EXPORTERS and consumers worldwide are processing figures from the International Grains Council’s July report which say world grain exporter stocks are expected to fall 24 per cent over the global marketing year ending 2019.

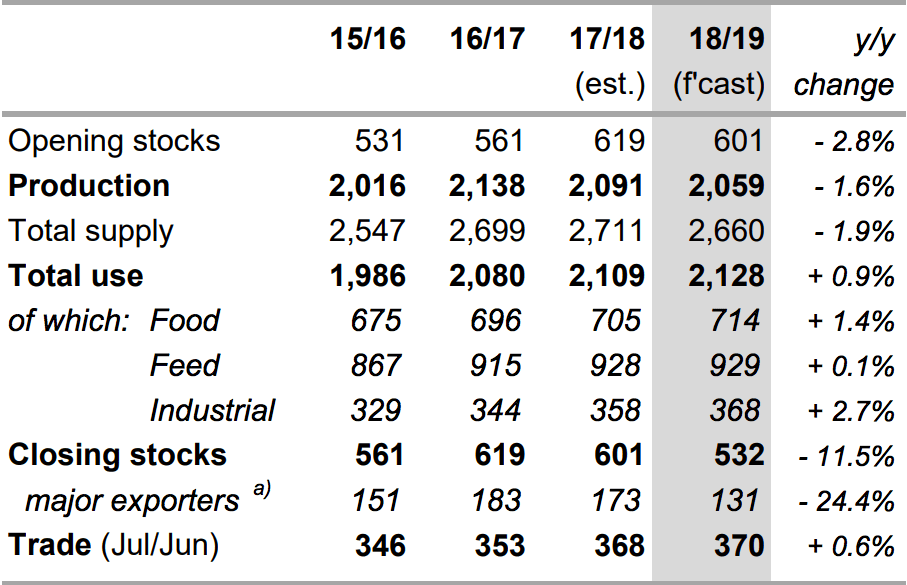

Table 1: IGC total grains: supply and demand summary, million tonnes. (a) Major exporters Argentina, Australia, Canada, EU, Kazakhstan, Russia, Ukraine and US. (Source: IGC)

Unfavourable weather for 2018/19 crops in several key growing regions is expected to cut world total wheat and coarse grains production by 2pc to a three-year low of 2059Mt. Table 1.

On the consumption side, IGC sees sustained growth, with usage increasing this year to a record 2128Mt, led by gains in industrial use of maize, and human consumption of wheat.

The first fall in world wheat stocks in six seasons is contributing to the contraction.

The projected annual decline in world wheat stocks, measured as an aggregate of respective local marketing years, is small.

However what makes the fall significant is that a comparatively large stock decline is anticipated among the major wheat-exporting countries: Argentina; Australia; Canada; EU; Kazakhstan; Russia; Ukraine, and the US.

Forecast wheat carry-out at the end of the 2018/19 marketing year among those exporters is forecast at 63 million tonnes (Mt), down from last month’s estimate of 70Mt.

Trade maintains record, prices were firm

In spite of reduced sorghum purchases by China, IGC projects yet another increase in world grain trade this year to 370Mt, potentially the sixth successive yearly record, driven mostly by expanding maize shipments.

Wheat trade is forecast 176Mt in 2018/19, around 1Mt lower then each of the two previous years.

The indicative world barley price has risen 11pc higher since June, and wheat has

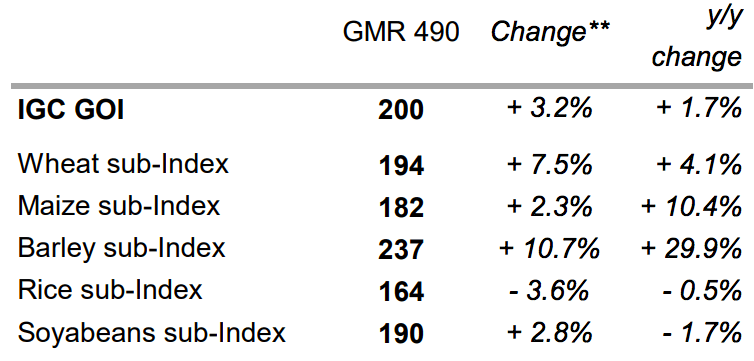

Table 2. IGC grains and oilseeds prices index from latest report GMR 490, base January 2000=100, **change compared with previous report GMR 489. Source: IGC

climbed 8pc, bringing the full-year change in those indices to 30pc and 4pc respectively.

