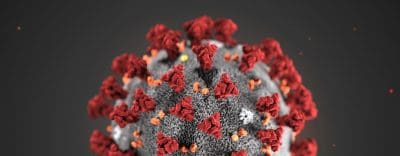

A digital image of the coronavirus showing the crown-like spikes on its surface. The strain with its epicentre in China has this week been named COVID-19 by the World Health Organization. Image: WHO

AUSTRALIAN Grain Industry Conference (AGIC) events scheduled to take place in Vietnam and China next month have been postponed due to novel coronavirus, now officially known as COVID-19, which is already affecting Australia’s grain-export pathways.

Australian Export Grains Innovation Centre (AEGIC) chief economist Ross Kingwell said disruption to containerised freight appeared to be the biggest effect of coronavirus with respect to Australian grain markets.

In its report released this week entitled ‘Novel coronavirus: potential impacts on Australia’s grain producers’, AEGIC said grain traders were anticipating a slowdown in the physical delivery of grains into China, triggering lower international prices of grains.

“Incoming freight is being piled up on wharves because of disruption to supply chains, and the ease of movement of containers from port to up-country destinations has certainly been affected,” Professor Kingwell said.

“Shippers are already seeing a change in sea-freight rates.

“The Baltic Index, a common benchmark for the cost of moving grains and other dry commodities, continues to drop towards 10-year lows, reflecting concerns about future trade volumes and flows.”

With some transport hubs in China either unstaffed or understaffed, even containers which do get to their destinations in China are not getting back to container terminals to be reloaded on ships.

“There are delays in ships getting containers off, and although the ports are open, there are disruptions to normal business operations.”

Trade sources have told Grain Central that the call for containers for agricultural exports is relatively small this month now that pulse exports timed to arrive before Ramadan have petered out.

Also, Australia is at the tail of a low-volume cotton season, and preparing to gin an even smaller crop this autumn.

Barley demand softens

AEGIC’s report said around 2 million tonnes (Mt) of malting barley is annually exported from Australia to China for beer production, with another 2.8Mt going into China’s feedgrain sector.

The coronavirus outbreak subdued China’s Lunar New Year celebrations, which reduced beer consumption, and AEGIC said this would cause a negative flow-on effect for subsequent importation of malt and malt barley used in beer production.

Professor Kingwell said for Australian barley and sorghum producers, China’s reduced need for feed imports due to last year’s African Swine Fever (ASF) outbreak was far more serious in the short term than the onset of the coronavirus.

Feed use in pig production in China is down 35 per cent in 2019 due to the decimation of its pig herd.

Mixed for wheat

AEGIC expects the impact of coronavirus on wheat to be relatively insignificant.

“Wheat is not a discretionary item of household consumption, and per-capita consumption of wheat in China has been increasing, in line with increasing per-capita incomes.”

However, Australian wheat producers could be advantaged if the Australian dollar depreciates further due to the global impacts of the coronavirus.

This would make Australian wheat more attractive for importers, a benefit offset by dearer imported inputs such as fuel, fertilisers, chemicals, machinery and technology, especially with coronavirus also affecting their production offshore.

In late December 2019, before the announcement of the coronavirus, the Australian dollar traded at 69 cents against the US dollar.

“Since then the Australian dollar has trended downwards to 67 cents, and could devalue further to around 65 cents.”

AEGIC modelling says if the global price for wheat falls due to the effects of the virus from $US230/t to $228/t free on board (FOB), and the Australian dollar depreciates from 69 to 65 cents, then the price of Australian wheat would rise from $A333/t to $351/t FOB.

Short-term slowdown

Containerised and bulk wheat and barley is exported to China from Australia throughout the year.

Professor Kingwell said any grain arriving now would likely be used weeks later than initially expected, and forward sales of grain would slow or stop to give Chinese mills and malthouses time to chew through accumulated stock.

“We’ve been told some malt factories have temporarily closed, and there’ll be a series of short-term and medium-term consequences.

“Already we’re seeing that with respect to barley, and in the medium-term, demand for barley will be a bit less than we thought.

“Anything that is viewed as a luxury or discretionary product will be affected, and beer falls into that category.”

AEGIC staying home

AEGIC’s Australian Technical Quality Wheat seminars in Tokyo and Seoul remain on the calendar for June.

However, AGIC’s March events, both of which were scheduled to include AEGIC presentations, have been postponed, possibly until later in the year because of travel restrictions and health risks linked to coronavirus.

AGIC is an initiative of Grain Trade Australia, Pulse Australia and the Australian Oilseeds Federation, and this year had its Asian conferences scheduled to take place in Ho Chi Minh City, Vietnam on 3 March and in Shanghai, China on 5 March.

“In AEGIC, we’ve made a management decision that our staff will not engage in international travel for the foreseeable future,” Professor Kingwell said.

“The decision was made two weeks ago because many potential Chinese delegates would not be able to travel, and international guests also.

“We’re still at the phase where infections and deaths are growing, and have people not turn up for work.

“Things change day by day.”

Bigger than SARS

The AEGIC report says coronavirus is likely to have more serious global economic impacts than the SARS outbreak of the early 2000s.

It said economic losses stemming from the SARS outbreak in 2002 and 2003 were estimated globally at $US40 billion.

In 2003, China’s GDP was $US1.3 trillion. By contrast, at the end of 2019, when the coronavirus emerged, China’s GDP had increased 10-fold to $US14 trillion and China had become the world’s second largest economy.

China’s private consumption now accounts for more than one third of the country’s enlarged economic activity.

Economic fallout

Australia’s economic prospects are now tightly tied to the performance and growth of the Chinese economy.

China is Australia’s largest two-way trading partner, export market and import source.

Since 2003, China’s two-way trade with Australia has grown from around 8 per cent of all Australian trade to 32pc in 2019, when China’s share of the value of Australian exports in 2019 reached a record 38pc, or $117 billion.

“There are serious implications for Australia’s economy of any long-lasting wider spread of the coronavirus.

“Already economic consequences within China are being observed, and external ramifications are emerging.”

Examples include temporary closures of factories within China, and others in Asia which rely on them, and global retailers like Apple and IKEA.

China accounts for about one third of global economic growth, a larger share of global growth than from the United States, Europe and Japan combined.

“Any decline in China’s economic growth has negative implications for world economic growth.

“Economic analysts predict China’s annual growth rate will slump to between 3 and 4 per cent in the first quarter of 2020, while annual growth in 2020 may be limited to around 5 per cent.

Global economic growth may slow to an annual rate of around 2.3pc, the lowest since the 2007 Global Financial Crisis.

Source: AEGIC, AGIC

Grain Central: Get our free daily cropping news straight to your inbox – Click here

HAVE YOUR SAY