Harvesting last year in WA, the only state where farm cash incomes increased significantly in 2021-22, according to ABARES data released today. Photo: Tim Barndon Jnr, Kulin

WESTERN Australia has led the country with a 125-per-cent increase in projected cropping farm financial performance for the year to June 30, according to ABARES Financial performance of cropping farms report released this week.

South Australia saw a slight boost to farm cash incomes of 5pc.

Incomes declined for all other states with Tasmania seeing the sharpest drop at 60pc, followed by New South Wales on 13pc, Victoria down 3pc and Queensland down 2pc.

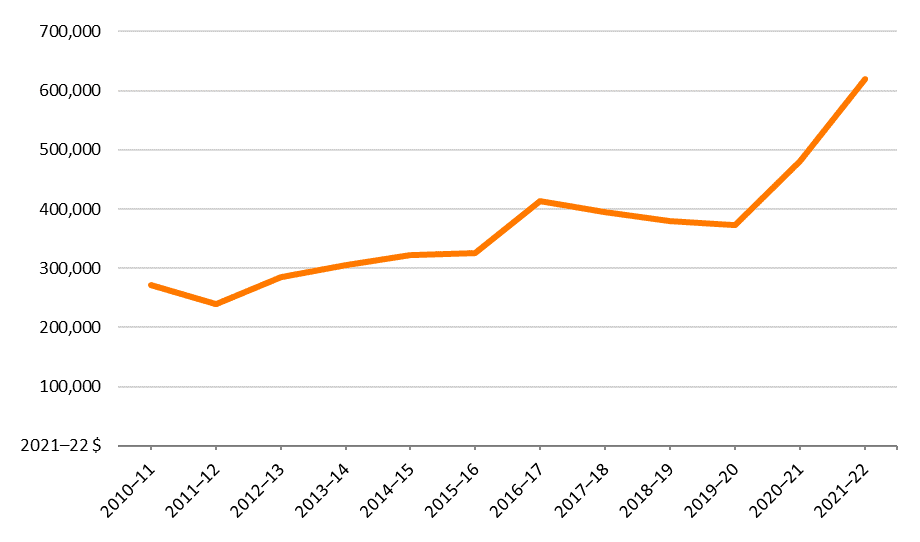

WA’s returns boosted the national figure with Australian cropping cash incomes estimated to have increased by around 28pc to average $619,000 per farm in 2021–22.

Looking long term, the average farm cash income for cropping farms in 2021-22 is estimated to have been around 76pc above the long-term average of $352,000 per farm in real terms for the 10 years to 2020–21.

ABARES executive director Jared Greenville said the overall rise was mainly due to higher receipts for wheat, barley and oilseeds.

“It’s been a boom year,” Dr Greenville said.

“We can put this down to higher receipts from wheat, barley, oilseeds, and grain legumes.

“That said, prices are higher for farm inputs such as fuel and fertiliser, and this has affected returns and will do so even more into 2022-23.”

Dr Greenville said ongoing productivity gains in Australian agriculture have helped drive the strong farm performance result in 2020-21.

“Over the long-term, average annual productivity growth in the broadacre industry was 1pc.

“Looking beyond the averages, we see that broadacre-sector performance is being driven by larger farms, with the largest 10pc of broadacre farms producing around half of total output, while the smallest 50pc of farms produce around 10pc of total output.”

Graph 1: Farm cash income, cropping farms, 2010–11 to 2021–22 average per farm. Source: ABARES Australian Agricultural and Grazing Industries Survey

WA dominates specialist returns

The success of WA operations in 2021-22 was further highlighted when ABARES examined the cropping-only or specialist cropping farms.

WA cropping regions in 2021-22 saw specialist farm cash incomes more than 25pc above the 10-year average.

It was the only state to see this result in all cropping regions.

Specialist cropping farms in Queensland and southern NSW and parts of South Australia reported farm cash incomes below the long-term average.

Nationally, specialist cropping performed well, with farm cash incomes 89pc above the average in real terms for the previous 10 years.

Mixed livestock-cropping operations also saw substantial increases, with average farm cash income estimated to have been around $396,000 per farm in 2021-22, around 63pc above the average in real terms for the previous 10 years.

Farm cash income, specialist cropping farms, 2021–22. Source: ABARES Australian Agricultural and Grazing Industries Survey

Small rise in farm debt

At the national scale, average cropping farm debt increased by 7pc over 2020-21, with most of the increase going towards land purchases.

Despite increased debt, farm-equity ratios increased slightly to average 87pc in 2020-21.

Improvements in farmers’ equity position was mainly due to a rise in average land values in 2020-21.

Approximately 18pc or 16,000 Australian farm businesses are classified as cropping farms, of which 7500 are specialist cropping farms and around 8900 are mixed livestock-cropping farms.

The findings from the report are drawn from ABARES Australian Agricultural and Grazing Industries Survey (AAGIS).

Source: ABARES

HAVE YOUR SAY