Queensland recorded the largest rise in bulk exports for 2021-22, up 201pc on average. The Port of Brisbane is the centre for grain exports in the state. Photo: Port of Brisbane

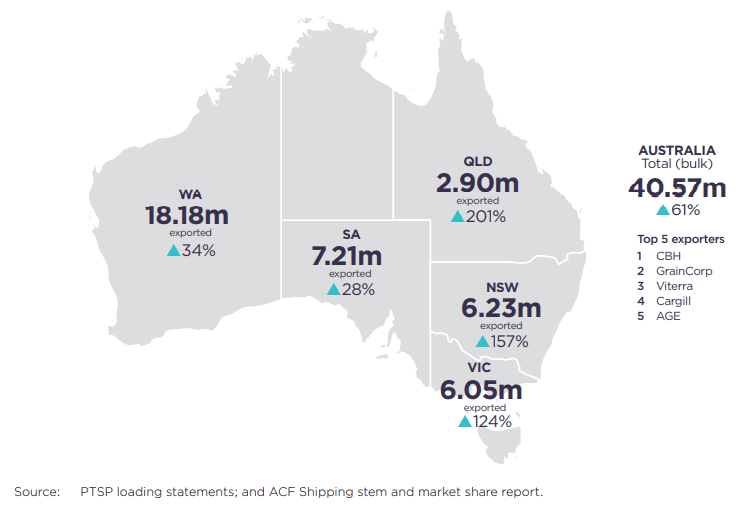

AUSTRALIA’S bulk grain exports were 40.6 million tonnes (Mt) in the year to September 30, and exceeded the previous season’s record by 22pc, according to the Australian Competition and Consumer Commission’s Bulk grain ports monitoring report published today.

This followed a record total grain production in 2021-22 in Australia of 65.7Mt, an increase of 11pc on the previous record in 2020-21.

“Two consecutive seasons of record high-volume harvests created strong demand for export services, and most grain export terminals experienced either the same level or an increase in the number of exporters using their facilities compared to the previous year,” ACCC deputy chair Mick Keogh said.

The ACCC’s annual Bulk grain ports monitoring report details exporter and port terminal service providers’ market share, as well as capacity utilisation at Australia’s bulk grain port terminal facilities.

All states except South Australia achieved record bulk export seasons, with Queensland topping the list by exporting 2.9Mt, a 201pc increase on average levels.

New South Wales saw a rise of 157pc on average exporting 6.2Mt, with Victoria exporting 6Mt (124pc above average), Western Australia exporting 18.2Mt (34pc above average) and SA exporting 7.2Mt (28pc above average).

Every facility in WA exceeded stated capacity, with Bunbury exceeding its stated capacity for the first time.

SA was the only state that did not have a facility exceed its stated or estimated capacity.

Graphic 1: Bulk exports by state for 2021-22 compared to average. Source: PTSP loading statements; and ACF Shipping stem and market share report via ACCC.

New exporters in market

A record number of 32 exporters participated in the national bulk grain export market in 2021–22, including two new mobile loader operations.

Exporters shipped bulk grain from all 31 operational facilities across Australia, and recent entry into the PTSP market meant that there was more capacity again this year on offer to facilitate the record shipment levels.

However, several facilities are predominantly being used by a small number of exporters.

The exporting businesses of CBH, GrainCorp and Viterra accounted for 58pc of all bulk exports in 2021-22, 5pc below average, and 6pc below 2020-21.

There were nine new entrant exporters, including Australian-Asian Agricultural Exports that exported close to 400,000t from CBH’s WA facilities in its first year.

While new entrants mostly shipped relatively few shipments each, in total they exported 1.6Mt of grain, or 4pc of national shipments.

New mobile loader operations

The two new mobile loader operations in 2021-22 both entered the market at Brisbane, likely in response to the record demand for shipping capacity.

The lower upfront and capital costs of mobile ship-loading operations has reduced the barriers to entry in some markets for bulk grain port terminal services.

In SA, T-Ports is also planning to begin export operations at Wallaroo in mid-2023 using its transhipment vessel, another novel form of entry into a traditionally capital-intensive market.

“The addition of new mobile loader operations provided extra options and pathways to export Australian grain at a time of record demand,” Mr Keogh said.

“While additional bulk export facilities were a welcome development, it is unclear whether the recent increase in the number of port terminal services providers and exporters will prove to be a long-term trend.”

Downward trend for wheat

The ACCC has observed a trend of increasing production and export of non-wheat grain, driven by factors such as increasing barley yields and dual-purpose cropping.

This trend was not observed in 2020-21 as the then record wheat crop drove up the proportion of bulk wheat exports to 62pc.

Despite the 2021-22 harvests of both wheat and non-wheat grains remaining similar by proportion to 2020–21, the proportion of bulk wheat exports declined to 59pc of bulk grain exports in 2021–22, down from 62pc in 2020-21.

Non-wheat exports accounted for 41pc of bulk grain exports in 2021-22, which is one percentage point above average.

Canola accounted for 14pc of bulk grain exports, 4pc above average, most likely driven by the record canola production in 2021-22.

The ACCC notes that the mix of grain production and exports each year is influenced by many factors including global grain prices and tariffs.

Source: ACCC

HAVE YOUR SAY