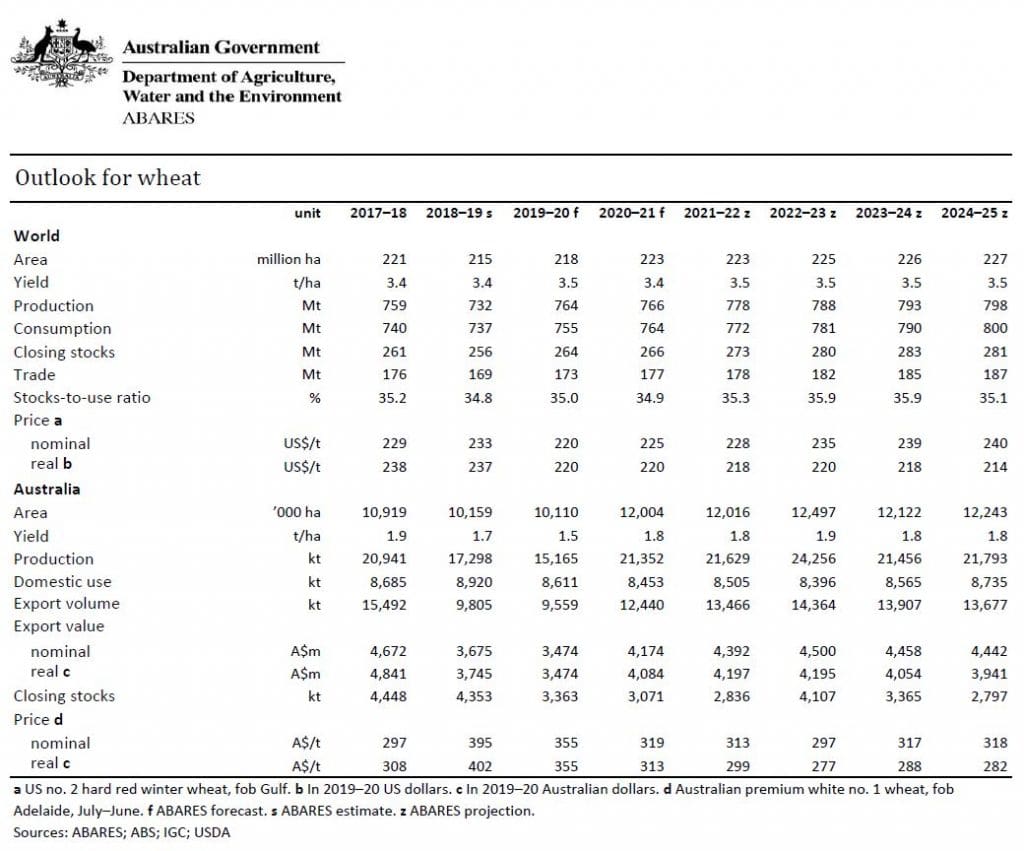

THE world wheat indicator price is forecast to average slightly higher at US$225 per tonne in 2020–21, up from US$220/t, according to ABARES March quarter Agricultural Commodities report released today.

Lower wheat production in the Black Sea region, the European Union and the United States is forecast to result in higher prices.

ABARES predicts that over the medium term to 2024–25, world import demand for wheat will continue increasing in line with population growth, changing diets and rising incomes.

However, prices are projected to fall gradually (in real terms) over the medium term due to world supply growing faster than demand.

World wheat production to increase

In 2020–21 world wheat production is forecast to increase marginally to around 766 million tonnes (Mt), largely reflecting record production in India and a return to more favourable seasonal conditions in Australia and Argentina.

World wheat consumption is forecast to increase in 2020–21 and over the medium term to 2024–25 due to a growing world population consuming more milling and feed wheat.

Australian exports to recover

Persistent drought conditions have led to more Australian wheat being consumed domestically rather than being exported, driving up domestic prices and reducing exports.

The majority of intensive livestock operations are in New South Wales and Queensland, where persistent drought has severely affected local feed grain supply.

Wheat is being shipped from Western Australia and South Australia and trucked from Victoria to meet demand.

In a normal season, NSW and Queensland are net exporters of wheat.

Asian markets

The volume and quality of wheat exports from the Black Sea and Argentina have increased significantly over the five years to 2019–20, making wheat from these sources competitive in price-conscious Asian markets.

Australia is expected to regain these Asian markets when increased production and exportable supply lead to more competitive export prices.

This will enable Australian exporters to once again take advantage of transport cost advantages over more distant suppliers.

