Harvesting at Northampton in the Geraldton zone in late November. Photo: Amery Drage

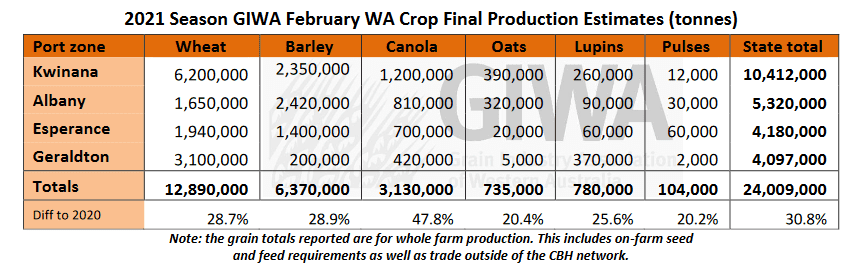

THE total grain production in Western Australia of just over 24 million tonnes (Mt) for all grains is more than 30 per cent higher than previous record years, according to the Grain Industry Association of WA’s first report for 2022.

The exceptional result was due to a record area sown of 9.2 million hectares, 7.8pc more than 2020, and 16pc more than previous record years.

Other contributors were good subsoil moisture across the state, an early start to planting, warm growing conditions and above-average fertiliser usage in the winter to set up very high yield potential for all crops, followed by very mild conditions during grain fill.

This combination of factors rarely occurs over such a wide area.

WA produced around 38pc of Australia’s grain in a year when all of the eastern states with the exception of South Australia, harvested record or near-record crops.

The year was not without its challenges, and severe frosts in September wiped out at least 2Mt of grain in the central grainbelt.

Many growers in this region only just made a profit, which was heartbreaking considering how good things looked up until the frosts hit.

There was also severe waterlogging over large areas in the south and western rim of the grainbelt.

However, the incredibly mild finish allowed these areas to recover to an extent that could not have been imagined at the start of spring.

High inputs costs temper outlook

Looking ahead to the 2022 growing season, the cost of putting a crop in has gone up substantially, primarily due to high fertiliser and herbicide prices due to supply constraints, and this will result in less area sown and subtle swaps in crop types.

There will be more fallow in the low-rainfall regions unless there is another exceptional start, and more canola will be planted in the medium and high-rainfall zones.

The total area sown to crop in the low-rainfall zones will be strongly driven by the amount and timing of rainfall in April and May.

Barley will be swapped out for wheat in the higher-rainfall zones due to the current lack of upside potential to price compared to wheat.

There will be more crop and pasture legumes sown to provide nitrogen for 2023 sown crops.

Oat area will probably remain static as, even though sown area was down a lot in 2021, there was more grain produced than in previous years.

The western and south coast regions of the state have subsoil reserves of moisture, while the low-rainfall zones are completely dry.

The next few months will have a big impact on the size of the 2022 crop area.

A summary by region of GIWA’s outlook for the 2022 cropping season follows:

Geraldton

Canola was a standout crop in 2021, with new varieties showing more resilience and reliability in the lower-rainfall districts.

As a result, there will be more area sown to canola and less to lupins in 2022.

After two good seasons, the low rainfall district will look to more chemical fallow this year to reduce their risk profile and reduce weed burdens.

Growers are mindful that the chances of getting a third good season in a row cannot be high, and this could amount to a drop in cropped area of around 30pc.

Kwinana

In the North Midlands region, canola area may rise dependent on the timing of the break to the season, but many growers have little scope within their rotations to sow more of it, or bring additional paddocks into crop.

The increasing risk from sclerotinia, and also now for lupins, is also a deterrent.

The barley area should fall in favour of more wheat, and sheep producers will keep more numbers and increase the pasture area slightly.

Overall, cropped area will fall slightly.

In the zone’s south, there is likely to be a slight move away from barley to wheat, and growers not maxed out with canola area will plant more hectares.

Growers with sheep are retaining older ewes and we will see a slight increase in sheep numbers for the first time in many years.

In the zone’s North East, canola was the standout crop in 2021 for profitability, but wheat will again be the dominant crop for the region.

The area of crop will probably drop to historical averages, as little ground was left to fallow in 2021.

Growers are planning to concentrate on their better set-up paddocks to keep the lid on input costs.

Albany

In Albany West, there is likely to be more canola sown and a shift out of barley to wheat by up to 25pc.

Growers are planning to sow slightly more lupins and keep more area to pasture.

There is still a reasonable tonnage of undelivered grain in the zone.

In Albany South, canola area should be at least similar, and wheat may increase in area where it performs better than barley.

Those with livestock will increase their numbers and pasture area.

In the zone’s eastern reaches, or the Lakes Region, no major changes are planned other than options to cope with a late break to the season.

Some marginal paddocks may go to fallow for weed control and pasture areas may rise for those with stock.

If any crop is reduced in area, it will be barley.

Esperance Zone

There may be more legumes being considered as they are cheaper to plant, but pulses from 2021 remains unsold with poor market opportunities.

Barley area may decrease, with more wheat and canola taking its place in the zone.

High fertiliser prices have dampened enthusiasm for cropping in the Esperance port zone.

Source: GIWA

Further detail on crop conditions in individual WA port zones can be found on the GIWA website.

What was the grain production tonnes in Western Australia in 1990 and what is the grain production tonnes forecast for 2022-23?

What are the reasons for the difference in grain production over this period?

Hi Bill. ABARES data puts WA 1990-91 production at 7.3Mt vs 23.8Mt in 2022-23. Growth has come from more cropped area, partly at the expense of sheep, higher-yielding varieties and better farming practices. Rgds, Liz