There is renewed hope that Australian cotton may soon be flowing into China in larger volumes. Photo: Cotton Australia

OPTIMISM is growing among Australian merchants that a lifting of the Chinese soft ban on cotton is on the horizon, with a flurry of meetings between government leaders in recent weeks signaling a possible thawing of trade relations.

The Australian arm of the China National Cotton Group Corporation has already acted on this renewed confidence, by shipping a consignment into the country via Qingdao port.

CNCGC merchant Tom Zheng said the company was storing the bales in a bonded warehouse.

“We shipped some of our bales to China, which I don’t think any other merchants are doing,” Mr Zheng said.

“We see the signs of improvement in relationships between the two countries.

“We have hope that some day, hopefully sooner rather than later, the ban will be taken away.

“This is why we were bold enough to ship some of our bales to China.”

As the only cotton merchant in Australia with ties to China, Mr Zheng said the company took a hit when the soft ban was introduced in 2020.

He said, like all other merchants, they had to act fast to diversify into other markets.

“China used to account for 70 percent of Australian cotton destinations.

“When China put [the] soft ban in place for cotton, it was a hit and merchants acted very quickly to expand sales.

“In 2022, we re-shifted our strategy and tried to expand our market sales.”

Mr Zheng said this includes selling to countries, such as Vietnam, Indonesia, Thailand and India.

“We did that fairly well.

“Sales into South-east Asian countries aren’t our strength; traditionally we are all Chinese-market oriented.”

More cotton movements

Rumours are circulating that more shipments of Australian cotton to China in the pipeline.

Reuters has reported that Cotton Australia chief executive Adam Kay has heard claims of Chinese merchants entering forward contracts for cotton.

Grain Central understands that there is still strong demand from Chinese millers for Australian cotton, with some companies attempting to circumvent the soft ban and import bales.

Despite the ban remains, Australian cotton is still going into China.

For the year to February 2021, about 37,000t of Australia’s almost 720,000t crop went to China.

This is substantially down from pre-ban years, such as 2019 when China imported almost 300,000t of a 454,000t crop.

It is unclear how these small quantities of cotton have entered China, except that it is assumed most were on a once-off basis.

Under World Trade Organization standards, China has to allow at least 960,000t of cotton imports each year and Chinese mills need to the apply to the government for a slice of that figure.

In 2020, it was rumoured that the Chinese Government told mills that if they used a license to import Australian cotton then that amount would be subtracted from next year’s application.

This action worked to deter most millers from importing Australian cotton.

However, in some circumstances, such as if a miller didn’t intend to apply for a license for the following year or was one of a small quantity that operate in free trade zones, the Chinese Government policy wouldn’t apply.

Chinese-owned mills in Vietnam

There are also indications that yarn made from Australian cotton is entering China via Vietnamese mills.

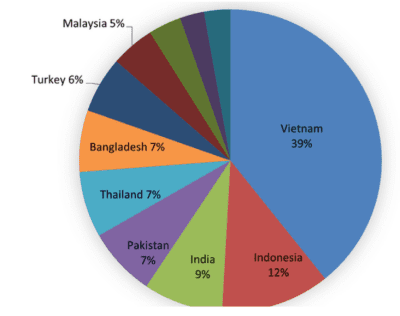

The 2022 season shipments year to date (March 1, 2022 – December 31, 2022). Source: ACSA

According to that latest Australian Cotton Shippers Association data, approximately 1.8 million bales of the record 4.8Mb 2022 crop was exported to Vietnam.

It was by far the largest market for Australian cotton for that year.

Chinese spinners operating in Vietnam make up about 48pc of consumption, with 42pc being domestic and the remaining facilities owned by Taiwanese and Korean companies.

China is also by far Vietnam’s largest market for cotton yarn.

This indicates that Australian cotton still remains integral to China’s textile industry, despite the significant reduction in direct cotton imports.

Positive signals

ACSA chairman Matthew Bradd said although there was still interest from Chinese businesses in Australian cotton, there was little concrete information coming out of the company.

However, he didn’t discount the idea that the speculation may be an indication that trade relations were moving in the right direction.

“There’s a few rumours floating around; you wouldn’t want to put anything in concrete,” Mr Bradd said.

“However, everything is on the right track.

“Things are looking more positive…and relations seem to be on track for them to potentially lift a soft ban, but there is nothing in place at the moment.”

Other commodities impacted by Chinese trade restrictions include barley, coal, iron ore, red meat, wine, timber and lobsters.

Recent meetings between Minister for Foreign Affairs Penny Wong and Minister for Trade Don Farrell and their Chinese counterparts appear to be positive with more discussions planned.

Mr Farrell last month confirmed that coal shipments had recommenced into China.

He said a Geraldton lobster factory have had success obtaining an import permit and dairy company, Bulla, have started re-exporting some of their products into China.

“[T]here’s a whole lot of positive signs in a whole range of products that indicate that bit by bit, these issues are going to be resolved,” Mr Farrell said.

“The problems didn’t occur overnight, and they’re not going to be resolved overnight.”

Ahead of Australia’s new crop cotton becoming available from April, current stocks are tight, with Cotton Australia reporting in October that 95pc of the 2022 crop was sold.

Australia is expected to produce a crop of around 5 million bales for 2023 when ginning gets under way in coming weeks.

Grain Central: Get our free news straight to your inbox – Click here

HAVE YOUR SAY