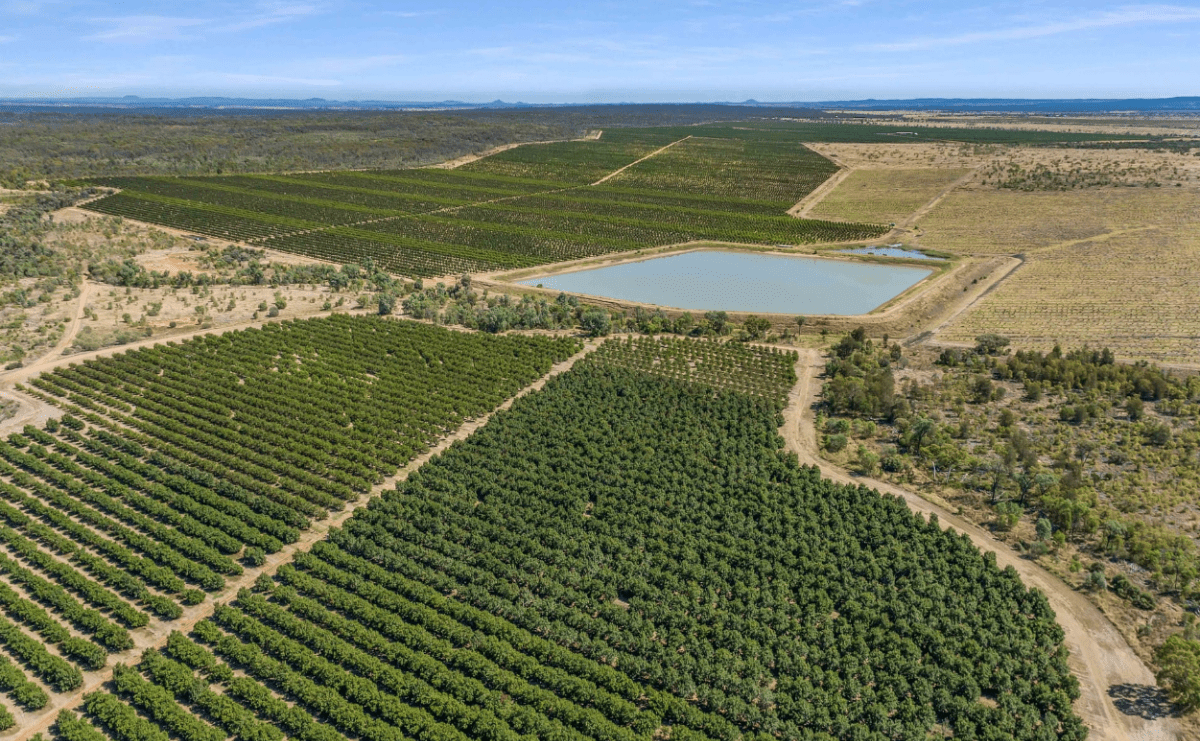

Cowal Agriculture featured a strong history producing a range of crops. Photo: LAWD

MACQUARIE Asset Management (MAM) has been confirmed as the new owner of the 5976-hectare Central Queensland irrigation portfolio, Cowal Agriculture, after purchasing the aggregation for around $120 million earlier this month.

Land, Agribusiness, Water and Development (LAWD) listed the property for sale via expressions-of-interest (EOI) in October last year on behalf of vendors, US-based investment fund Global Endowment Management.

A standout feature of Cowal Ag was its water entitlements with 27,157 megalitres of medium-priority water and 4648ML of unsupplemented water, and a 12-kilometre frontage to the Nogoa River.

The two-parcel portfolio had a strong history of growing cotton, chickpeas, mungbeans and wheat, with 3549ha developed for irrigated row-cropping, and 144ha under centre-pivot irrigation.

LAWD agent Danny Thomas said there was strong fund interest in the property.

Mr Thomas handled the sale of Cowal Ag alongside fellow LAWD agent Simon Cudmore.

“It was a two stage EOI we ran with a preferred party for a while and that didn’t come to fruition, so we went back to the market,” Mr Thomas said.

“We had three very interested parties who engaged with us again.

“We could have transacted with any one of those three parties; they were all highly credible institutions.

“They were all keenly interested in the asset, and, at the end of the day, we could only sell to one of them.”

The sale of Cowal Ag demonstrates MAM’s continued interest in high quality Queensland irrigation properties.

It comes after the fund announced in February that it acquired the the remaining 51 per cent stake in Cubbie Station, located in south-west Queensland.

This transaction took the agricultural funds total ownership of Cubbie to 100pc.

Expressions of Interest have closed for the 4386ha Central Queensland Gemfields Aggregation. Photo: LAWD

Emerald interest firms

Mr Thomas said the strong demand for Cowal Ag demonstrates the increasing institutional interest in the highly productive Central Queensland region.

He said the June 2021 sale of 2PH Farms to the Costa Group was the “first significant deal”, that he believes will be followed by more strong transactions.

Costa Group bought the Central Queensland horticulture business for around $220 million, which included 1474ha of citrus plus 240ha of table grapes, and irrigation entitlements from Fairbairn Dam.

“I think Emerald is having a bit of an awakening in the eyes of the institutions.

“They are seeing real value there, and I expect…Cowal to be the first of several transactions that we see knock-on out there through that system.

“I don’t think they realised just how productive it is and in relative terms just how good a value it represents.”

Another Central Queensland irrigated asset, Gemfields Portfolio, has passed the EOI stage and has seen some strong interest.

The 4386ha property hit the market in June with an estimated sale price of around $70M.

The multi-generation family-owned operating featured of two non-contiguous landholdings, Gemfields (779ha) and Cypress and Bauhinias (3607ha).

Mr Thomas said process for the sale of Gemfields was “progressing well”.

Grain Central: Get our free news straight to your inbox – Click here

HAVE YOUR SAY