The snapshot

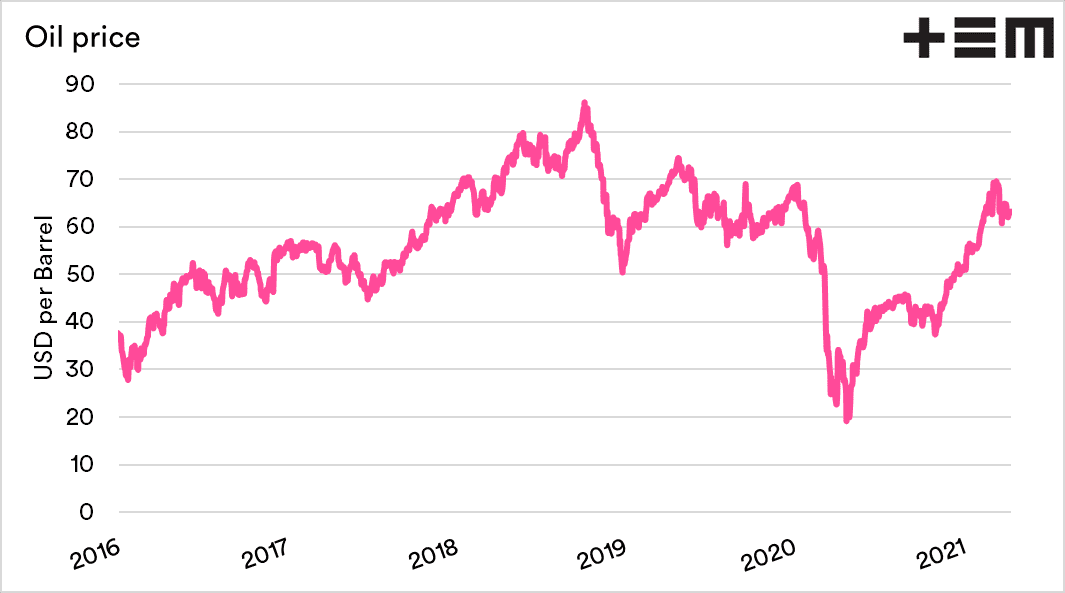

- The price of oil has been improving and is back to pre-Covid levels

- Rising oil is a good sign for an improving global economy.

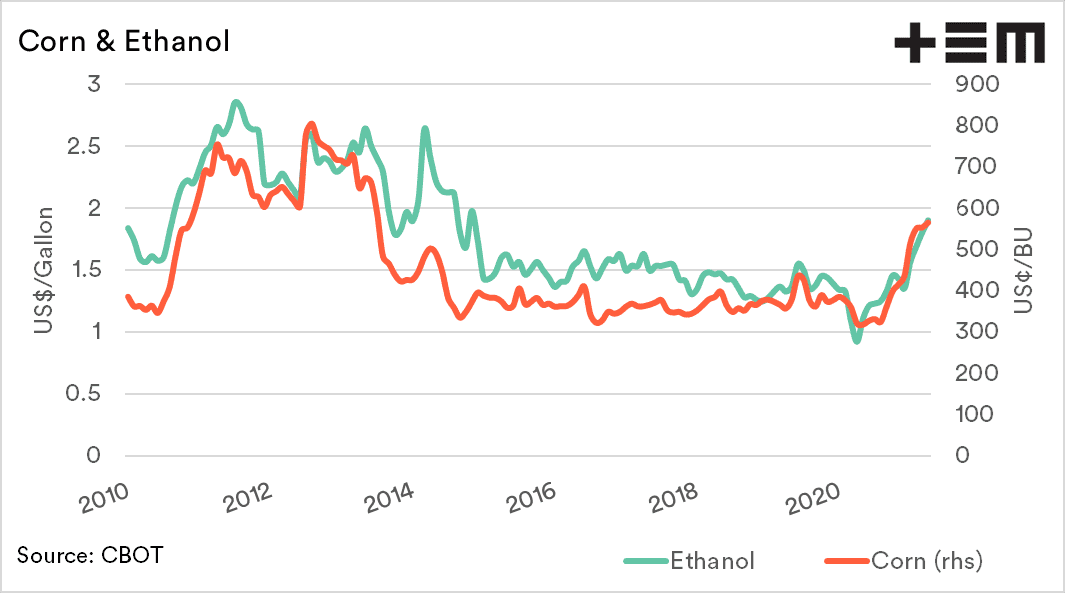

- A large proportion of corn in the US is converted to ethanol.

- Corn, ethanol and oil enjoy similar movements.

