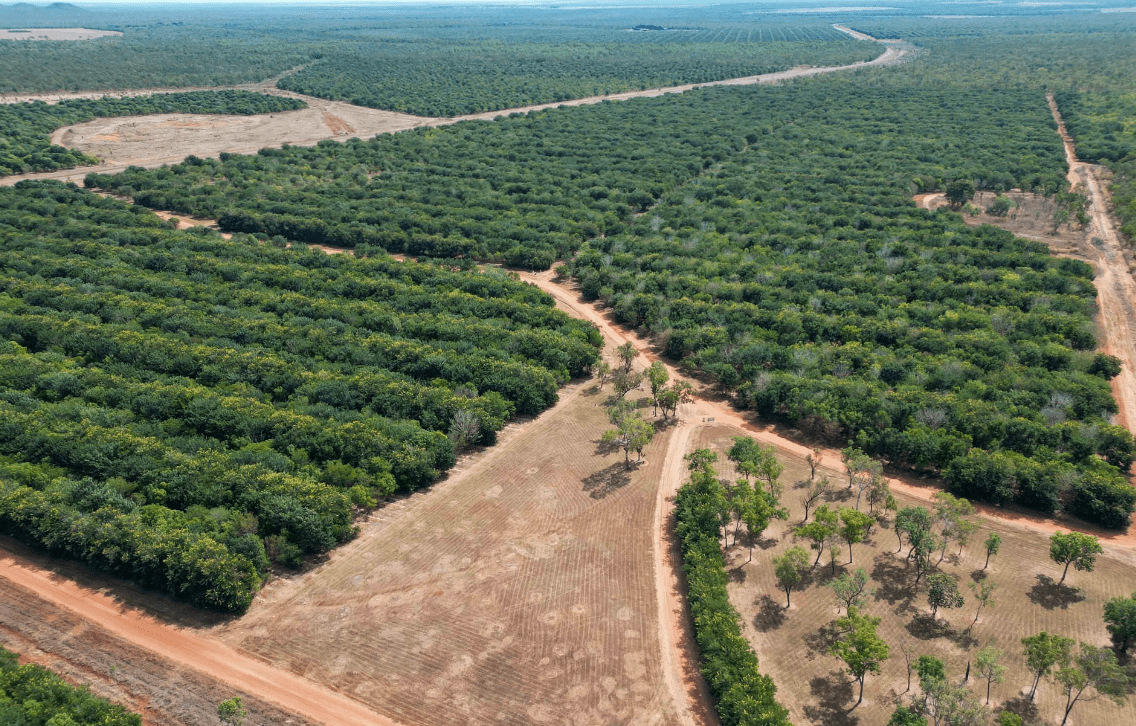

Oolloo Road offers a large-scale irrigated cropping development opportunity in the Douglas Daly region. It is currently planted to sandalwood. Photo: LAWD

A SURGE in rare irrigated and dryland cropping opportunities, coupled with new cotton gin infrastructure, have boosted confidence in northern Australia’s burgeoning agricultural industries.

Of the new cotton and cropping frontiers, the Ord region in north-east Western Australia leads the way when it comes to increased interest in properties suited to broadacre developments.

This is thanks to the industry being relatively well developed, and having reliable water and established pumping infrastructure in place.

In recent days, a 1650ha opportunity near Kununurra is one of the largest single irrigated cropping development in recent years to come forward.

Listed by Ray White Parkes, New South Wales, agent Kim Watts, the property includes 19 megalitres of water per hectare per year.

Currently not planted to sandalwood or other permanent trees, the property provides a rare chance to invest in an operation with a history of producing crops such as cotton and corn.

Northern Territory-based Gray Land and Livestock agent Andrew Gray said the Ord was generally preferred over the NT for horticulture and broadacre developments.

“There is certainly an interest in country that is developed with water,” Mr Gray said.

He said the cost to distribute water in the Ord was more affordable than in the NT.

Sandalwood listings set market

Apart from land releases made by the WA and NT governments, large-scale cropping properties have been a rarity on the market.

Many buyers have turned to purchasing properties on offer following the collapse of sandalwood company Quintis to make a foray into cropping or grow irrigated fodder.

While these properties require work to remove the sandalwood trees, a relatively low purchase cost alongside the inclusion of licences for reliable water plus irrigation infrastructure can make for a viable investment.

In a May publication, Herron Todd White director Will McLay highlighted recent sales of sandalwood properties as indicators of the affordability of northern Australia’s irrigation land.

