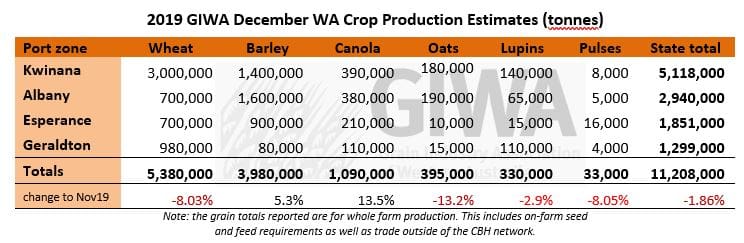

HARVEST is winding up for growers in Western Australia with the majority of the tonnage now in the bin, according to the latest crop report from the Grain Industry Association of Western Australia (GIWA).

Grain yields have been disappointing for most, except those growers in the western regions of the Albany Port Zone and areas in the west of the South Kwinana Port Zone.

Even though total tonnage at 11.2 million tonnes (Mt) is well down on recent years’ it is a good result considering the season.

Recent advancements in farming practices have enabled growers to break even or turn a profit in a very difficult year.

The exception to this is in the northern grain growing regions where many growers will return less than their variable costs.

It has been a while since harvest has finished so early in WA and in the old days “your headers were too big if you finished before Christmas”, although this year the crops for most were not big enough for the headers!

Most grain growing regions started the season with no summer rain and with a very dry soil profile compared with the big crops of 2018.

When the break to the season did not occur until the end of the first week in June most growers were re-setting programs and planning for a below average year based on previous experience.

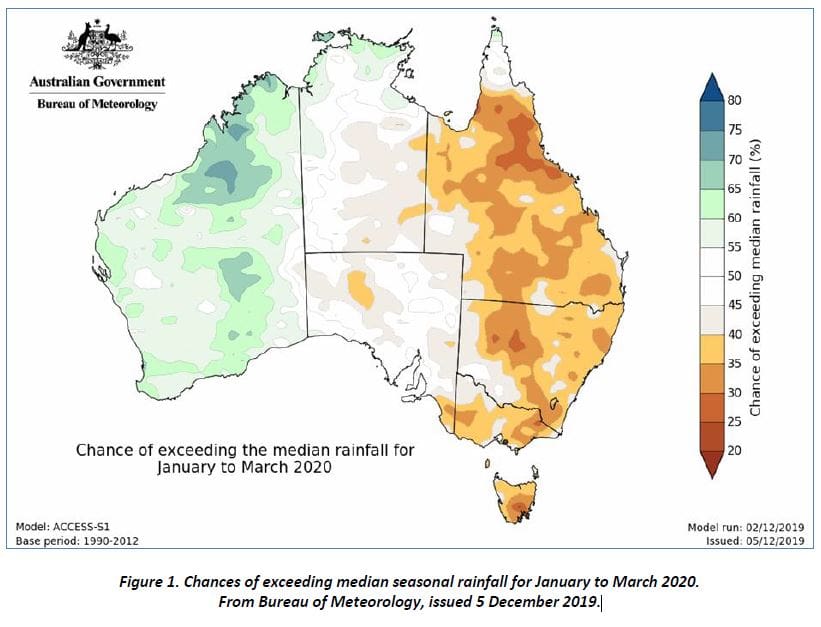

The seasonal outlooks and updates during the growing season have again been very accurate and in recent years’ seasonal forecasts have become an increasingly important component around risk with decision making.

The good news for Western Australia is there is a movement in the weather patterns back to a more “normal” situation (whatever that is), for the first three months of next year.

Average wheat yield for the state is going to be about 1.17 tonnes/hectare from about 4.5 million hectares (Mha) planted and barley about 1.94t/ha from about 1.95Mha planted.

The low average wheat yield for the state has had the greatest impact on the reduced tonnage produced due to the dry conditions in the major wheat growing regions and has not been this low for such a large area for well over 10 years.

Barley grain yields are well down in the central and northern regions of the state although tonnage has had a late kick from the southern and coastal regions performing very well.

Canola tonnage is up from estimates a month ago due to grain yields in the higher rainfall regions yielding more than expected.

Deliveries as opposed to production of oats, lupins and to a lesser extent barley are well down on recent years.

The private acquirers picked up the bulk of oat production. Lupins have been held back by growers due to the lower barley prices to give them options to go more to barley for sheep feed, and quit lupins for cash rather than feed to sheep if barley prices remain low.

Geraldton Zone

With harvest pretty well wound up in the Geraldton Port Zone most growers delivered one third to half their recent average tonnages. Grain yield across the board was well down due to the short growing season, lack of spring rain and hot temperatures in the spring.

Wheat on the good sandplain yielded between 0.8 to 1t/ha with the deep ripped country around 200 kilograms/ha more. The good heavier country that was able to store moisture and give crops access to it later in the season was slightly better. Wheat quality was surprisingly good considering the tough finish.

