HARVEST has commenced and there will be lots to think about, from logistics of the harvesting to fixing the inevitable breakdowns – and how to reduce the risk when selling grain.

Grain trader insolvency – some points to remember:

In recent years the Australian grain industry has been rocked by grain traders going into liquidation, and generally resulting in debts being left unpaid, with both growers and other traders losing money.

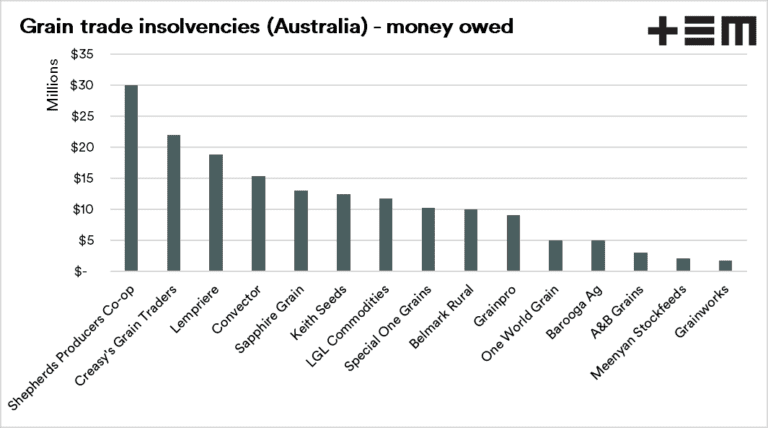

I have spent some time looking through reports to find the value of grain trading businesses which have gone bust. (I don’t believe this list is exhaustive, and if you know of further insolvencies, please feel free to contact me here).

The total value for the insolvencies which I have found for recent years is A$170 million. This total value is not great when compared to the overall value of the grain trade in Australia. The impact on individuals, especially farmers is enormous.

One key takeaway from these insolvencies is the smaller nature of the trader, with none of the ‘majors’ going bust.

There are some tips and warning signs below, which may assist in reducing the risk of being a victim of a default.

Tip 1: Paying well above the market

The market is the market; there is generally little difference between buyers. The capacity for a trader to buy is generally based on their ability to sell/manage the risk of their position. This means that there is little opportunity for buyers to be substantially higher than the pack.

There have been examples of buyers offering substantially higher prices than other buyers, then later going into administration.

“If it sounds too good to be true – proceed with caution.”

There are some exceptions such as buyers paying up during harvest in order to fill a vessel. In general, though, if a trader, especially a small one is offering a substantial premium – have a think about how they can show that price.

Tip 2: Counterparty Insurance

It is possible to take out counterparty insurance when selling grain. There are a number of insurance companies which offer this as a service.

These insurance policies are relatively complicated; however, it will provide some protection if the buyer goes bust. This insurance will generally have to be taken out prior to entering into a contract.

It is important to note that there will likely be an excess on these products, which although will provide more than the insolvency process will, it will still be a significant cost.

Tip 3: Online trading

In recent years online transacting of physical grain has come of age in Australia. There are a few offerings, two of which are below which offer a form of security over the grain.

Clear Grain Exchange (CGX) is the oldest online exchange which provides the ability to trade at most bulk handling facilities in Australia. The title of the grain is held with a custodian, which means that if the buyer goes bust, the grain stays under the control of the seller.

A large proportion of grain insolvencies tend to occur in grain outwith the bulk handling system (i.e. ex-farm or delivered homes). It is also possible to route these types of contracts through CGX.

GrainCorp released a similar offering in recent years called CropConnect. CropConnect provides the ability to have secured payments with retained title but only between eligible growers and approved buyers. This service is available solely through GrainCorp sites.

Tip 4: Don’t put all your eggs in one basket

It is a basic tenet of risk management – spread your risk. When constructing a portfolio of shares, it is advisable to have a wide mix in differing fields. This way if the market moves, your entire portfolio shouldn’t be disrupted.

“Spread your risk to reduce the cost of a default”

The same occurs when selling grain. If you have sold all to one buyer and they go belly up, you have lost everything. If your trades are spread across many, then you will feel a reduced impact in the event of insolvency.

Tip 5: Research and choose wisely

Do your research into the company.

Use your network

The bush telegraph is one of the fastest communication methods on the planet. Talk to others in your region to find out if they are paying on time.

Use your search engine

Check out the buyer on google/social media. Are there negative reviews/commentary about the buyer?

Perform a credit check

Although a credit check-in may not show any red flags, for a small amount of money, it may give a piece of mind.

Check the assets

A buyer with assets (bulk handler, etc) will have more for creditors to go for in the event of insolvency.

Whilst there are no guarantees in life, these are some actions which can be taken to reduce the potential of being impacted by default by a buyer.

This article was originally published on the Thomas Elder Markets website: https://www.thomaseldermarkets.com.au/

To view original article click here

It also pays to sell to a trader who pays quickly. That way you reduce your exposure. If you shop around you can get payment terms as quick as 2 days, so much better than 30 days end of week.