Hillston cropping property, Winton, has had strong interest from local and interstate buyers after coming on the market late last year. Photo: QPL Rural

AGENTS and prospective sellers are hoping for a quick recovery for the New South Wales Riverina region property market after flooding caused a slowdown in sales and listings in the second half of last year.

Widespread and severe flooding caused disruptions to property inspections, cancelled auctions, and deferred listings, and dimmed the confidence of interested buyers.

However, with harvest almost completed and the rain drying up, several mixed farms have come on the market and inquiry remains strong.

Hopes for recovery after slowing

QPL Rural agent Jason Haines is based in Temora, and said he hoped the early interest in listings including Winton (see below) was a sign that strong demand in the Riverina property market will be seen in 2023.

He said flooding, harvest delays and limited summer-planting opportunities have all impacted property transactions in his area.

“Generally…in the Riverina, there has probably been just a little more caution in the market than what there has been in the last 12 to 18 months,” Mr Haines said.

“The local harvest probably didn’t meet expectations, so it’s probably just taken a little bit of heat out of the market locally while people wait to see where they sit.

“For the irrigators, the summer crop, whilst it enjoyed the last couple of weeks of heat, still has a lot of caution around it.”

Despite the seasonal issues, Mr Haines said prospective sellers shouldn’t be turned off.

“There is still plenty of positivity around”.

“I am still getting plenty of demand from people looking to expand existing enterprises; particularly a push from that southern Riverina and into Victoria looking to be in our space and get into probably cheaper dollars per acre country.”

He said he did not see an overall downturn on the horizon for property prices, just more caution from buyers.

“Land prices are very good, and I think that market is going to remain strong for a while yet.”

Growth to stabilise

Nutrien Harcourts West Wyalong agent Will Dean said he saw a minor drop in interest from buyers due to flooding and seasonal concerns.

Mr Dean said in some cases, interested buyers were “going cold due to the flooding and the uncertainty regarding their income for the season”.

He said demand should return to the market; however, capital growth should return to more sustainable levels.

“We have seen growth over the last four to five years in our area close to 100pc and it will probably slow down to single figures,” Mr Dean said.

He said the number of prospective buyers per listing has also dropped slightly from an average of six to eight registered parties to four or five.

“While the properties are still making the levels that we suggested at the start of the campaigns, it might be taking a little bit longer to get there, or the buying pool isn’t as deep.

“However, the level of interest is probably still a lot better than it was before the last three seasons…and you are still moving properties quicker than you were back then.”

Transactions decline

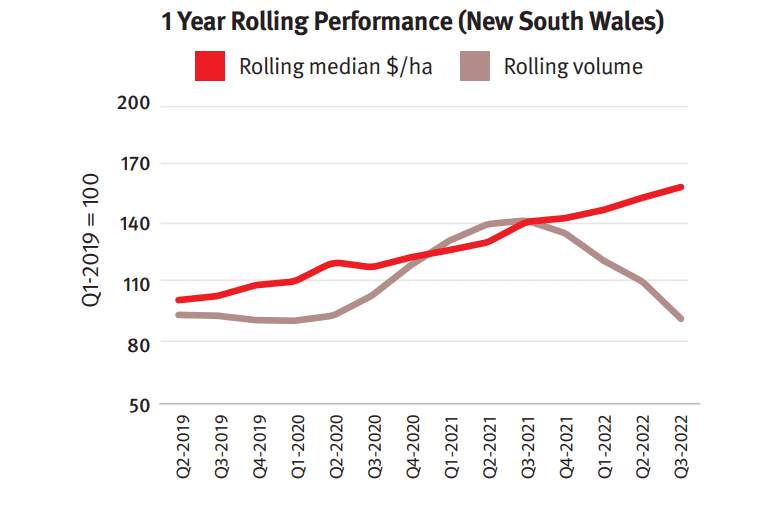

The latest Elders Rural Property Update released yesterday supports the on-ground experience of agents.

Data showed that in July-September 2022, the total transaction volume for NSW dropped by 22.4pc with 552 sales recorded.

The report indicates that this outcome was “primarily due to disruptions from wet weather in the Riverina Murray region limiting listings”.

The median price per hectare also eased by 0.2pc to $8082/ha over the quarter.

However, this value is still 10.8pc higher than median price per hectare of rural properties in the same three months of 2021.

Percentage changes to the rolling median price per hectare and rolling transaction volume from Q1 2019 to Q3 2022. Q1 2019 is represented as 100pc. Source: Elders Rural.

Elders Rural NSW real estate manager Richard Gemmell said he expected the number of listings and sales will improve into autumn.

“November and December delivered much less rainfall than previous months to the point where many regions began to display dryer conditions,” Mr Gemmell said in a statement.

“Early Autumn we expect a number of delayed campaigns and new to market listings to become available, offering both strong sales results and sound investment opportunities.”

He said overall 2023 was expected to see the continuation of the overall sentiment of “inquiry outstripping supply”.

This trend will keep property prices growing in NSW, although not at the high levels of recent years.

Strong interest for Winton, Meragh

The Clemson family has already seen strong inquiry for their 4290ha mixed-farming Meragh/Glenview aggregation in the Burcher district, north of West Wyalong.

The Clemsons have owned most of the holding for around 50 years, with one parcel in the family for 80 years.

The aggregation has listed with Nutrien Harcourts West Wyalong, and Mr Dean said the vendors have conservatively managed the property as mainly a Merino-breeding operation alongside cropping and a small beef herd.

He said the property was 90pc arable and could accommodate more cropping thanks to a productive mix of soils from strong red loam to soft red clay.

“It has very fertile soil and is probably regarded as one of the best farming blocks in the area,” Mr Dean said.

He said there has been good interest for the property, which would be an ideal standalone operation.

“We have had inquiry from locals and interstate from people looking to expand in the area.”

Mr Dean said interest has also come from parties from higher-rainfall country south and south-east of West Wyalong looking to expand.

Meragh/Glenview is an aggregation of five properties, four of them contiguous, and one across the road.

The current owners have 900ha sown annually to wheat, barley and oats.

Improvements include 1054t of grain storage, a shearing shed and sheep yards, a workshop and multiple sheds.

Located between Forbes and West Wyalong, the Meragh/Glenview aggregation is on the market. Photo: Nutrien Harcourts West Wyalong

Located in the Hillston region, one of the areas worst hit by last year’s flooding, cropping property Winton came on the market at the end of 2022 and has listed with QPL Temora.

Mr Haines said Winton was a highly productive operation with a history of producing dryland cereals, oilseed and pulse crops.

He said the 1711ha aggregation of three holdings is being offloaded by unnamed vendors who are “looking for a change and slowdown in life”.

“It is beautiful for that open dryland cropping, (has) very good infrastructure, and it has been very well maintained over the last few years,” Mr Haines said.

“It will be a good base for someone who wanted to establish themselves with a new location and new enterprise.”

Mr Haines said he has fielded inquiry from people who were searching for an ideal starting property.

“We have got people looking at the moment who are looking to diversify into a new location; we have got people who want a first farm.”

Winton is approximately 86pc arable and features 610t of silo storage and several machinery sheds.

Grain Central: Get our free news straight to your inbox – Click here

HAVE YOUR SAY