The IGC report said gains in the wheat sub-index accelerated late in July as disappointing harvest results in some major exporters highlighted the tightening global supply outlook.

Brewers’ droop

They say in the trade that nothing cures high prices like high prices, and it seems possible that the rapid rise in the price of barley may turn as feed users switch out of barley and into cheaper grains such as maize.

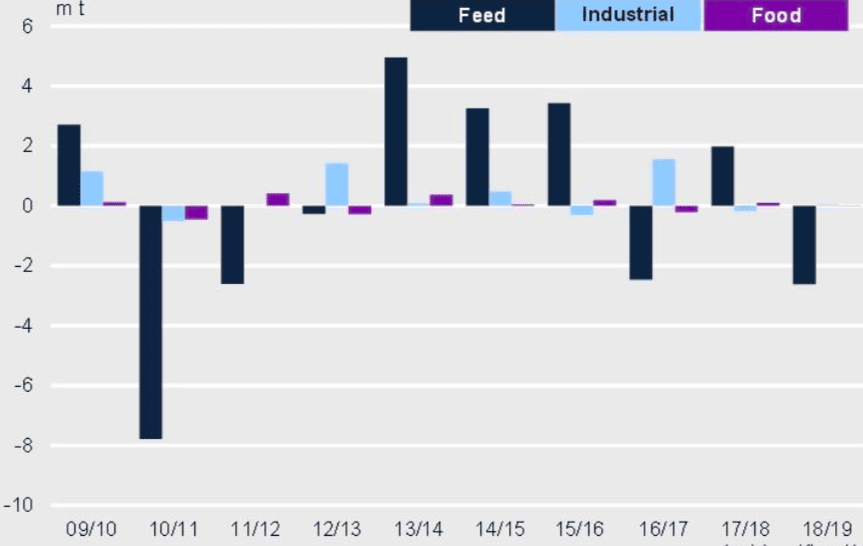

Barley: changes in world consumption. Feed (dark blue bars), food (mauve) and industrial (light blue), million tonnes, 17/18 estimate, 2018/19 forecast. Source: IGC

IGC reported that barley use in the 2018/19 year might drop 2pc to 146Mt, 6pc below the five-year average, as lower feed use in the EU, Saudi Arabia and Turkey would more than outweighed higher use reported in China.

Price may also be curtailing barley’s favour in the lucrative industrial markets in beer and spirits production.

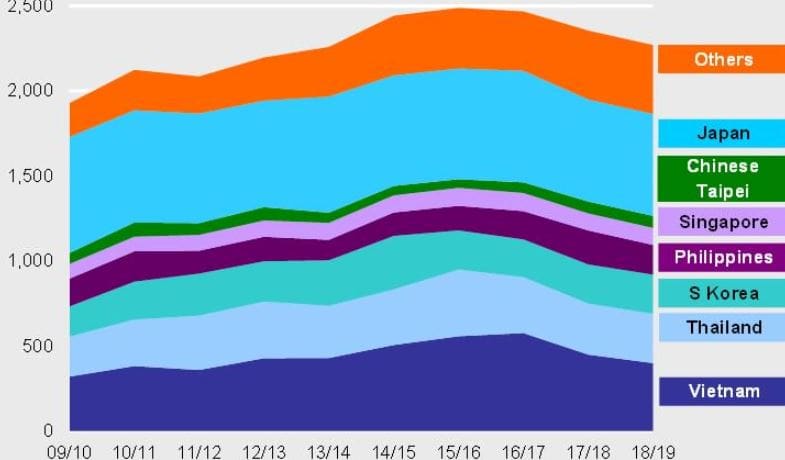

Barley malt imports by Far East Asian countries, million tonnes (grain equivalent), 17/18 estimate, 2018/19 forecast. Source: IGC

Makers of beer and whisky may not be able to reduce barley use as quickly as the stockfeed sector can, but they too can react to high prices, reducing barley use in order to remain competitive in their markets.

The IGC July report contains a quarterly update on trade in barley and malt, illustrating generally lacklustre demand in the brewing sector.

IGC summary report link and subscription details here.

Source: IGC

HAVE YOUR SAY