CBH webinar panel Will Reid, Drew Robertson, Ben Tiller and CBH Group proprietary trading manager Michael Gardiner take questions on today’s CBH market outlook webinar.

PROVIDED key global weather and demand drivers do not change over Australia’s harvest period, Western Australia’s grain-marketing heavyweight CBH Group sees steady to firm markets for wheat, barley and canola ahead of new-crop shipments.

Through a Market Outlook Webinar held this morning, CBH trading specialists in summary see barley as most vulnerable to competition from corn in the global feedgrain market, while wheat and barley demand looks set to benefit from dry conditions which have impacted European Union and Black Sea production.

CBH Group wheat trading manager Will Reid said while Russia’s wheat crop was 9-10 million tonnes (Mt) bigger than last year’s, the increase had largely come from its northern growing areas, which were a considerable distance from Black Sea ports.

“Large volume is further north with a bigger distance to drag,” Mr Reid said, adding that this reduced its competitiveness in global markets.

He said the big driver for Australian prices were the smaller crops in the EU, down 18Mt from last year, and the Black Sea, down 3-4Mt.

This limited supply put a “very very positive spin” on Australia’s export wheat values.

“Russian wheat is extremely expensive for this time of year.”

Mr Reid said the onus was on exporters to ship new-crop grain ahead of Europe’s 2021-22 crop.

“There’s a large incentive to maximise shipping pace.

“The world needs Australian wheat from December to June.”

He said wheat was relatively expensive in global terms and was “buying planted area worldwide”.

“It makes it difficult to carry Australian wheat beyond July.”

CBH has forecast Australia’s 2020-21 wheat crop at 29.03Mt versus ABARES’ 28.9Mt.

The CBH forecast includes 7.8Mt for WA, more than 11Mt for New South Wales, and less than 1Mt for Queensland.

Mr Reid said South-East Asian milling markets such as Indonesia, Myanmar, Thailand, The Philippines and Vietnam could be better serviced this year from Australia, thanks largely to NSW returning to the export game.

“Traditional quality-focused markets like Japan and Korea will continue.

“Also in the Middle East…we’ll see a strong return of Australian grain into those markets.

“China is a bit of a swing factor.”

Mr Reid said Australia had made big inroads into feed wheat markets including The Philippines in recent years, but these would be facing stiff competition from corn and feed barley.

“Our wheat needs to maintain price competitiveness to continue selling into those markets.”

EU benchmark

Mr Reid spoke about the rising relevance of European wheat as a benchmark for Australia.

“If we look at basis, Australian wheat looks cheap relative to Chicago.”

However, he said the relevance of Chicago wheat futures to Australian wheat was not great at present.

“Increasingly we see Black Sea and EU wheat is the driver for global values.

“The world needs the Australian wheat to make up for the smaller EU crop, but Australia needs global demand.”

Mr Reed said the dry finish to the WA growing season seemed likely to complement the softer one most of NSW was experiencing by offsetting higher wheat protein from the west against lower ones from the east.

“I think in general it will be positive; largely APW and Hard wheat is helpful in marketing the crop.”

Barley buys demand

CBH barley trading manager Drew Robertson said CBH had forecast an Australian barley crop of 11.74Mt, above the standing ABARES estimate of 11.18Mt.

CBH’s estimate for WA barley sits at 3.85Mt, well above the Grain Industry Association of WA estimate of 3.29Mt released on Friday.

Mr Robertson said NSW, which is currently pencilled in by CBH to produce 2.76Mt, was seen as having potential to exceed 3Mt.

“There’s upside potential in NSW and Victoria, and probably some downside in WA.”

Global beer demand has fallen as a result of COVID-19, which along with China’s tariff on Australian barley, has weakened the global call for malting barley.

Mr Robertson said the weakened barley complex had enabled barley to price into feed rations and displace some other grains, particularly corn.

“Barley looks cheap compared to relative feedgrains.

“There will be substitution in feedgrain rations in the EU and Australia.”

