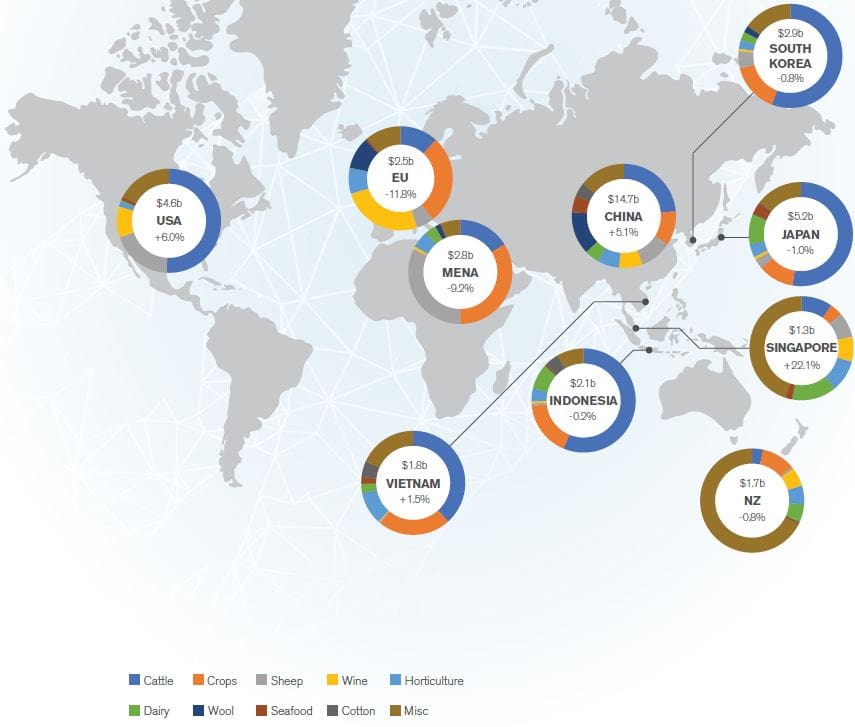

Figure 1: Australian agricultural exports 2019/20

THE value of Australian agricultural exports reached $50.1 billion in 2019/20 – the second most valuable year on record – despite a year-on-year decline of $601.4 million, according to Rural Bank’s Australian Agriculture Trade 2019/20 report.

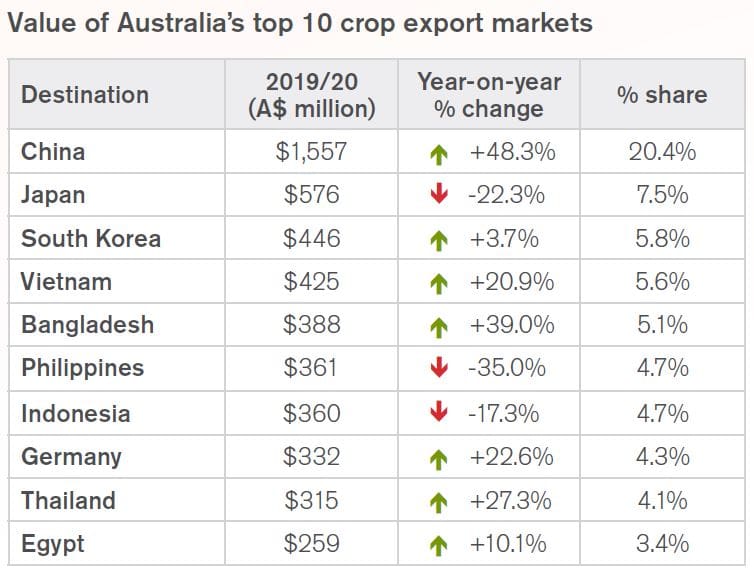

China accounted for 30.3 per cent of total export value, and overtook Japan for the first time to become the top market for Australian beef.

Livestock experienced the largest growth rate in 2019/20, with the value of cattle exports increasing by 16.6pc ($2 billion) and sheep increasing 3.3pc ($141.7 million).

Other growth industries include cropping with an increase of 2.4pc ($180.7 million), dairy at 2pc ($50.6 million), sugar at 9.8pc ($149.8 million) and fruit at 11.1pc ($154.2 million).

Commodities that experienced a decline in export value include cotton (-$1.6 billion), wool (-$1.3 billion), seafood (-$88.4 million), nuts (-$48.4 million), wine (-$46.2 million) and vegetables (-$15.8 million).