Lupins and canola on the better sandplain yielded around 1t/ha for lupins and around 500kg/ha for canola. Deep ripped country two years out consistently yielded half a tonne more for lupins and around 300kg/ha more for canola. As was expected with the late start, barley crashed due to the heat in the spring and the crash was worse than expected.

Due to being tight for cash from the poor year there will be some significant changes to crop mix in 2020, with growers likely opting for risk adverse programs based around more wheat area.

Kwinana Zone

Kwinana North Midlands

As you move south in the state, whilst grain yields are well down, they are closer to 40 to 50 per cent rather than 50 to 75 per cent down as is the case further north. Cereal crops in the west of the zone had put on more growth in the winter than further east and crashed when the heat came on in the spring. In the west, screenings were higher with the longer season higher potential varieties such as Sceptre and Ninja, contrasting with varieties such as Chief and Zen which yielded comparatively well with screenings well under 5 per cent. Chief has been performing well since it was released a few years ago and the indication in the region for next year is that the barley area will be replaced with Chief due to its good grain yield. Chief has the option of controlling Brome grass and is also able to be used as a follow crop after an Imi barley such as Spartacus.

The premium cereal grades were hard to find in the region with dedicated noodle growers delivering less than 50pc to APWN than what they would normally do, and barley malt growers down by 60 to 70pc on what would normally go Malt 1 or Malt 2.

Lupins and canola on deep ripped country yielded several hundred kilograms per hectare more than on the non-ripped country, as it did in most of the state. Hybrid canola has consistently been yielding more than the non-hybrids in both the west and the east of the zone, although looking to next year most growers will either back off on canola area without sub-soil moisture at the start of the growing season, or sow retained TT seed to keep input costs down following the poor year in 2019. The area of hybrid canola has been steadily increasing in the northern areas of the state due to its ability to tough it out at the start and finish ahead of the OP TT varieties, although the lack of Clethodim efficacy in break crops has seen growers move away from OP TT canola due to the difficulty in controlling ryegrass. In the eastern areas, growers minimise the risk of low canola grain yields by sowing on fallow and only on soil types best suited to canola. Unfortunately, this year in some areas even if you did everything perfect to give canola a chance, many canola paddocks did not return a profit.

Hay tonnage was well down in the state this year although the dedicated hay growers in the region will mostly grow as much or more next year for the rotational benefits in weed control, as much as for price.

Kwinana South

Most growers in the region will wind up harvest this week. Grain yields have been okay without breaking any records with most growers down 10 to 20 per cent on recent averages for cereals and 30 per cent down for canola. The grain quality has been generally okay with wheat hovering around the 5pc mark depending on variety and soil type. The grain yields for wheat range from around 3 tonnes per hectare in the west to 1.5t/ha in the eastern areas of the region. Grain yields have been better on the good medium country as is the case with most of the central and northern regions.

The barley has had very high screenings and very little has been going into the malt stacks.

Growers are not making any dramatic changes to paddock plans for 2020 just yet, for now it is more wait and see what the summer brings as far as rainfall goes. Cash will be tight for those in the lower rainfall zones and most growers in those areas will probably be looking at increasing wheat area from barley and break crops.

Kwinana North East

Grain yields in the region fall away in the eastern parts of the zone with the warm temperatures in the spring resulting in more damage to crops than first thought. Many growers north of the Great Eastern Highway were well below recent averages with whole wheat averages generally below 1.0 tonnes per hectare. Many paddocks yielded in the 0.6 to 0.8t/ha range. Wheat quality has been all over the place with some growers commenting that they have never delivered into as many grades before.

The grain yields of most crops improve a little south of the Great Eastern Highway with wheat yielding in the 1.0 to 1.5t/ha range in the east and some better yields up to 2.0t/ha in the western parts of the region.

In the north eastern areas of the zone wheat went in the 0.750kg/ha to 1.3t/ha range and barley 500 to 700kg/ha. The barley in most of the low rainfall zones was maturing during the scorching conditions in September and suffered more than the wheat from the tough finish.

Canola and, to a lesser extent lupins, were a disaster with most paddocks yielding less than 500kg/ha.

Albany Zone

Albany West

Grain yields really picked up moving into the western and southern parts of the Albany Zone. Most growers have been yielding more than expected for all crops with grain quality excellent. The lack of waterlogging in the zone has been a real bonus over the last few years and shows what potential the region has as a grain producing area in these types of seasons.

Most growers have reported frost taking the top off the canola yields, more so than the cereals, and even with the frost, plenty of canola paddocks are yielding more than 2.5t/ha. The lift in expected canola tonnage this month has been due to the extra grain yields being reported in these western regions.