Recent increases in Argentina’s wheat export tax and the possibility of the Russian Federation restricting exports due to concerns about domestic supply are also likely to lead to an increase in the price of wheat from these suppliers, adding to Australia’s competitiveness in world markets.

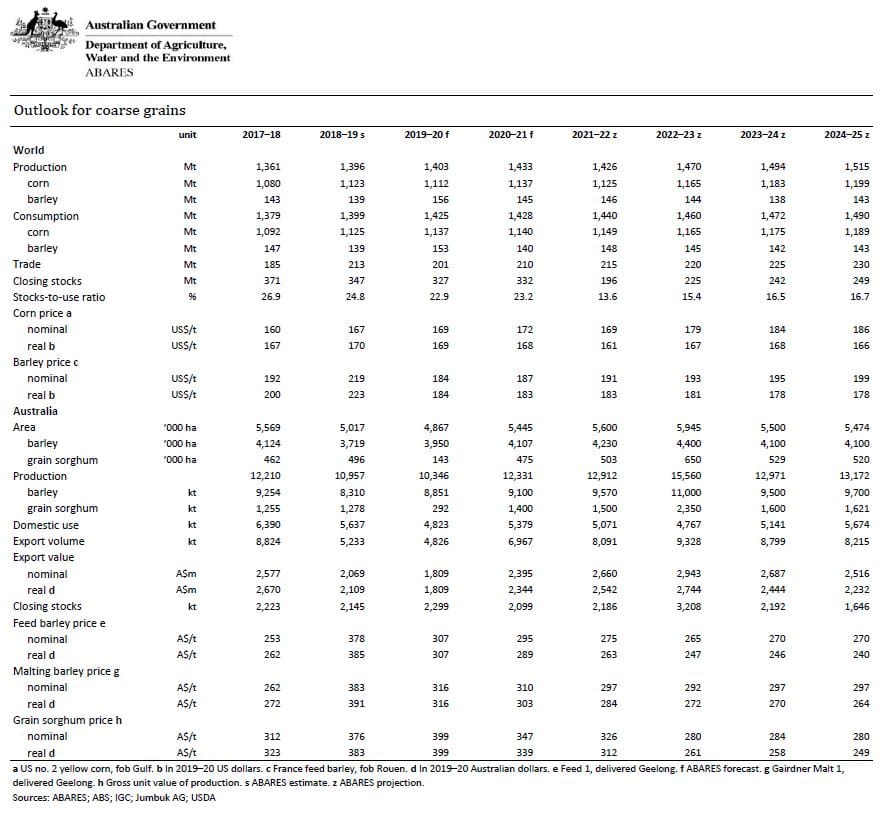

Coarse grain demand slowing, production growing

ABARES forecasts world barley and corn prices will remain relatively unchanged from low levels in 2020–21 and over the medium term to 2024–25.

Global production has outpaced consumption in recent years, resulting in significant inventories and relatively low prices.

This is the result of long-term improvements in productivity and crop yields.

Projected lower wheat prices mean that substitution in feed grain will prevent any significant price increases in coarse grains.

World coarse grain production is forecast to rise by 2pc in 2020–21, primarily driven by higher corn production in the United States after a poor season in 2019–20.

In combination with elevated US stocks, this is likely to mean corn prices will remain at their current low levels in 2020–21.

Global barley production is forecast to fall slightly as production returns to more average levels, following a record year due to widespread favourable conditions for major producers.

Australia’s coarse grain production to recover

Two consecutive years of drought in eastern Australia have reduced coarse grain production in 2019–20 to its lowest level in 13 years.

The drought has increased feed demand substantially.

Domestic grain prices have risen substantially above world prices as a result of the high cost of meeting biosecurity-related import protocols.

Soil moisture levels were at record lows at the end of 2019, so persistent and timely rainfall will be required for production to recover from these levels.

If adequate rainfall is received over autumn 2020, widespread planting is expected in response to high domestic feed grain prices.

