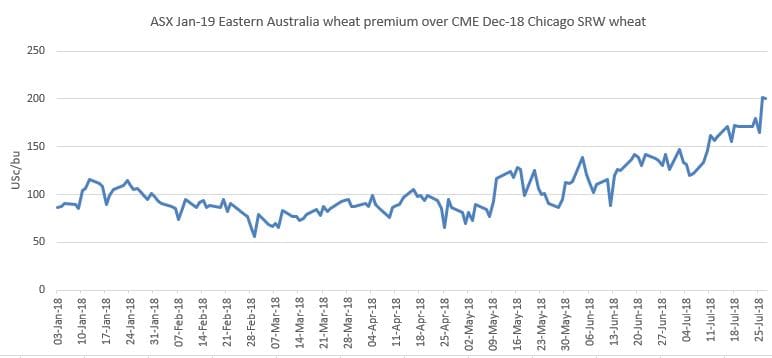

THE BASIS price of Australia’s new-crop wheat futures has risen sharply this month when compared with the international benchmark, the CME Chicago Soft Red Winter (SRW) wheat price.

This price differential is referred to, in grain price risk management terms, as the basis, and is the premium or discount between the US and Australian wheat futures price.

The ASX24 January 2019 eastern wheat futures (WM) contract again last week rallied more strongly than Chicago, as the developing Australian wheat crop floundered, causing buyers to step up and sellers to set higher price targets.

“Basis for new-crop Jan Eastern Wheat was out to US$1.98 per bushel last Thursday, having been around $1.24 just a few weeks ago,” Bell Commodities client advisor, Bob White, said.

“Potential basis sellers have been reluctant to do anything, as drought years can see enormous moves in basis.

“Open Interest in the January 2019 Eastern Wheat contract has been rising with the rally, a positive technical signal.

“Maybe it is time for some profit taking but I don’t think the rally is over.”

Yield potential falls

The inland crop zones of all mainland states have suffered a dry July.

A slide in yield potential could be halted, or even reversed, with good rain in August and into spring, but demand pressure on the 2018 wheat harvest in the three eastern states is likely to result in a shortage.

“I am getting emphatic statements from many across NSW about big falls in production for this season.

“Northern and western Victoria are deteriorating.

“Isolated falls over the weekend will help but soaking rain is needed soon, and the forecasters are predicting that the arrival of soaking rain looks unlikely before spring.

“It has been an extremely dry winter so far, and the outlook for spring is no better, so summer crops are under threat also.”

Dry south drives rally

“The ASX Jan-19 contract rallied approximately A$60/t in a matter of a month, as buyers responded to deteriorating crop conditions in all zones outside of WA,” Market Check head of strategy Nick Crundall said.

“Dryness has crept into southern NSW and Victoria causing, for the first time in a while, the southern zones to lead prices higher,” he said.

“This contributed to the aggressiveness of the rally, as the market is relying on production out of these regions to fill the void in NSW and Queensland.

“We also saw domestic consumers enter the market over the last couple of weeks, trying to get cover on for new crop; which only exacerbated the run up in prices.

“Looking forward, as always the spring will largely determine price action, with further upside from here reliant on a hot/dry spring period.

“If we see a softer finish to this crop, there is some downside in our price, both absolute and relative however we should see strong underlying support in our market as a lot of damage has already been done to crops and our balance sheets are running on fumes.”

Some traders say the domestic market was awake to the risk potential of poor crops this year because import and transhipment trade has been active for many months already, following below-average rain since last year.

The pathways and decision tools for sea freight, rail and long-haul road transport already in place make it natural for consumers to extend their grain cover and reduce risk for the latter part of 2018 and until summer crop prospect begin to come into focus.

“It’s worth noting, that in the last 10 years our domestic demand has increased significantly, combined with our ending stocks situation being tighter now than in those years.”

Grain Central: Get our free daily cropping news straight to your inbox – Click here

HAVE YOUR SAY