lives. They have a lot of trust of the manufacturers of food and what they read on the packets,” she said.

Ms Wardle said the other main players were investors, financial institutions and governments.

“Ships leaving Australia will be hit with a European carbon tax as early as next year,” she said.

Ms Wardle said the response so far from manufacturers to the changing dynamics had been mixed.

“In many cases (they have done) absolutely nothing. On the other end of the spectrum there are multinational companies who have science-based targets and projects. They are working directly with growers and other industry stakeholders to achieve these targets,” she said.

Accountability, traceability

Ms Wardle said a survey of CBH customers found they had a range of expectations and concerns about food production sustainability, security and provenance.

Jane Wardle

“When we ask our customers to rank sustainable traits, overwhelmingly the majority said chemical-residue-free was the most important. The customer wants the same grain they are paying for, they just want less chemicals on it,” she said.

“They don’t want to pay the 20 to 100 per cent premium for organic, they just want the producers and manufacturers to get better at keeping chemicals out of their food.

“They want traceability. They want to know where their food comes from. They don’t want horsemeat in their beef; they don’t want dodgy glucose in their honey; they don’t want their food to be adulterated along the way or sneakily made in the factory.

“The demand for nutritious food has gone gangbusters since COVID. So, there is still a lot of opportunities for our industry. It is widely agreed that grain is healthy, but can we value-add on top of that?”

Footnote: At the GIWA annual general meeting held before the forum, Esperance region grower and GIWA barley council chair, Lyndon Mickel, was elected GIWA chair, taking over from Narrogin farmer and GIWA oat council chair, Ashley Wiese.

Grain Central: Get our free cropping news straight to your inbox – Click here

HAVE YOUR SAY