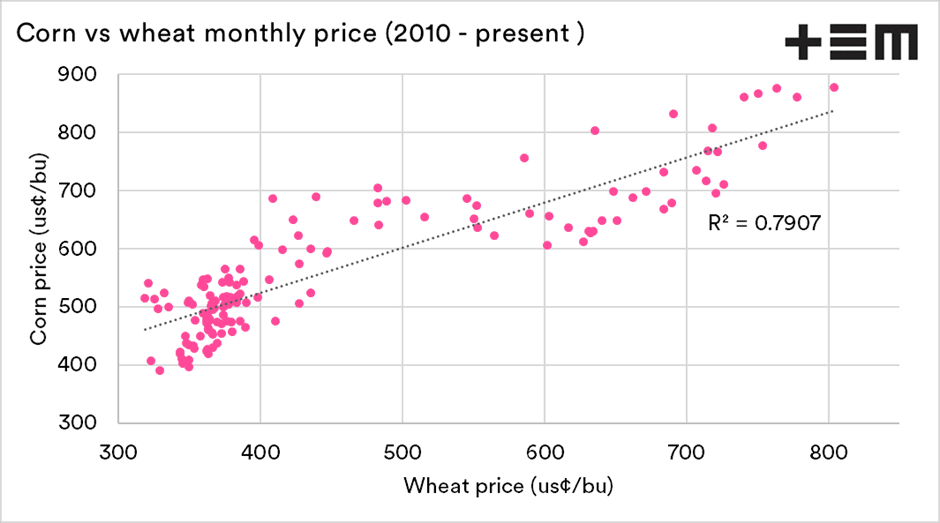

- Corn and wheat futures correlate with one another.

- Our local price correlates well with US futures.

The detail

The oil price was one of the victims of the Covid crash in 2020. At the height of the uncertainty, the world went into lockdown. The drivers (literally) of the economy were shut down, and demand for energy went into freefall.

The recovery is in process, and the oil price has returned to pre-COVID levels. This is a good signal of economic recovery. The question is, how does this impact agriculture?

The impact

First and foremost, the impact is on the fuels which we use on farm. An increase in oil, leads to an increase in fuel. That is pretty obvious, and we covered this back in February (see ‘fill her up’).

https://www.thomaseldermarkets.com.au/market-insights/market-morsel-fill-her-up/

The question, though, is how much impact does it have on the fuel price. Let’s look into the relationship between crude and grain.

In a recent WASDE update, I briefly discussed the increase in ethanol production in the US (See ‘WASDE: Grains’, and that is the perfect place to start.

The United States is the largest producer in the world, and a large proportion of this is converted into ethanol for use in road fuels (approx. 40pc). This ethanol production is part of government-mandated programs to define the minimal fuel level, which must be from renewable sources.

The chart below shows the ethanol and corn price over the past decade. As we can see the two pricing points tend to follow one another.

On a monthly average, the correlation between the two commodities is 0.88, with 1 being a perfect correlation and 0 being no correlation.

What about wheat?

We may not grow much corn in Australia, but that does not mean that price movements in corn will not impact the commodities we produce. There is a degree of interchangeability between corn and wheat, as they can be used for similar applications.

The monthly change in the price of wheat and corn futures is displayed below. The monthly movement in prices tends to track one another over time.

The relationship between US wheat and corn futures is strong, and our local wheat pricing has a strong relationship with US wheat futures (see here)

What does it mean?

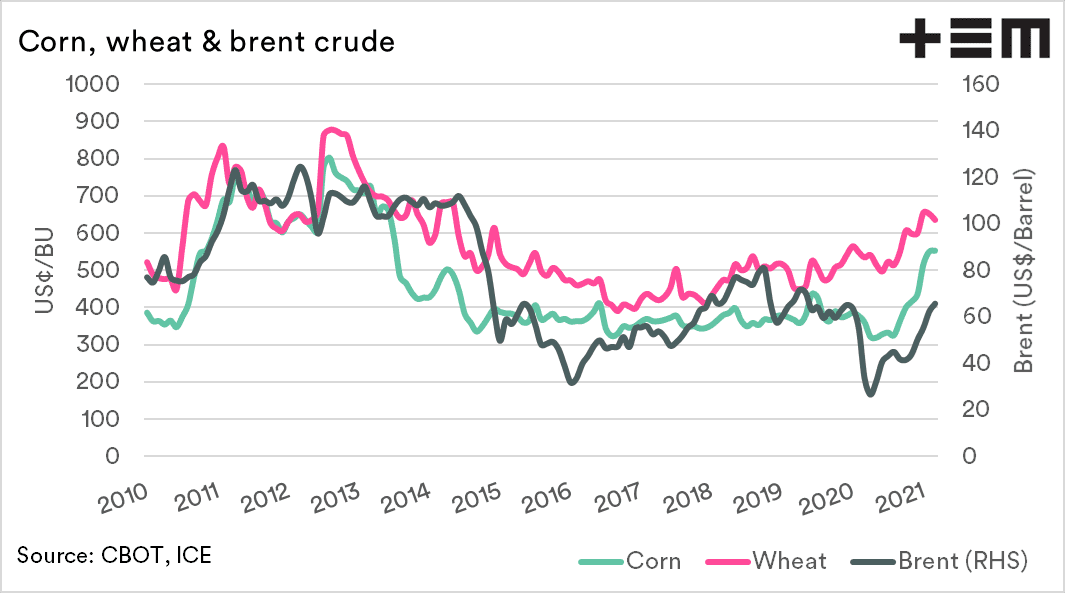

Oil and ethanol have a relationship; ethanol has a relationship with corn. Corn has a relationship with wheat.

These commodities, whilst distinct, have moved with one another. A rising oil price can flow through the grain chain through to our wheat price in Australia.

So, whilst high oil prices can cost us more in fuel, they can be a good omen for grain.

This article was originally published on the Thomas Elder Markets website: https://www.thomaseldermarkets.com.au/

To view original article click here

HAVE YOUR SAY