TUESDAY was a significant day for the Australian grain industry, with the Bureau of Meteorology declaring an El Niño event, and hot, dry and windy conditions adding a new level of stress to many crops in New South Wales.

Crops on the plains and outer slopes of central and southern NSW suffered the most, with many districts recording temperatures of more than 30 degrees Celsius, uncommonly high for this time of year.

The first load of transshipped barley arrived at RainAg’s Wellcamp site this week. Photo: RainAg

Dry topsoil and depleted subsoil reserves are already limiting yield potential in many cereal, pulse and canola crops, and frosts earlier this month coupled followed by drying westerly winds is further stressing crops.

“This kind of heat has been like taking a blowtorch to Australian grain crops,” StoneX senior cash grain broker Stefan Meyer said.

“Dry, hot weather means that not only will we see a reduction in production, but we’ll also see an increase in demand.

“This demand is driven by farmers having to pivot toward feeding hay, straw and grains to cattle and sheep, which normally would have been eating green grass.

“This local supply/demand imbalance may push Australian grain prices to become less competitive in the global export market, which is in contrast to the situation we saw over the last two years, where we had the cheapest, high-quality wheat in the world.”

The 2023-24 marketing year starts October 1, and Mr Meyer said new-crop wheat exports will likely be close to half the record 31 million tonnes (Mt) shipped in 2022-23.

Mr Meyer said low-protein ASW1 from Western Australia will have to compete against cheap grain from origins including Russia, Kazakhstan, Romania, and Ukraine.

“We will continue to have strong inelastic demand for noodle wheats like H1/APH2 from premium markets such as Japan and China.”

Drought premium returns

On Monday, episode3 analyst Andrew Whitelaw published online his take on what the dry conditions are doing to values in Market Morsel: The drought premium in Australia.

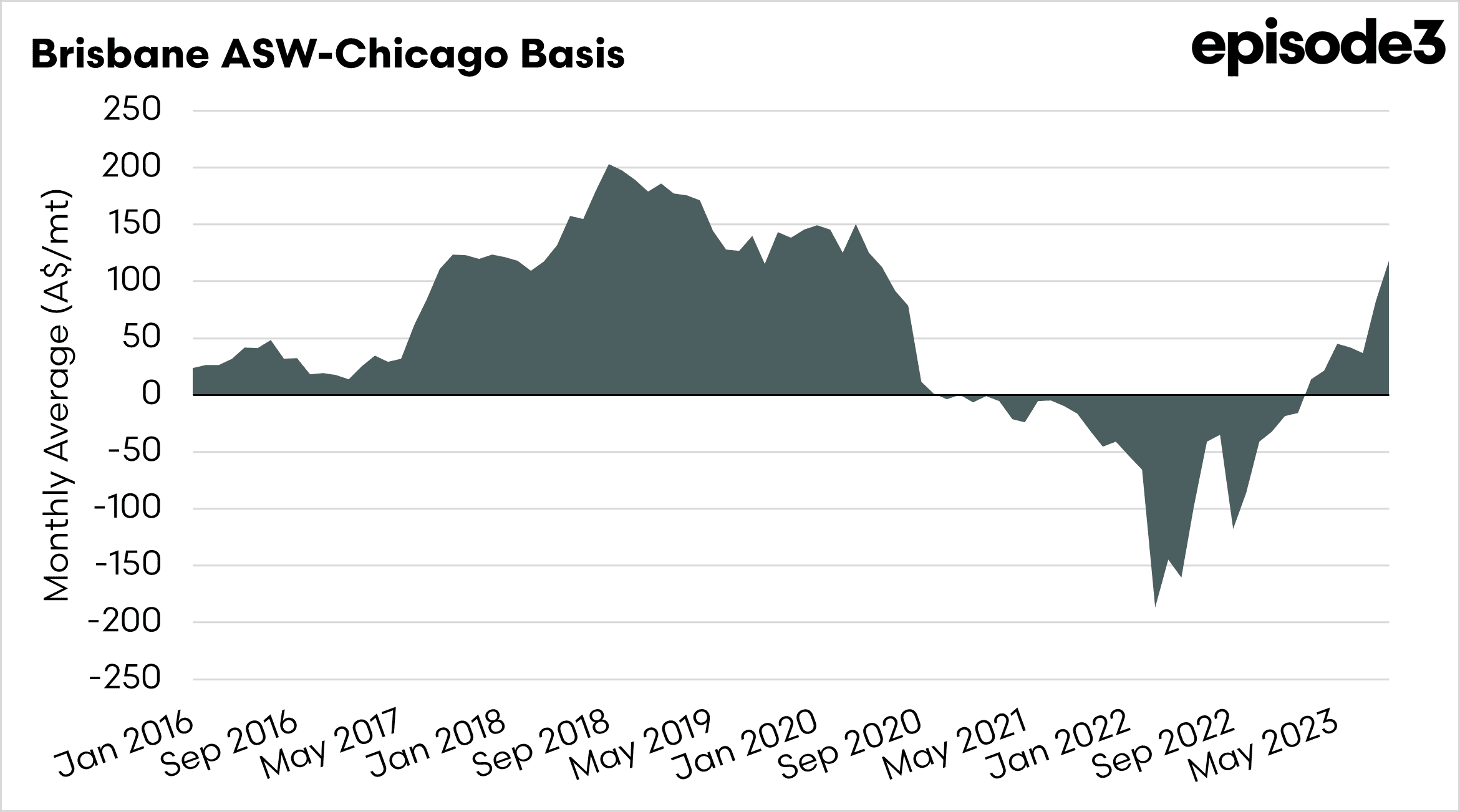

In it, Mr Whitelaw said that after three bumper years, dryness has arrived in parts of the Australian grainbelt, and the basis level between ASW wheat in Brisbane and Chicago wheat futures tells the story.

