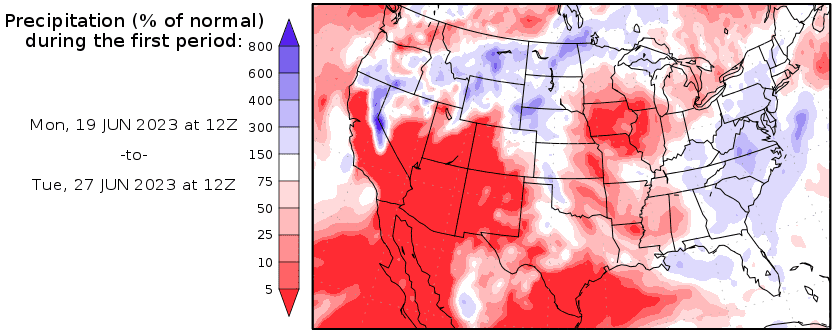

US WXMAPS. Percentage of normal precipitation forecast 19 June to 27 June 2023. Precipitation forecasts from the National Centers for Environmental Prediction. Normal rainfall derived from Xie-Arkin ( CMAP) Monthly Climatology for 1979-2003. Forecast Initialization Time: 12Z 19 June 2023

WEATHER maps suggest the US is about to enter the hottest month of the summer, with sizeable soil-moisture deficits across much of the Corn Belt. This does not bode well for the USDA’s current corn yield projection of a record 181.5 bushels per acre, or even matching the current record of 176.7 bushels per acre. Some in the trade are already talking low 170s, and the market reaction was evident late last week with US corn futures bid up strongly. Interestingly, murmurs of corn production issues in China, the world’s second biggest producer and biggest importer, stoked Dalian corn futures to a one-month high last week as domestic consumers also get concerned about 2023-24 supply.

Blocking pattern

Drought continues to tighten its grip across the US Corn Belt, with several states seeing significant falls in soil-moisture ratings in the latest US Drought Monitor update. Rainfall across the Midwest has been well below average for months. A stagnant, blocking, dry-weather pattern has now led to the rapid expansion of drought conditions in many row cropping states, with the prospect of rain pushed out to the back end of the 15-day forecast.

Precipitation in the first half of June has been quite sporadic for the corn belt, with falls more concentrated west of the Mississippi River, favouring the High Plains and Southern Plains states. The first full week in June, commencing Saturday 4 June, was reportedly the third driest first week of June for the US Corn Belt in more than 30 years, building soil moisture deficits and crop stress.

The 13 June national drought snapshot saw the drought worsening across much of the Midwest but improving in Texas, Oklahoma and Kansas. A strong upper-level ridge of high pressure continues to dominate the central portions of North America. According to last week’s report, moderate to exceptional drought now covers 20.9pc of the US, up from 18.3 percent the prior week. However, the agricultural areas are particularly hard hit.

Deteriorating subsoil moisture

Drought now covers 57pc of the corn area, up from 45pc a week earlier and 17pc in the same week last year. The soybean story is similar, with 51pc now drought-affected, up from 39pc last week and just 9pc a year prior. The sorghum picture has improved marginally, with the drought-declared area down two percentage points week on week to 64pc, much better than the 77pc at the same time in 2022.

Drought now covers 57pc of the corn area, up from 45pc a week earlier and 17pc in the same week last year. The soybean story is similar, with 51pc now drought-affected, up from 39pc last week and just 9pc a year prior.

The weekly crop progress report released by the National Agricultural Statistics Service (NASS) on June 12 showed a further deterioration in the national subsoil moisture rating. NASS reported that 47pc of the nation’s cropland had a subsoil moisture rating of short-to-very short, compared to 44pc a week earlier and 28pc at the same time last year. It was the worst rating since NASS began reporting national soil moisture conditions in 2014 and is nearly double the seasonal average of 24pc for early June: quite problematic for the emergence of later sown crops.

The national crop ratings were slightly lower week-on-week but are yet to truly reflect the hot, dry weather and rapidly declining soil moisture reserves in key production regions. The corn crop was rated 61pc good-to-excellent, down from 64pc the previous week, 72pc a year earlier and the long-term average of 70pc.

In Illinois, traditionally the second biggest corn-producing state, the short-to-very short subsoil rated area rose from 60pc on June 5 to 68pc on June 12. This is up from 9pc in the same week a year ago and the long-term average of 13pc. Severe drought now encompasses almost 15pc of the state. The crop is hanging on for dear life, with the good-to-excellent rated area dropping just two percentage points across the week to 48pc. But widespread soaking rains are needed before month end to avoid a catastrophe.

Iowa is the nation’s biggest corn-producing state, and the picture is not much better, with just over 14pc of the state enduring severe drought conditions. The subsoil moisture conditions did improve slightly from 53pc short-to-very short on June 5 to 59pc a week later. The good-to-excellent rated area dropped from 72pc to 70pc over the same week. Corn is a tenacious plant, and yield potential can be maintained for a certain period when under stress, but the yield potential cliff face is fast approaching with every rainless day.

The first national soybean ratings for the season were released last week, coming in at 59pc good-to-excellent, a downward revision of 2 percentage points week on week. The crop ratings for the biggest producing state, Illinois, came in at 47pc good-to-excellent last week compared to 51pc on June 5. Iowa is the number two producer, and the crop rating there fell from 70pc to 66pc over the same period. While the critical yield determining period for soybeans is still as much as six weeks away in most regions, high temperatures combined with sustained periods of moisture stress when the plants are young are still detrimental to the final yield.

While the corn and soybeans planting program is winding up, the sorghum planting program is still in full swing. As of last week, 64pc of the forecast area had been sown, compared to the five-year average of 68pc. The already emerged crops were rated 57pc good-to-excellent last week, up from 47pc on June 12, 2022. Kansas is the big swinger in sorghum, producing almost two-thirds of national production. The state’s crop was rated 57pc good-to-excellent, up slightly from 55pc a year earlier.

Late rain

With the winter wheat harvest now underway in the southern states, exactly half the planted area is experiencing drought, up from 47pc last week and 45pc last year. The recent rains came far too late to positively impact production, although quality has reportedly suffered in some regions. The spring wheat, durum wheat and barley crops are faring much better at 4pc, 2pc, and 11pc drought declared, respectively. These are all very similar to the previous week’s ratings but significantly better than at the same time in 2022.

The corn market has its eyes planted firmly on the weather forecasts at the moment as crunch time approaches. Early pollination will commence in the first week of July, and optimum yields, which the USDA is currently forecasting, require adequate soil moisture in the week before and the three weeks after tasselling.

While forecasts show a possibility of rain in early July, substantial and sustained falls are required to salvage average production potential in many regions. Evapotranspiration will currently be around 4mm per day, rising to as much as 6mm per day at tasselling, the peak seasonal water demand period. In extreme situations such as high wind speed, high temperatures, low relative humidity, and adequate soil moisture, the evapotranspiration rate can be as high as 10mm per day. But soil moisture deficits of at least 100-150 millimetres are projected for eastern Nebraska, Iowa, Missouri, Illinois and western Indiana by 30 June.

HAVE YOUR SAY