Elders analyst Richard Koch

Elders economist Richard Koch looks at the booming opportunity for Australia sorghum to service the Chinese thirst for baijiu, a popular alcoholic spirit. Baijiu is the world’s biggest-selling liquor, with an industry valued at around $160 billion in 2023, bigger than the combined global market for whiskey, gin, vodka, rum and tequilla.

HAVING spent some time away from agriculture and coming back to it, things that are business-as-usual to those involved in the day to day seem truly remarkable to me.

One of those things that doesn’t seem normal is seeing sorghum continue to trade at better than milling wheat values.

I’ve asked some of my grain industry colleagues how’s that possible. When I left the grains industry in 2010, sorghum was always at a discount to wheat based on its lower nutritional value in the feed ration.

Something has changed in sorghum market dynamics since then and that is that it’s no longer being used solely for stockfeed.

There were some vague references to the baijiu, a popular alcoholic spirit, market in China.

There was no clear answer on just how big this market is. One bloke said 500,000t and another 3mt.

I started to dig up a little bit after some research. To say I was surprised is an understatement.

The baijiu market is big, very big.

Baijiu is the world’s biggest-selling liquor, with an industry valued at around $160 billion in 2023, bigger than the combined global market for whiskey, gin, vodka, rum and tequilla. It dominates the Chinese spirits market with over a 90 percent share.

Baijiu is deeply embedded in Chinese culture and is commonly consumed at social and traditional gatherings and is favoured by rural and older generations. It can be fermented from rice, vegetable, white grains or beans but a heavy sorghum blend is preferred for its aroma.

Sorghum can account for up to 50pc of the grain used in production of baijiu, though exact inclusion rates vary among individual producers.

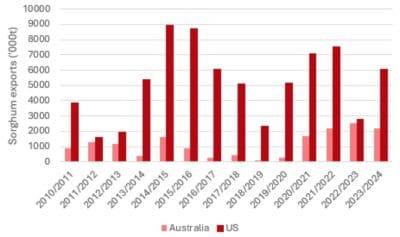

Australian & US sorghum exports to China – 2010-2024

The US Grain Council (USGC) were in China in 2019 investigating the potential of the Baijiu market.

Reece Cannady, USGC manager of global trade said baijiu was a big part of Chinese demand.

“Up to now, we thought sorghum imports have been driven by demand for sorghum in livestock feed, but key traders have started selling US sorghum to the distilled spirits industry,” Mr Cannady said.

The delegation concluded that market demand for baijiu production was substantially higher than original estimates, which were about 3mt.

China dominates the global sorghum trade

In the last full export year 2023/24, there was about ten million tonnes of sorghum exported globally with 90pc of the total going to China.

Of that, the US (6.1mt), Australia (2.2mt) and Argentina (1.3mt) accounting for 96pc of Chinese imports.

Over the past few years, the US has consistently exported around 6-7mt of sorghum to China.

Owing to the current trade war between US and China, US sorghum exports to China have ground to a halt, falling to just 78,316t in January / February from more than 1.4mt over the same period a year earlier.

Sorghum is not a big crop in China. They grow around 3mt in their northern provinces and, with planting starting around now, it’s unlikely that they will have time to significantly increase local production to fill the void left by the decline in US exports.

Prolonged tensions between China and the US have the potential to create an enormous opportunity for Australian sorghum.

Potential to reshape our northern cropping industry

Consistent milling wheat prices for sorghum could have the potential to reshape our northern cropping industry.

The ability to double crop and grow high yielding sorghum crops (there were reports of some crops this year yielding more than 10t/ha) could be a game changer for northern grain producers. Potentially, sorghum could be also grown on irrigation on the Ord River in the NT.

Investigation of the market

The good news is that the Grain Research and Development Corporation has done some research into market opportunities.

Chris Blanchard of the Functional Grains Centre at Charles Sturt University was upbeat after his GRDC funded study.

“We did some market intelligence into that area to get a sense of what the drivers of purchasing were in that market, and there seemed to be some really good opportunities there,” Prof Blanchard said.

He found that Australian sorghum varieties contained more ethanol than common Chinese varieties and that our red sorghum varieties are important in the flavour development of baijiu.

There are also domestic opportunities.

“We’d love to see more sales into China, but we’ve also had people approach us with an interest in establishing baijiu production in Australia,” he said.

“That’s another exciting opportunity for sorghum growers to sell into.”

Are our industry structures working?

Normally the process would be that the Austrade office in China would identify the opportunity and alert local industry bodies to the potential.

One of the problems with the current grains industry structure is that the grower is not close enough to the end user.

We sell our grain as ‘Australian’ internationally through intermediaries and there is no incentive for the individual producer to get closer to the customer to understand their needs. The industry handles this in a crude manner now by setting grain delivery standards that create segregations or stacks, but the reality is that these stacks can often be co-mingled with other grains by intermediaries to meet customer requirements.

Do we know what sorghum varieties are best suited to producing Baijiu and are preferred by distillers in China?

Do we understand their needs and how we can better meet them?

Do we know who the big distillers are? Do we know where they are?

If not, grain producers in Australia should be asking why.

- Author Richard Koch is a business intelligence analyst with Elders.

HAVE YOUR SAY