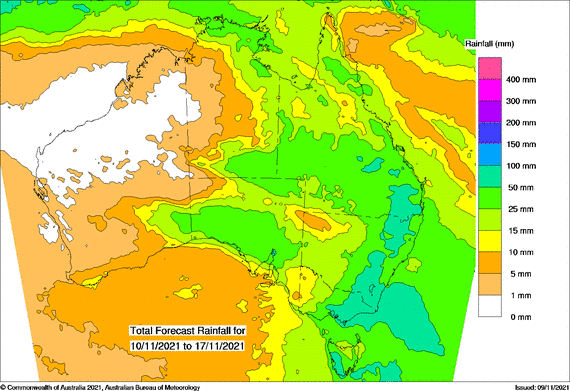

IN September, I wrote about the potential for a wet harvest, as the Bureau of Meteorology was forecasting a wetter than average three months. At the time, there wasn’t a particularly strong premium for higher grades.

It seems that the wet weather is upon us. If this rainfall had come a few months ago, it might have assisted in making the big crop bigger; at present, it is just a nuisance.

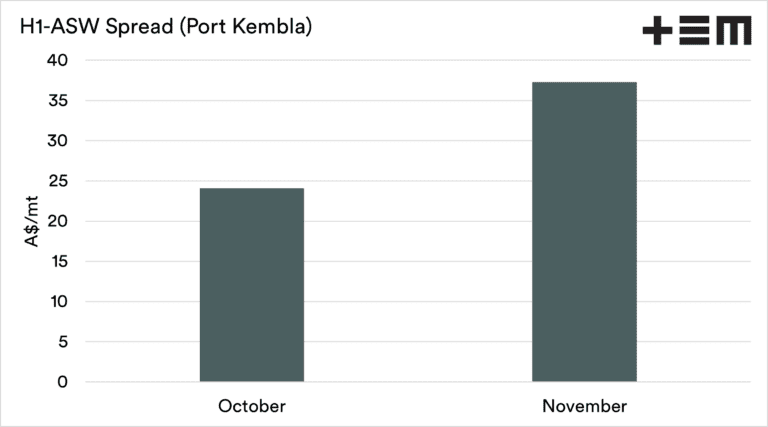

The big risk is that there is a downgrading of wheat as proteins drop. The first chart below shows the spread between ASW and H1 for October and November at Port Kembla.

The concerns about the rain are mounting and making buyers nervous. This has resulted in the average spread increasing from A$24/t to A$34/t.

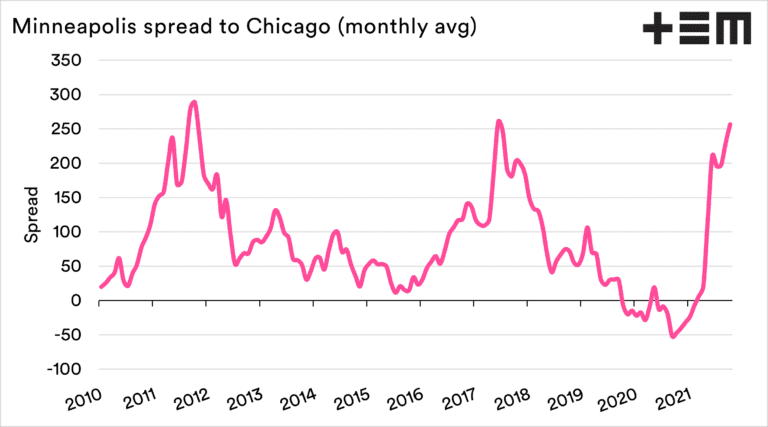

Earlier in the year, we wrote about our concerns related to the Minneapolis spring wheat contract (see here & here), and that it was a ‘coiled spring’.

At that time, it was relatively cheap compared to Chicago wheat. The drought in the northern US and Canada has resulted in a reduction in high protein wheat in the US. The Minneapolis premium over Chicago has increased dramatically.

Additionally, the French wheat crop quality has been low this year, placing more constraints on high protein availability. If the rain continues through our harvest, the premium for protein could increase as exporters look to fill the heavily booked shipping stem.

So, what do we do?

Before assigning grain to multigrade contracts, calculate the best place to put grain. Each contract will be different, but it might involve placing lower grades against multi grades with narrow spreads down to lower grades.

It may be worth holding onto higher grade wheat you have already harvested to see if premiums rise further.

If signing up for new contracts, be wary of signing up for any new fixed grade contracts, especially if in an area of high rainfall.

Hopefully, the rain is a fizzer, and this doesn’t amount to anything. Stay safe, and don’t get bogged.

This article was originally published on the Thomas Elder Markets website: https://www.thomaseldermarkets.com.au/

To view original article click here

HAVE YOUR SAY