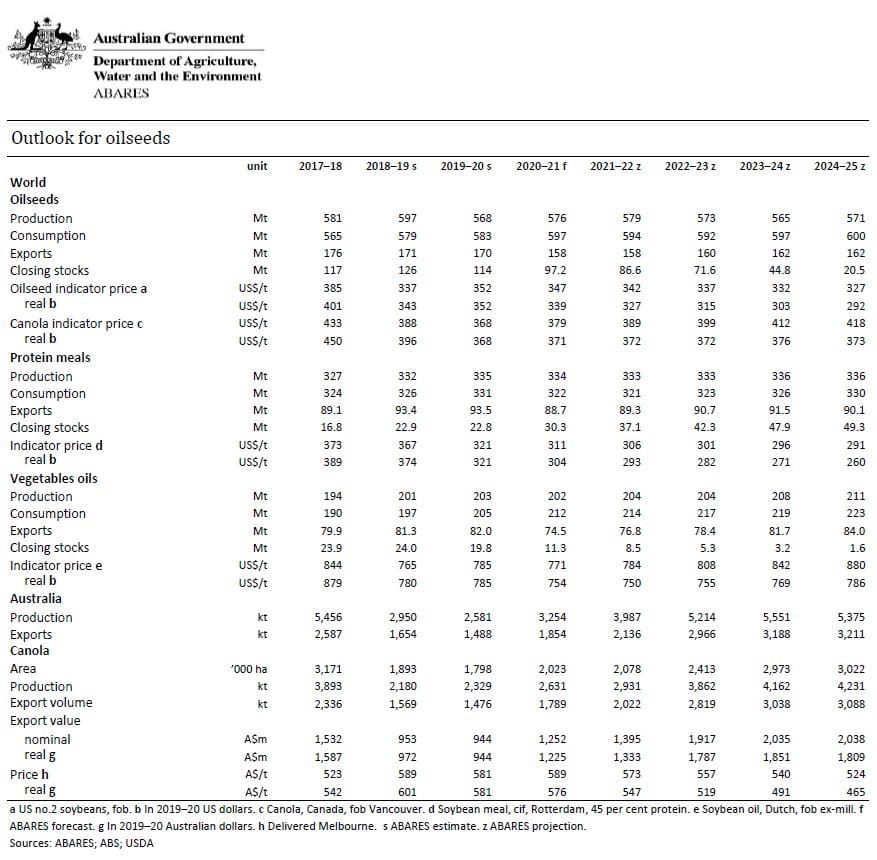

Oilseed prices heading lower

World soybean prices are forecast to remain low in 2020–21. The US soybean indicator price is forecast to average US$352/t in 2020–21, 10 per cent below the five-year average of US$393/t.

Demand for soybean meal in China has fallen because African swine fever (ASF) has dramatically reduced pig numbers.

Prices of all soybean products (seed, oil and meal) are expected to fall as supply recovers in 2020–21 while demand remains weak.

Canadian canola prices (including ABARES indicator price) have fallen as a result of the Chinese Government’s decision in March 2019 to impose restrictions on imports of Canadian canola.

ABARES world canola indicator price (fob Vancouver) is forecast to be US$379/t in 2020–21, 5pc below the five-year average of US$398/t.

ABARES has assumed these restrictions will be lifted in 2022–23, and trade between Canada and China will resume.

If realised, the Vancouver price is forecast to rise strongly and equalise with other export prices.

Poor seasonal conditions across most growing regions will result in Australian canola production 30pc below the five-year average, at an estimated 2.3Mt in 2019–20.

The area planted to canola is expected to increase, and production will rebound to 2.9 million tonnes in 2021–22.

Cotton prices to fall

The world cotton indicator price is forecast to average US76.5 cents per pound in 2019–20, down from US84.4 cents/lb in 2018–19.

Increased global production of cotton, high stock levels and competition from synthetic fibres such as polyester are expected to keep cotton prices near current levels in the short and medium term.

Cotton production and exports

Australian cotton production is forecast to be 600,000 bales in 2019–20. This is only 13pc of the production achieved in 2017–18.

Continued drought in NSW and Queensland has depleted the water storages used for cotton irrigation.

Little or no soil moisture prior to the planting window, combined with low rainfall in late spring and early summer, have diminished the prospects for irrigated and dryland crops.

At just over 60,000 hectares, the area of cotton planted is the lowest since the emergence of Australia’s contemporary cotton industry in the late 1970s.

Australian cotton production is forecast to recover in 2020–21.

Agricultural sector resilience

Australia’s agricultural sector overall has been remarkably resilient in 2019–20 despite prolonged drought and widespread bushfires.

The value of farm production is expected to be $59 billion, helped by high commodity prices.

Drought-related falls in production have reduced farm incomes in affected regions.

Average farm cash incomes for all broadacre farms are projected to fall by 8pc from $165,700 per farm in 2018–19 to $153,000 per farm in 2019–20.

This is around 4pc below the average of $158,000 per farm in real terms for the 10 years to 2018–19.

In 2019–20 31pc of broadacre farms are projected to have negative farm cash incomes, compared to 26pc in 2018-19 and 15pc in 2017–18.

Source: ABARES

Grain Central: Get our free daily cropping news straight to your inbox – Click here

HAVE YOUR SAY