Barley crops are also yielding very well with whole farm averages of more than five tonnes per hectare not unusual. The barley grain quality has been very good and many growers who grow barley for tonnes are getting a high percentage of deliveries into malt grades.

Wheat grain yields have also been very good as have lupin crops. The stand out this year has been the success of faba beans in the wetter paddocks within the region. The high water-use of faba beans lend themselves to the wet country and if they can get away before waterlogging sets in they can handle the conditions better than most other crops and can pump the profile dry in the spring with the warm weather. The marketing of faba beans has put growers off in the past, although the potential profit in areas where only pasture can return a profit year in year out makes faba beans a good alternative.

Albany South

Grain yields in the region have been average or above average in the west, graduating to below average in the east due to lack of rain and frost. The yields vary a lot for all grains depending on soil type and position in the profile from frost. Growers who picked up storms have faired much better than growers next door who missed out. Some growers in the eastern areas have been significantly impacted by frost for three years in a row now, where previously frost was an uncommon event.

Albany East (Lakes Region)

Harvest is or will be wrapped up by the weekend in the region with the general comment that most crops yielded slightly less than expected. With the lack of sub-soil moisture and June break to the season, growers were not holding too many hopes of a bumper season and this turned out to be the case. Growers planned for and managed crops with expectations of below average grain yields. The very dry spring and frost combined to return grain yields of a few hundred kilograms less than was thought prior to harvest. Wheat was in the 1.4t/ha range rather than 1.6t/ha, and barley has been going 1.6-1.7t/ha rather than 1.8t/ha. Grain quality was all over the place based mostly on soil type. The better soils and growers with a higher percentage of the medium soils had less problems with screenings than those with lighter or very heavy soils. Growers commented there was probably more damage to crops from frost than was initially thought, contributing to the slightly lower grain yields.

Canola and lupins yielded in the 500-600kg/ha range with a fair bit of lupins left in the paddock due to the very short crops.

Esperance Zone

It has been a reality check for growers in the region except for some nice pockets close to the coast. Total grain production is well down from last year due to the dry year and frost events in September. Close to the coast grain yields for barley and canola have been exceptional due to the lack of waterlogging although as you move away from the coast normally “frost free” areas have been impacted significantly from the frost events which were followed by the very hot conditions. In the more northern and north western areas of the zone it was just a very dry year followed by an unusually hot spring.

Grain yields and grain quality vary a lot within farms and between farms, based mostly on factors out of growers’ control. In years like this where the extreme weather events have overridden management decisions, there is not too much you take away in learnings from the year. Most growers are happy to be done with 2019 and are looking forward to what 2020 will bring.

DPIRD climate summary

November rain was generally below normal over southern WA, confirming the very dry spring conditions.

The Bureau of Meteorology’s medium range rainfall outlook indicates December rain is likely to be below

normal for the South West and southern agricultural areas.

This is likely to be a hangover from the persistence of the Indian Ocean Dipole (IOD) event.

Seasonal rainfall outlooks from Australian and international models indicate an improving rainfall outlook

for WA over January to March 2020 (refer Figure 1 below).

Rainfall probabilities are near-normal or better, coming from the expected decay of the strong positive Indian Ocean Dipole event and warming sea surface temperatures to the north of WA.

This may not bring much actual rain for traditionally dry areas, but is more significant for the northern wet season.

Bureau of Meteorology seasonal outlook summary, issued 5 December 2019

• Drier than average January to March 2020 likely for eastern Australia, but wetter for parts of

Western Australia.

• January to March 2020 daytime temperatures are very likely to be above average across

Australia.

• January to March 2020 nights very likely to be warmer than average apart from the southeast.

• Climate influences—the currently strong positive Indian Ocean Dipole (IOD) will weaken, while a

negative Southern Annular Mode (SAM) may influence the first half of January before returning to

neutral levels.

Source: GIWA

From what I am hearing from the “coal face,” the deliveries to CBH will struggle to be 10 million tonne. This leaves 1.2 million estimated tonnes either in on farm storage or private traders (Bunge etc.) It could be perceived the traders are aware of 1.2 million tonnes still in the system which will be for sale in the future therefore it has a “damper” effect on todays grain pricing. Just a theory??? 1.2million tonnes over estimated is a lot of grain and it makes us (farmers) wonder ; How come???? Ray.

Ray, We report on total WA production which includes deliveries to CBH, which as you point out will end up between 9.5 and 10.0MT, plus grain retained on farm for seed for the 7M hectares of cereals and lupins sown each year, private sales of grain to Bunbury port, grain direct to dairies, barley to be malted here and malt grain for export , milling oats for milling here and whole grain for export, grain manufactured into pellets for pigs, chickens, sheep, and cattle and grain kept on farm for livestock to feed the 12M sheep in the SW. Whilst the tonnage retained on farm each year is increasing it is not 1.2M tonnes.