GROWERS and traders are starting to turn blue across Australia as they hold their breath for that first winter break.

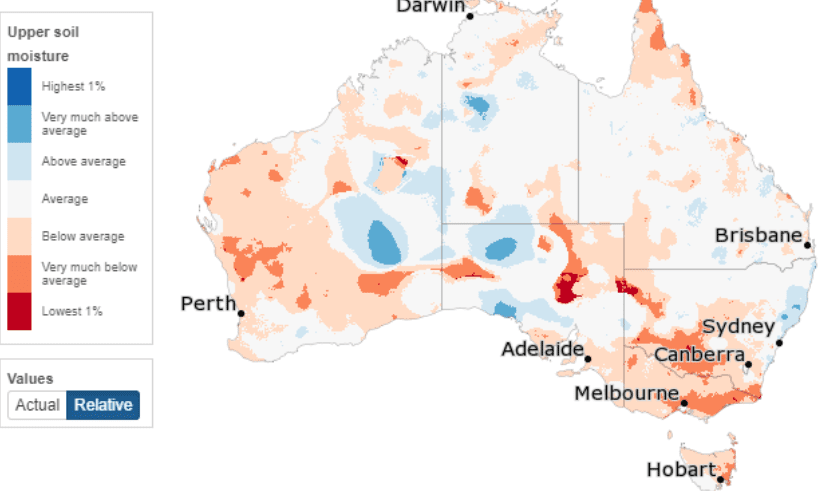

No cropping region has so far experienced a widespread break, with topsoil moisture being below average for the majority of Australia’s cropping country:

The situation is similar for lower soil moisture, with most zones having little to no moisture profile. The exception is parts of Western Australia’s grainbelt, which have been fortunate to retain some moisture from heavy summer rains.

The forecasts have provided false optimism to those eagerly awaiting the rain. The back end of many eight to 14-day models is frequently predicting significant rain events which fail to materialise. Although these models seem to be continually changing of late, the outlook is likely to remain dry for the first half of May.

Despite this, sowing rates remain active in southern and western areas of Australia, where many growers are content to sow dry. Northern New South Wales remains the primary concern from a production risk perspective, and its crop area is more likely to be reduced than other zones by a dry start due to its weather patterns and soil types which differ to southern Australia’s.

One positive from this lack of pre-existing subsoil moisture is that when the break does come, we should see even germination, in contrast to the uneven germination seen in many districts last year which resulted in grain quality issues.

To date, the impact of the dry start has been relatively muted, with local values remaining relatively stable in US dollar terms, and the falling Australian dollar helping to lift grower bids. The subdued market is partly due to the relatively weak correlation between March-to-May rainfall and final yields, evidenced by last year’s exceptionally dry start in Western Australia and above-average final production, albeit skewed by southern areas which were less affected.

Grain prices will reflect less risk premium around a continued dry pattern in the zones that are export dominant. Early production uncertainty in these locations will be partially mitigated by less additional shipping capacity being booked by traders instead of requiring the price-to-ration demand.

For the dominant domestic markets of the east coast, it’s a different story, with demand being less elastic and prices being required to rise to ration demand and draw in alternate origination sources should production issues arise. This is resulting in risk premiums being built into prices earlier than export zones.

Hopefully, for the growers of Australia, we will see a good break arrive over the next few weeks, and those who have been waiting can breathe a little easier.

Source: COFCO

HAVE YOUR SAY