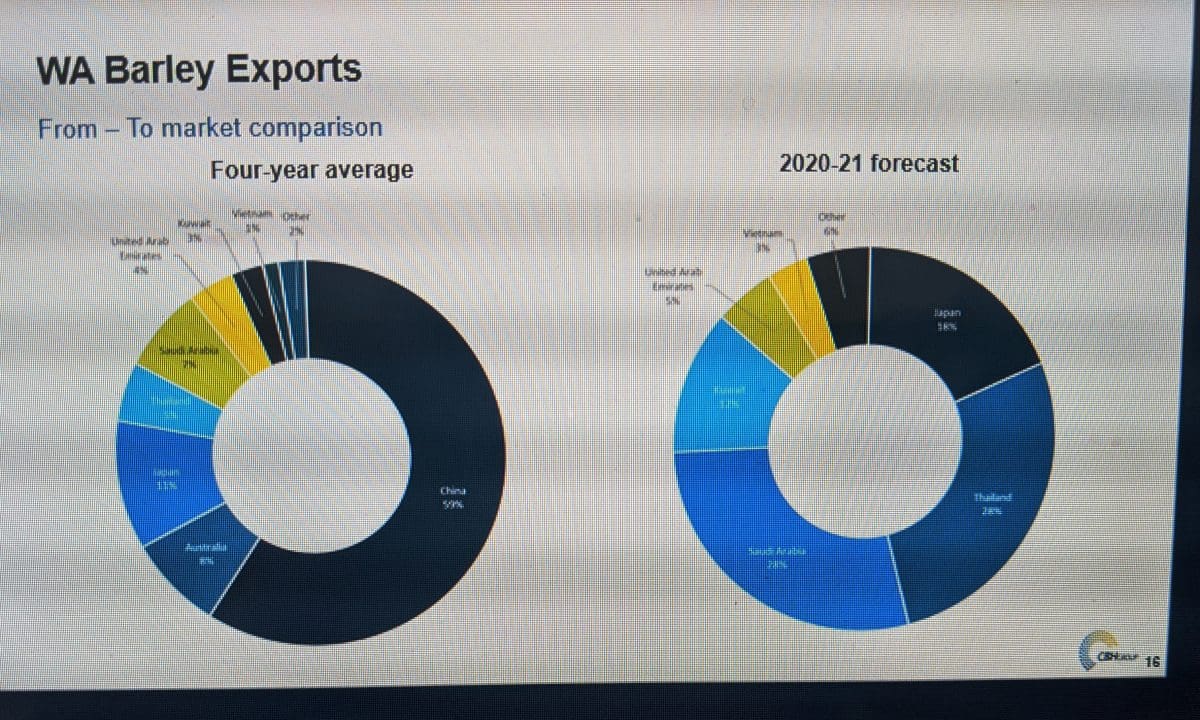

Expected WA barley export market share for 2020-21 versus the four previous years’ average. Graphic: CBH Group

Mr Robertson said Japan, Kuwait, Saudi Arabia and Thailand were all expected to increase their buying of WA barley for feed and food in 2020-21.

While markets like India and South America have potential to step up for Australian malting barley, Mr Robertson said no combination of markets could take the place of China.

“China has a malting capacity of 5.3Mt; it far outstrips others.”

When China in May announced tariffs on Australian barley, the discount of barley to wheat blew out to $150/t, but has since contracted to around $80/t.

“We’ve seen quite a strong rebound of barley prices since then.

“Australian feed barley is now equivalent to the cheapest feed barley in the world, and we’re now calculating into all global demand centres.

“The big question for barley is whether higher yields will overcome the price spread with wheat.

“If not…we are likely to see a decline in barley production into the future.”

Mr Robertson said WA looked likely to fill its domestic malting requirements, with Bass and Flinders the two varieties expected to meet the highest demand.

“Certainly if you are a grower of Bass or Flinders, you could potentially see a slightly better premium.”

He said China’s tariff on Australian barley had fundamentally shifted international trade flows.

“They’ve been very busy buying malting barley from Ukraine, France, Canada and even Argentina.”

The latter origin appears to have shipped about 500,000t to China in recent months.

“In some markets that Argentina would traditionally supply in South and Central America, there may be some opportunities for Australian malting barley in 2021.

“It’s very difficult to forecast at this point in time.”

China has continued to buy Australian barley, albeit in hugely reduced volumes, to produce malt for reexport, and there has been talk in the trade of considerable 2020-21 volume selling into China.

“Some people have been talking about 600,000t of Australian barley into free-trade zones.

“With the current sentiment out there, this is becoming increasingly unlikely.”

Mr Robertson said any reprieve on the China tariff issue looked like “a multi-year scenario”, either through an administrative review in China, or through the World Trade Organization.

Canola values climbing

CBH head of trading Ben Tiller said CBH’s estimate for national canola production sits at 3.19Mt, below ABARES’ on 3.4Mt.

The CBH estimate has pencilled in WA for 1.43Mt, South Australia for 340,000t, NSW for 730,000t NSW, and Victoria for 700,000t, and exports of roughly 500,000t in China, which he said was not without risk.

“It remains to be seen how Australian exporters service that market knowing that they are opening themselves up to increased scrutiny,” Mr Tiller said.

Europe is once again expected to be Australia’s major canola market as it looks to service a 23Mt demand with a 16Mt crop, where a dry seeding period saw hectares fall away from canola.

“This gap they are experiencing will be met by Canada, Australia and Ukraine.”

Mr Tiller said Canadian exports could total 2.5-3Mt, with non-GM Australian exports of 1.8-2Mt, and Australian GM exports competing with Canada into Europe.

He said European demand for canola, including for the biodiesel market, remained vulnerable to surging COVID cases and potential lockdowns.

Ukraine’s smaller crop, down 25 per cent on last year at 2.5Mt, is expected to see 2.1Mt sell to Europe.

Mr Tiller said prices for canola were expected to remain firm based on the global oilseed complex, with strong crush margins, particularly in China as its swine herd rebuilt and demand for canola meal climbed.

“We’re just breaking out of the $610-$640/t trading range, and expect $620-670/t free in store, and a GM spread of $30-$50/t.”

Grain Central: Get our free cropping news straight to your inbox – Click here

HAVE YOUR SAY