This is because Brisbane is the port zone for northern New South Wales and southern Queensland, home to the bulk of the country’s domestic grain demand.

“When it gets dry in these regions, grain has to be pulled from all over to meet the domestic demand,” Mr Whitelaw said.

“Consumers have a long memory, and with talk of El Niño and drying conditions, they don’t want to get left short.”

Figure 1: Brisbane ASW wheat prices against Chicago futures wheat values, which shows the return to positive basis for Brisbane ASW in recent months. Source: episode3

The episode3 charts shows Brisbane’s massive premiums over Chicago wheat in 2018 and 2019, when drought in NSW and Qld decimated grain production.

“We can see that the premium in Brisbane has increased markedly in recent months.

“At present, the premium is still way off the peak drought premiums.”

The episode3 chart shows the current ASW price in Brisbane at A$84/t below the drought peak, and Mr Whitelaw said that while that gap may narrow, it appears unlikely to close.

“We do expect basis to be positive, but it is hard (at present) to see basis levels rising to the peaks of 2018 and 2019; we just aren’t at that level of drought yet.”

“The crop conditions are deteriorating, and we expect that there will be downward revisions as we move forward into harvest; the question is just how far.”

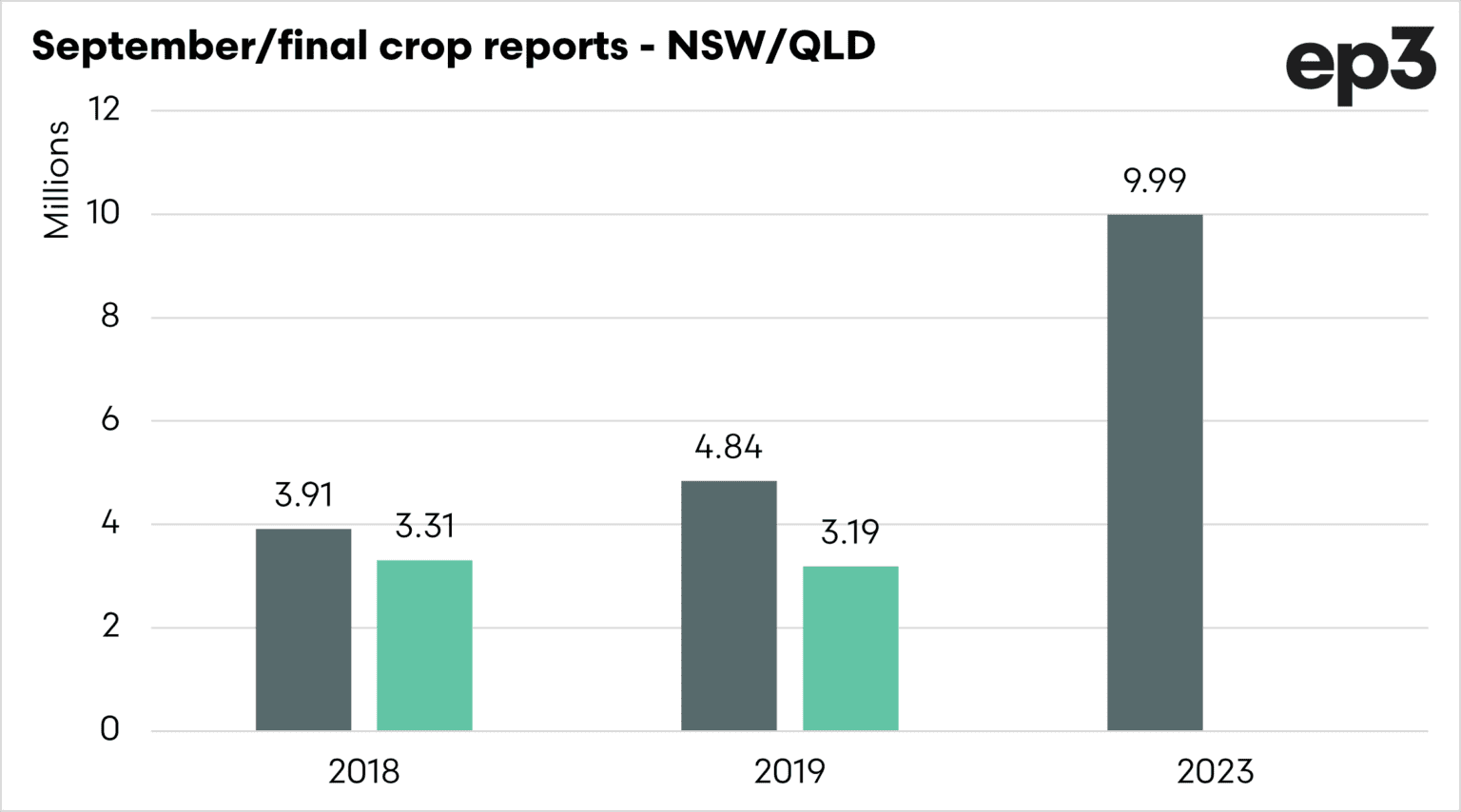

Figure 2: Combined wheat and barley production estimates for NSW and Qld, grey being the September and green the final figures. Source: episode3

As indicated in figure 2, the current combined production forecast for NSW and Qld wheat and barley in 2023 is more than the total figure for 2018 and 2019 combined.

“We expect revisions, but not to near the levels experienced in those years.

“This reduces the need to move large quantities from neighbouring states…or even transshipments.”

Source: StoneX, episode3

HAVE YOUR SAY