“Early 2020 saw some much-needed rain in the eastern states, which has meant improved prospects for farmers in both broadacre industries and horticulture. We expect to see growth in cropping values, while livestock exports are likely to decrease as producers focus on restocking,” Rural Bank chief operating officer, Will Rayner, said.

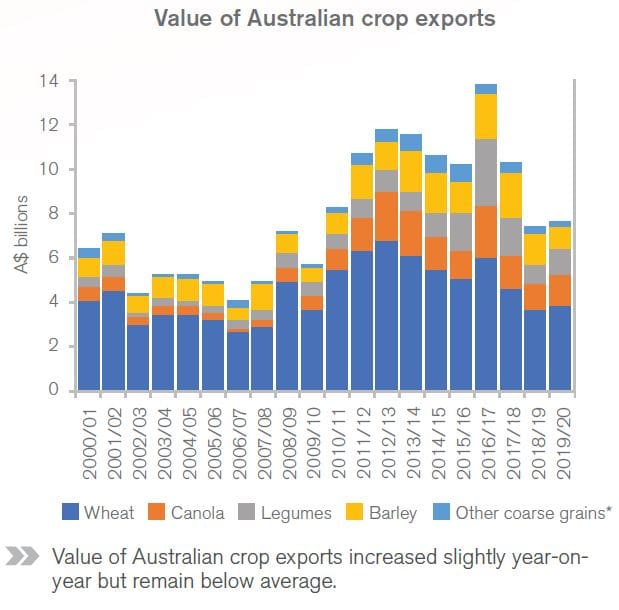

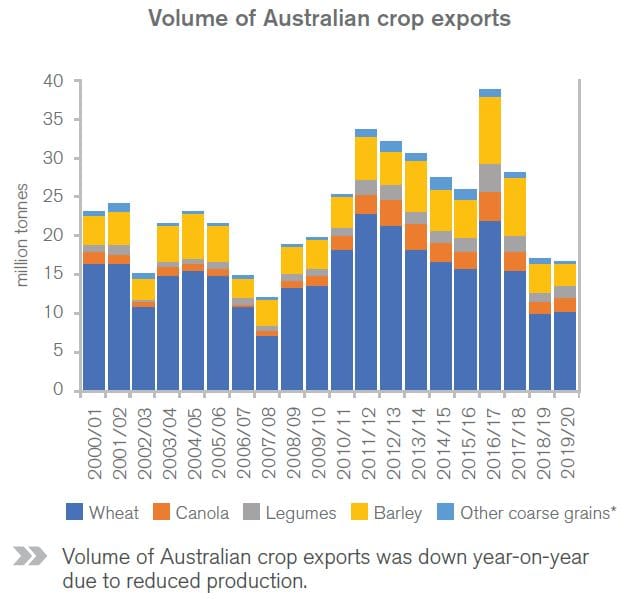

Cropping (Grains)

- The value of Australian cropping exports in 2019/20 increased 2.4pc on the previous year, but remained 27pc below average.

- Export values increased for canola (21pc) and legumes (33pc) but rose from a low base and remained below average.

- Drought in parts of eastern Australia limited stocks available for export in 2019/20, but increased export prices demonstrated demand for Australian cropping products.

- A promising start to the cropping season in parts of eastern Australia has provided optimism for improved production.

Cotton

- Australian cotton exports fell to their lowest value since 2009/10 as two years of low production and a drawdown of stocks significantly reduced volumes available for export.

- With an estimated record low 590,000 bales produced in the 2019/20 season, supply is expected to be tight moving forward.

- Reduced production domestically was driven mainly by drought conditions in Queensland and New South Wales, coupled with high water prices due to competition for low allocations of irrigation water from other users such as nut and citrus trees, as well as the mining sector.

- The industry will be confronted with new challenges in 2020/21 as COVID-19 control measures are expected to disrupt milling processors, and cotton prices could succumb to pressure from low oil prices making synthetics an even cheaper alternative.

Sugar

- Australian sugar exports recorded an increase in value in 2019/20 after two years of decline.

- Despite growth of 9.8pc, the value of exports was 6.6pc below the five-year average, weighed down by below average prices.

- Australian sugar exports increased in value in 2019/20 as prices improved in response to a global sugar deficit and export volumes recorded a modest increase.

- Growth is unlikely to be repeated in 2020/21 as the impacts of COVID-19 reduce sugar consumption and global production is expected to increase.

Source: Rural Bank

To view the full Rural Bank Australian Agriculture Trade2019/20 report, visit: www.ruralbank.com.au/trade

HAVE YOUR SAY