These include large-scale NSW grain and cotton grower Ron Greentree, who – via company Prime Grain – reportedly paid $7.6 million in September 2023 for Voyager Farms, a 517ha plantation also put on the market by Quintis.

In the same month, northern pastoralist Sterling Buntine purchased a 363ha plantation in Kununurra, reportedly at more than $5M.

Mr McLay estimated that the Quintis property sales set the market at about $15,000 per irrigated hectare, including water.

He said the anticipated remediation costs to clear the sandalwood and re-establish the land to be about $5000/ha.

“This expenditure results in an irrigated farm with a value in the order of $20,000 per irrigated hectare, which is a $5000-$15,000/ha discount on values observed in the southern markets,” Mr McLay said.

“The trade-off to this more affordable location is obviously the additional operating expenses that come with producing a product in a remote area, in addition to increased seasonal and environmental volatility and lack of supporting infrastructure, although this is quickly improving.”

Under instruction from the receivers, Elders is handling the sale of the Quintis Estate, featuring 248ha near Kununurra, 1928ha in the Burdekin region of North Queensland, and an oil-distillation facility at Albany in south-west WA.

These properties were listed in the same timeframe as Douglas Daly sandalwood property Oolloo Road or the Midway Farms, a 1798ha aggregation owned by Black Kite, and Eagle Park, a 385ha sandalwood plantation located near Katherine, also in the NT.

Mr Gray is handling the Eagle Park listing, and said the sandalwood plantations are expected to be felled and replaced with another crop.

He said Quintis was one of the few existing operators with large-scale irrigation pumping which would prove attractive to potential buyers.

“Country with that type of irrigation pumping equipment is basically Quintis properties.”

LAWD agent Olivia Thompson, who alongside colleagues Danny Thomas and Erica Semmens listed Oolloo Road, said she expected “broad interest in the properties” and has marketed the aggregation as suitable for conversion to high-value crops, such as cotton, horticulture and intensive fodder production.

She said the scale and properties were “rare” for the NT given they were “an already established designated cropping area with a substantial water licence.”

“It is versatile as well…in that it is an unrestricted licence in the context that it’s not only for growing fodder or cotton,” Ms Thompson said.

Gin-adjacent listing

Alongside irrigated properties, the recent listing of Edith Springs and Tarwoo Station last month has offered potential buyers the prospect of purchasing an established farming operation located adjacent to the new cotton gin.

The gin operates from a 150ha block on a separate title within Tarwoo Station.

Elders agent Alison Ross said Tarwoo was suited for a cattle-breeding enterprise, as well having potential for a feedlot.

Edith Springs has produced cotton in recent seasons. Photo: Elders

She said the proximity of the gin offered the opportunity to use the cottonseed as cattle feed.

Under the stewardship of the Black family, the 9620ha Edith Springs has been a prime example of cotton’s potential in the NT for about five years.

Steve Black purchased the property in late 2018 from Indonesian-owned Benart Livestock, and trialled a crop the following year.

Corporate interests

The first six months of 2024 have also seen increased corporate investment interest in northern Australian cotton and cropping enterprises.

Last month, ASX-listed farm owner and manager Duxton Farms announced the purchase of Portion 5088, a section of the Wildman Agricultural Precinct, located 135km east of Darwin.

The 2386ha land acquisition also featured a 8021ML water licence.

This plot of land is the first stage of the project, and Duxton Farms plans to develop a range of farming operations including livestock, broadacre and horticultural crops.

Mangoes, melons and sorghum have the potential to be harvested and grown at this precinct, which could also house cattle.

Duxton has already signalled a foray into NT cotton through its lease of the 141,000ha Mountain Valley Station.

In November 2022, Duxton Farms chair Ed Peter said the company would be leveraging its existing cotton experience in NSW to trial cotton.

“Initially the company will focus on restocking Mountain Valley…but we will look to develop a cotton trial in time,” Mr Peter said.

Alongside cotton, Duxton has also indicated it will be looking to convert grazing land to dryland cropping to increase the operation’s production of fodder crops such as millet, lucerne and sorghum.

Farm-management and investment group CropScale Australia’s agreement to purchase the 42,300ha Douglas West in the NT in March provides another example of investment interest in northern cropping.

In a statement CropScale said it plans to operate regenerative agricultural and pastoral activities at Douglas West.

Grain Central: Get our free news straight to your inbox – Click here

HAVE YOUR SAY