Commodity Overview

- Winter crop production is forecast at 44.7 million tonnes, nine per cent above average following September rainfall in Eastern states.

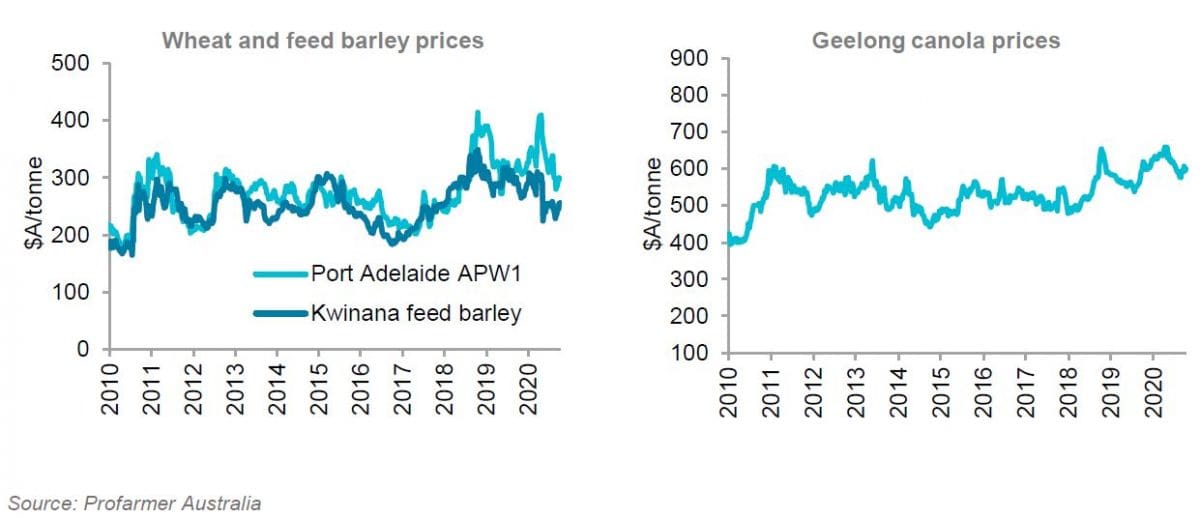

- Wheat prices are being supported by concerns around dry conditions in the northern hemisphere but are expected to soften around five per cent under harvest pressures.

- A wet outlook for Eastern states raises the potential for quality downgrades in cereals and pulses.

AUSTRALIAN winter crop production is forecast at 44.7 million tonnes, nine per cent above average and a 49pc year-on-year increase, according to Rural Bank Insights Update October 2020 release today.

Year-on-year production increases to wheat (85pc), barley (8pc), canola (47pc) can mostly be attributed to improved yields in New South Wales.

After a dry start, rainfall in the second half of September resulted in monthly totals of average or above average for most of NSW, Victoria and South Australia.

September rains have provided most crops with the moisture needed to carry through to harvest, with at least average yields expected in SA, and above average in Victoria and NSW.

Below average rainfall throughout the growing season in Queensland has caused crops to mature early, with harvest already underway in some areas.

Western Australian rainfall was below average except for the south west region of the state, which has caused declines in yield potential resulting in wheat production estimates declining 9pc month-on-month.

With little appetite from either the seller or the buyer, grain markets remain mostly stagnant in the ‘pre-harvest lull’, typical for this time of the year.

Domestic demand remains flat, with most domestic buyers having sufficient cover to get through to harvest.

International demand has turned to northern hemisphere crops where winter crop harvest is complete.

Stocks running low

Australian stocks are running low, limiting availability for any immediate demand.

Most growers still holding stock would have sold by now if they were going to.

Poor soil moisture and dry conditions in Russia and the Ukraine during planting are fuelling fears crops will not have time to establish before the northern hemisphere winter (and crop dormancy) sets in.

In response to these concerns, Chicago Board of Trade (CBOT) wheat futures have risen 8pc since the start of September.

In Australia, subdued domestic demand and limited buying has seen local values follow international pricing, with new crop wheat prices increasing eight per cent to over $300 per tonne.

Downward pressure on local prices is anticipated as harvest starts with the expectation growers will have to sell some of their crop, particularly in areas coming out of drought.

Whilst there may be some short-term spikes because of supply chain pressures to get grain to ports, we expect harvest pressures to soften prices to around 5pc from current levels.

The quality of cereals and pulses in the lead-up to harvest may also become a concern.

Too much rainfall between October and December or rainfall after crops have ripened can cause disease and mould in pulses and sprouting in wheat which can severely degrade quality.

Whilst increased production will compensate to some degree, severe downgrading of quality could result in reduced return for the grower.

Source: Rural Bank

HAVE YOUR SAY