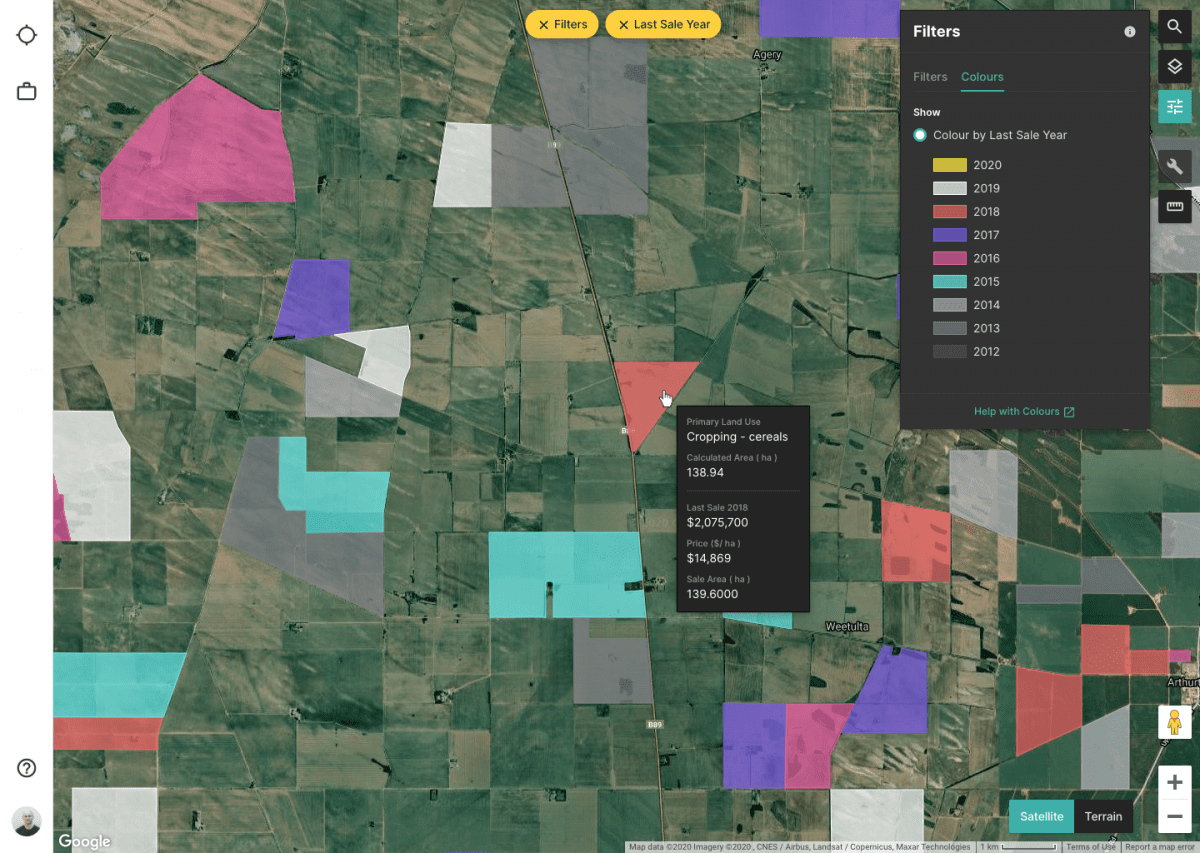

The Rural Valuations Hub allows land to be assessed across a range of metrics. Photo: DAS

TECHNOLOGY developed by CSIRO-backed start-up Digital Agriculture Services (DAS) is being rolled out by global agribusiness lender Rabobank in Australia.

Known as the Rural Valuations Hub (RVH), the software-as-a-service (SaaS) product uses data available from Geoscience Australia, the Bureau of Meteorology and other sources to deliver rural intelligence on a farm, regional and national scale.

The software enables users to assess land independently of traditional valuation methods such as recent district sales and worth of improvements, but can be used in conjunction with these methods to create a more meaningful picture.

RVH also allows users to use multiple dropdowns such as dry-sheep equivalent (DSE) to compare properties and districts, and is available to users outside Rabobank.

Help during COVID

Rabobank Australia chief operating officer Andrew Vickers said while the solution was co-created over three years to meet a specific industry-wide need, its value as a platform

for remote teams, individuals and broader agribusiness has been proven during the COVID-19 lockdowns.

Rabobank’s Andrew Vickers.

“We partnered with DAS to create and launch a rural valuations platform and solution that would improve property appraisals and workflows by taking advantage of advanced

technological approaches to make more informed assessments,” Mr Vickers said.

“Part of the power of the solution is how it’s seen Rabobank support Australian agriculture as the essential business it is during COVID-19.”

Mr Vickers said RVH has been used to undertake rural property valuations when they could not be conducted in person because of lockdown restrictions.

It caters to a growing appetite for AI-powered rural, agri and climate-risk intelligence that puts science in the hands of decision makers including farmers, lenders, insurers, commodity traders and rural suppliers.

Varying scale

DAS and Rabobank piloted the RVH in 2019 before rolling it out in early this year.

The software offers a digitised appraisal and valuation workflow, appraisal reports, comparative-sales analysis, custom capabilities and science-supported standardised insights and data.

It is also designed to scale globally, supporting farmers, clients and business continuity in weathering COVID-19 and other disruptions.

In the next phase of the partnership, Rabobank plans to use RVH outside Australia, as well as explore how the technology can be applied to areas like climate risk and portfolio management.

DAS co-founder and CEO Anthony Willmott said financial services that failed to invest in rapidly advancing technology, such as machine learning, would become uncompetitive in

years to come.

“We have found that the best way to drive advantages faster is to complement what we’re doing with a co-design partnership; Rabobank is both a cornerstone customer and an innovation partner more broadly,” Mr Willmott said.

“The work we’re doing on this strong performing digital platform provides efficient and compliant appraisals, but the real power is what the technology enables – including

portfolio management and understanding the impact of climate change and extreme events.”

Mr Willmott said while the technology had been built with continuous input and feedback from Rabobank, the benefit was that it could be used by any financial or lending

leader across Australia or globally, with DAS already seeing strong interest and uptake among its client base.

DAS was founded in 2017 in Melbourne with a vision to create a world-leading rural intelligence company.

DAS technology, including its signature Rural Intelligence Platform, analyses and predicts productivity and assesses physical risk remotely, including for drought stress, flood, fire, water and land use.

Source: Rabobank, DAS

HAVE YOUR SAY