THERE are four key factors which separate the top 20 per cent of grain businesses from the rest of the field – and it has little to do with location or size.

A GRDC project that benchmarked data from more than 300 agricultural businesses has found that the top businesses in Australia’s Southern Farming Region are consistently retaining 30pc of turnover as net profit.

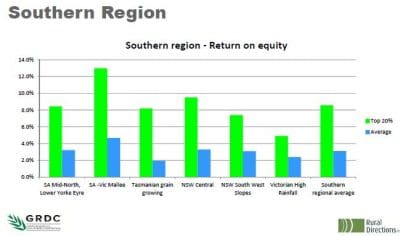

The average return on equity for the top 20pc in the Southern Region is 8.5pc, varying from 13pc in the SA-Vic Mallee to 5pc in the Victorian high rainfall zone.

The project identified four primary profit drivers that ensured enduring viability:

- Gross margin optimisation (operational)

- Low-cost business model (structural)

- People and management

- Risk management

It is the interaction of these four that results in different profit outcomes. If one of these four is overlooked it will compromise profit potential at some point.

Gross margin optimisation

Addressing the Growing SA 2017 conference in Hahndorf, Rural Directions consultant and project manager, Simon Vogt, said the key to gross margin optimisation was “to optimise the revenue pie” by getting the revenue model right, but doing it in a cost-effective manner.

“Yield maximisation at a ridiculous investment in variable costs is not always effective,” he said.

“Gross margin optimisation is about getting the revenue right in a grain business. Crop rotation is the foundation for setting up the revenue model by setting up the opportunity for crops that aren’t yield compromised. So to is excellent operational timeliness and agronomy.

“It is about balancing that without undisciplined investment in chemicals and fertiliser.”

Low-cost business model

Mr Vogt said a low-cost business model essentially meant having a low overheads cost structure.

It was a key profit driver, although it took a long time to adjust if it needed correction.

“If your business is out on one or two of the benchmarks of a low-cost business model, it could take five, 10 or 15 years to correct,” he said.

“If a business is carrying a lot of debt, it might be a five, 10 or 15-year window of prioritising profits to principal reduction to realign itself in regards to debt serviceability.”

He said the two big “rocks” behind the low-cost business model were machinery utilisation and labour utilisation.

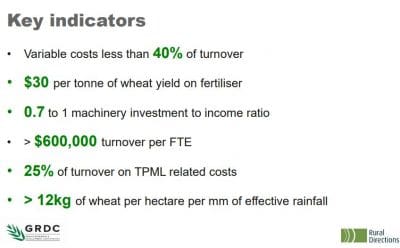

“In southern Australia that is around having a machinery investment-to-income ratio of 0.7:1.0 and ideally $600,000 worth of turnover per full time labour equivalent.

“Those two benchmarks often move in parallel as opposed to substituting with one another.”

Mr Vogt said growers needed to set up the revenue model to optimise income because both those benchmarks related back to income.

But achieving high levels of efficiency from machinery and labour resources were also needed through good planning, logistics and removing bottlenecks.

People and management

Mr Vogt said management drove the achievement of gross margin optimisation and running a low-cost business model. Good team function and skills transfer across generations was also important.

He said it meant consistent implementation across variable seasons and variable conditions.

“The top 20pc are absolute guns at getting implementation right under variable conditions. That all comes down to people and the management team,” he said.

Risk management

Mr Vogt said in broadacre, dryland agriculture there was a range of risks, including seasonal risk and commodity pricing risk.

“It means each business needs to understand what the key risks for their business are and look at how to mitigate those in a cost-effective manner,” he said.

“Good risk management is often about focussing on things that are within your control. While we can’t control how much rainfall we are going to get in September and October, we can control our crop rotation, the agronomy, operational timeliness and how much stored soil moisture we conserve over the summer months.”

Grain Central: Get our free daily cropping news straight to your inbox – Click here

He said another element of risk management was understanding the commodity business.

“Whenever we add profit margin to a commodity business we reduce the overall risk profile of that business. We can add margins by optimising gross margins or through having a lower cost business model. The business becomes more resilient to a production or business shock,” he said.

“Interestingly, the top 20pc of businesses can maintain profitability at decile 2 pricing whereas the average business requires decile 5 pricing to maintain profitability.”

Universal capacity for profitability

Mr Vogt said there was significant internal capacity on many farms to achieve greater levels of profitability from the resources they currently had.

“The reason we can be strong on that message is because we see the 2.5 to 3.0 times gap in profitability between the top 20pc of businesses and the average of the data set,” he said.

“We also see that, on average, both sets of businesses were of a similar scale and exposed to similar soil types and rainfall seasonality. The factors that can close that profitability gap are, in many instances, within the control of the grower.”

Management characteristics

The top 20pc of producers displayed the following six management characteristics:

- Having a systems focus

- Taking a ‘helicopter’ view when under pressure

- Internalising and taking responsibility for key business decisions

- Focusing energy on the things within their control

- Superior implementation ability

- Strong observational skills

Rural Directions, https://www.ruraldirections.com/pages/home.php

GRDC project reference RDP00013, ‘The integration of technical data and profit drivers for more informed decisions’

HAVE YOUR SAY