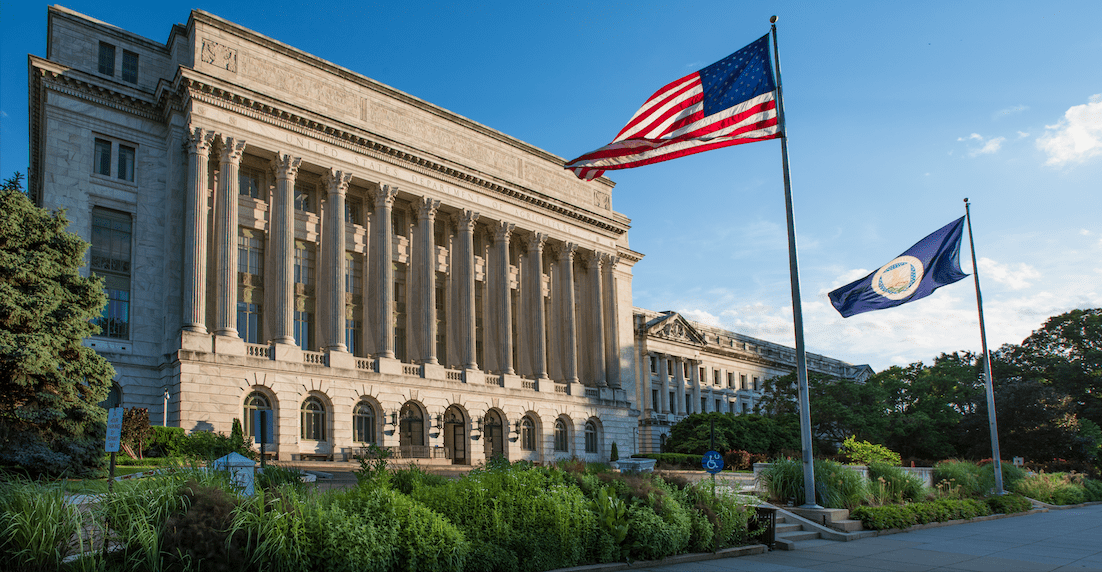

No information is coming out of the USDA with the funding freeze in the US.

THE New Year celebrations are now behind us and 2018 has been happily farewelled by many growers across the globe, particularly by a vast majority of eastern Australia’s winter-crop farmers.

Nonetheless, many of the same old issues continue to generate volatility on both global futures and domestic grain markets right across the globe.

World wheat values remain supported as rumours of supply tightness, and possible export restrictions in Russia, linger.

Fresh news is limited, as most of the Black Sea region only returned to work from holidays this week. Russia has been dominating global wheat trade so far this marketing year but United States (US) Hard Red Winter wheat is now priced to buy demand, trading last week at a US$10-per-tonne discount to Russian export values. That said, the trade is waiting on a sustained improvement in US export sales before slipping into its buying shoes.

The market did rally late last week on the news that Algeria had rejected a cargo of Argentine wheat on the grounds that it was below contractual quality standards. Argentina exported around 900,000t of wheat to Algeria last year. The North African country is Argentina’s second-biggest wheat client, and Argentine authorities are confident that the quality issue is an isolated case.

The trade stand-off between China and the US appears no closer to a resolution, despite mutterings from the White House, and tweets from The Don himself, suggesting all is on track. There are also unconfirmed rumours of more purchases of US soybeans by the Chinese government owned Sinograin. One day the soybean market is up on speculation of a resolution and sales. The next day the market falls as profit takers jump in to take risk off the table.

A US trade delegation is due in Beijing this week. Some reports say it is to continue the discussions, meaning progress has been slow, and others say it is to finalise an agreement; maybe the Don’s “going well” tweets are accurate. Nevertheless, one fly in the ointment could well be President Xi Jinping’s recently enunciated position on the reunification of Taiwan. Methinks this stalemate may well continue for some time yet.

And now we have another game in play in the US: In simple terms, Trump wants to build a wall between the US and Mexico, but the Democrats don’t agree with his border control policy. The impasse has led to the shutdown of non-essential government services across the country. More than 800,000 federal government workers have been without pay since 22 December.

One such non-essential agency is the United States Department of Agriculture (USDA). The lapse in funding means that key USDA reports, due for release this week, will not be published. Reports such as the World Agricultural Supply and Demand Estimates (WASDE), along with US production and US stock reports, will be delayed until at least one week after funding has been restored. With the Democrats now in control of the House of Representatives, it could be a long wait.

The WASDE report is a monthly publication that includes production and trade forecasts for the US and world wheat, rice, coarse grains (corn, barley, sorghum and oats), oilseeds (soybeans, rapeseed and palm), and cotton. For many traders and consumers across the globe, this report is an essential component of their market analysis and strategy development.

The January WASDE report is particularly important as it will likely contain the final production numbers for the US corn and soybean crops as well as updating the South American summer crop production estimates. There are growing trade expectations of a lower final US corn yield compared to the December WASDE estimate.

The December weather concerns across many regions of Brazil (extremely dry) and Argentina (exceptionally wet) have continued into the new year putting downward pressure on both soybean and corn production forecasts in both countries. The dry is also having a detrimental impact on summer crop production in neighbouring Mercosur trade pact member countries, Uruguay and Paraguay.

Another victim of the partial US government shutdown has been the trade aid payments to US farmers. The payments are designed to help and appease farmers affected by the US trade war with China. A second round of payments was authorised just prior to Christmas but they have not been paid. This comes at a time when US farmers are securing finance for their next summer crop program and it may reduce the amount of money banks are prepared to lend farmers.

Harvest here in Australia is now winding down with pockets in the Western Districts of Victoria, small areas of the lower south-east and lower Eyre Peninsula regions in South Australia and some late Albany and Kwinana crops still to be harvested. Favourable weather will see most of this knocked over in the next week or so.

Receivals in Western Australia have now exceeded 16 million tonnes (Mt). Wheat makes up around 9.3Mt of this total, barley around 4.7Mt and canola just over 1.4Mt. In South Australia total bulk handler receivals are approaching 4Mt and are expected to surpass that number by the time final harvest deliveries have been received.

Major bulk handler receivals in the eastern states total around 2Mt and probably constitute around 35 per cent of the total crop. The balance is either sitting in private stores, on-farm or has already been received directly into consumer storage facilities across Queensland, New South Wales and Victoria.

Experience says that no two years are ever the same in agriculture. New global supply and demand challenges will emerge in 2019 as old ones are resolved. But for now, political interference in the jurisdictions of Presidents Xi, Trump and Putin continue to dominate grain market news wires.

As legendary American folk rock duo Simon and Garfunkel wrote and sang many years ago: It’s the same old story!

Peter McMeekin is a consultant to Grain Brokers Australia.

HAVE YOUR SAY