GRDC chairman, John Woods.

THE Australian grain industry needs to get on the front foot to mitigate climate variability and reduce the greenhouse gas intensity of production to stay ahead of the game in a rapidly-changing world, according to Grains Research and Development Corporation (GRDC) chairman, John Woods.

Addressing the GRDC Grains Research Update in Perth, Mr Woods said the GRDC, in collaboration with CSIRO, would be directing investment to support the nation’s grain industry to better measure and reduce its greenhouse gas emissions.

He said agriculture around the world was facing increasing pressure on issues of climate variation, adaptation, emissions and carbon footprints.

“There is a bunch of pressures on us, but these are the macro pressures. I haven’t seen these squeezing industries, or potentially squeezing industries, so quickly. The dynamic has changed so quickly,” he said.

“It will impact how we manage crops, how we breed for heat, drought and frost and how we manage our farming systems. Those challenges are going to become more exacerbated over time.”

Mr Woods said consumer sentiment had shifted dramatically in recent years and it was time for the grain industry to act so it didn’t get caught “asleep at the wheel”.

“In relation to climate change and emissions, in my view the debate has moved on. Agriculture in Australia is a $60 billion industry, grains make up about $15 to $17 billion of that. We are around a quarter or more of the action in agriculture,” he said.

“We tend to keep our head down. We get whacked around a bit on things like glyphosate, but tend not to be exposed too much on climate change and emissions. But that is something we need to be very aware of.”

Regulation, capital, market access

Mr Woods said the shift in consumer sentiment was already impacting the grain industry in three key areas: regulation, access to capital and market access.

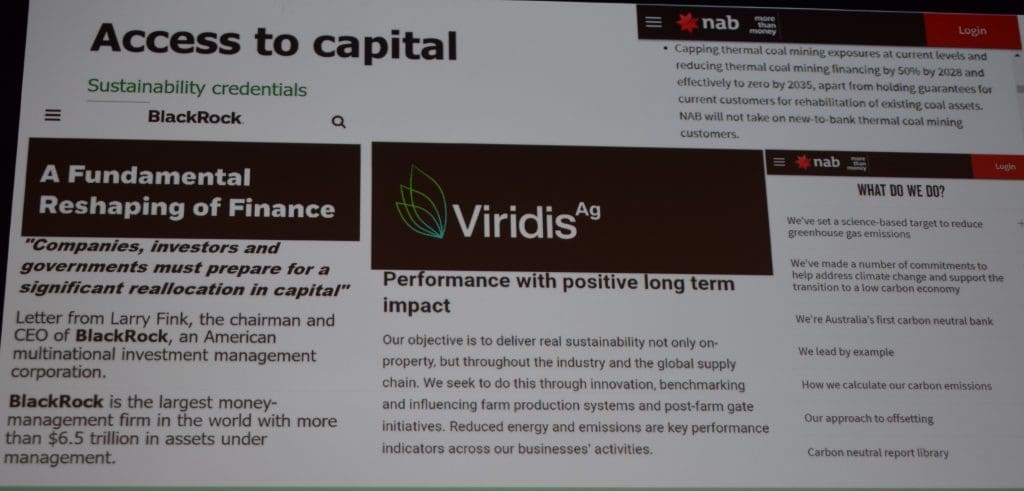

“It’s clear that future capital investment in the grains sector will be influenced by our ability to develop effective mitigation strategies and approaches to accountability,” he said

“We all require capital. BlackRock, the largest wealth management firm in the world, is reallocating capital around emissions and climate challenges. They have just announced they are moving out of all fossil fuel investments over the next three years.

“There are also global banks now talking about agriculture having ‘brown’ penalties and ‘green’ incentives. I haven’t seen anyone pull the trigger on this yet, but this is the language bankers and investors are now using.

“The third thing shifting on us is market access. Markets internationally and domestically are now starting to ask us what is our emissions profile in the grains industry and what are we doing about it? Our canola market in the EU relies on sustainability metrics. That is going to get harder and harder. We need to demonstrate clearly what our emissions profile is.”

Investing in emissions reduction

Mr Woods said the 18-month investment by GRDC and CSIRO would provide baseline data about the current level of greenhouse emissions in the grain industry, explore opportunities for mitigation and shape a realistic plan for emission reduction.

“We are going to identify the baseline of 2005, which is the international benchmark for emissions. We will then reflect on that as to how we operate today in 2020 as a grains industry. We will also look at what are the available mitigation measures growers can implement to both reduce emissions and increase profitability. We will also look at the R&D that needs to be done to accelerate that,” he said.

“Let’s have a landing on what the emissions are for grains going forward.

“We want to make sure we have tools for growers to do practice changes on farms and what that impact will be on emissions and profitability.”

Mr Woods said the investment outcomes would be essential in supporting and enabling the work by the wider grains industry to develop a Grains Industry Sustainability Framework, being led by Grain Growers Ltd.

“This investment will build on previous work undertaken through industry collaborations such as the Climate Research Strategy for Primary Industries (CRSPI) and the Managing Climate Variability Program collaboration, as well as investments to reduce nitrous oxide emissions from fertiliser and explore soil carbon sequestration opportunities,” he said.

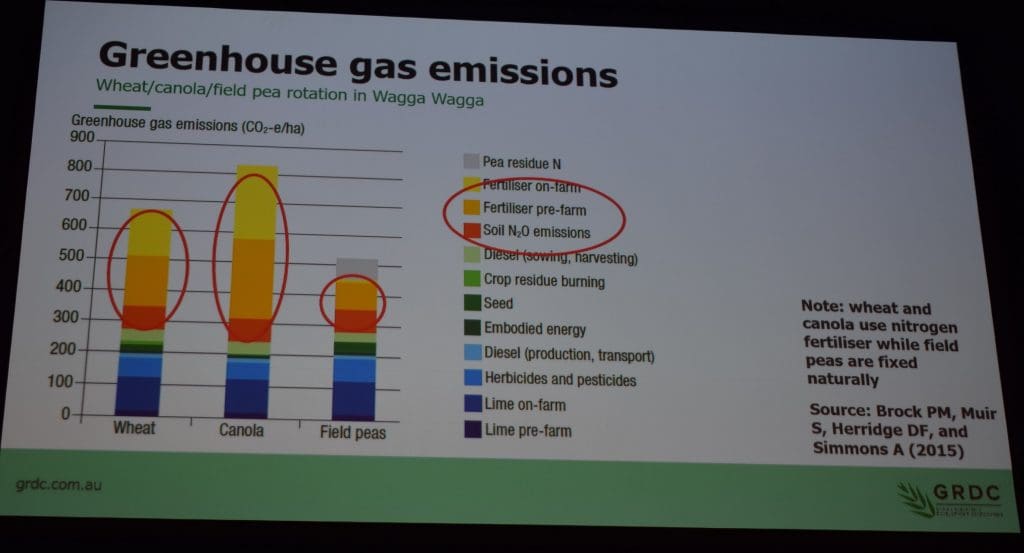

More than 50 per cent of emissions from the grain industry involve fertiliser use, particularly nitrogen.

Grain Central: Get our free daily cropping news straight to your inbox – Click here

HAVE YOUR SAY