THE global pulse trade is struggling for clear direction following mixed messages from India, according to traders who have received precisely opposite intelligence from the Indian Government this week.

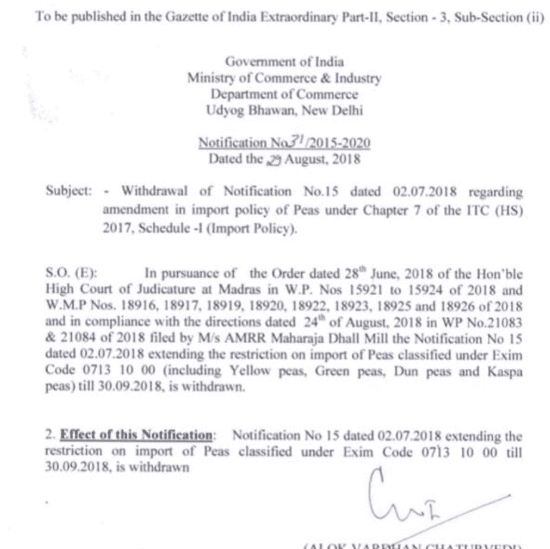

The Indian authority, dated 29 August, withdrawing the several-months-long notice restricting import of certain pea types.

To some acclaim, reports emerged overnight Wednesday that India’s import ban had been lifted on particular pea classifications of Kaspa, yellow, dun and green pea

A government document effecting this change referred to a successful application by a miller in southern India which resulted in the four-month-old ban being lifted.

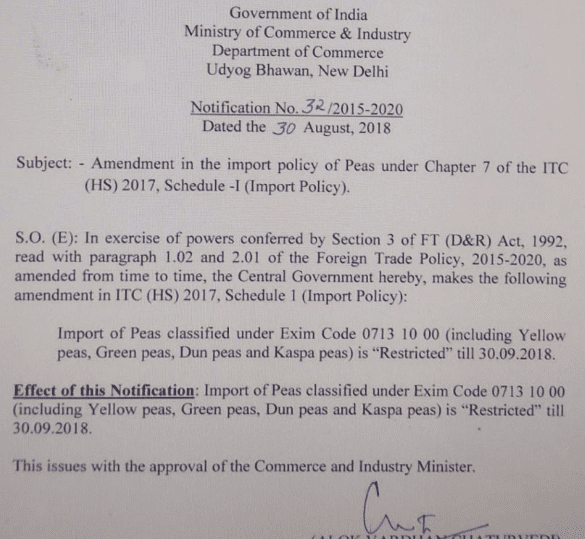

However, a fresh announcement hit the market overnight, which effectively reverted to the previous ban, leaving pulse trade participants uncertain.

If the lifting of the ban were to have remained, it would have reopened exports to Kaspa peas from Australia, which are imported into a typically small but high-value market.

At no stage this week were chickpeas or lentils, Australia’s two major pulse exports to India, mentioned as being likely to have a ban on their imports lifted.

The announcement was shaping us a game-changer for Canada, Europe and Black Sea exporters, striving to give structure and predictability to sales of new-crop peas, before hopes of a lift in the ban were dashed.

The news has caused importers across the Middle East to adopt a more risk-averse approach to their own transactions because India’s actions, every time, affect market price significantly.

“The lack of stability is impacting markets,” CIL North pulse trader Rob Brealey said.

On the one hand the previous import restriction could be explained as an effort to promote clearance of home-grown and imported stock in India.

“It was really to stimulate demand and hold prices at levels closer to the minimum support price (MSP),” Mr Brealey said.

On the other hand, it appeared that the ban presently in place would likely be extended beyond its expiry date of 30 September 2018, according to Mr Brealey.

“Over the years, trade in yellow peas in particular has gone from practically nothing to India in recent years importing between 2.5 and 3 million tonnes, at the same time as yellow pea production increased in the Black Sea region and to a lesser degree Canada and the US.”

Market disruption

The fact that yellow peas are cheaper than other pulses, including chickpeas, allowed them to capture market in India, because the economics made sense.

“That increased supply of yellow peas has taken away from chana or chickpea demand.

“By banning imports of yellow peas, it effectively stops the usage and pushes that demand back to other products, particularly chana.”

Traders said the impact of India’s policies is impacting the global as well as its domestic market.

Consumers and buyers in Pakistan, Iran, Iraq and the UAE have no confidence to buy forward, and are only willing to buy hand-to-mouth.

“It creates so much uncertainty not only in the market in India but elsewhere around the world.

“The buyers of pulses in Pakistan and into the Middle East and Bangladesh all lose confidence because they don’t know what the next move from the government will be.”

HAVE YOUR SAY