Baiada operates three feedmills in NSW with Hanwood (pictured) having the largest capacity. It’s Tangaratta operation in Tamworth is expected to increase now that its processing facility has permission to expand to 3 million birds a week, in line with Hanwood. Photo: ACMF

A RETURN to growth in the poultry sector looks likely to underpin stockfeed use of grain in New South Wales and will help offset a short-term downturn in demand from feedlots.

This has come as NSW recovers from the 2017-19 drought, and graziers with thriving pastures limit female turn-off to rebuild herds, and finish cattle with a much-reduced reliance on feedlots.

Driving the poultry increase is a planned expansion by Baiada, which in December received approval from the NSW Government to triple capacity at its Oakburn plant near Tamworth to 3 million birds per week.

Industry sources have told Grain Central Baiada’s weekly grain use at its nearby Tangaratta mill is already on the way up from around 3600 tonnes per week in recent months to 10,000t in coming years.

Along with Baiada’s feedmill at Hanwood in the Riverina, and Manildra Group’s Manildra flour mill in the central west, this will make it one of inland NSW’s three biggest grain consumers, each using more than 450,000t per annum.

Majors streamline

The Tamworth expansion will be the final stage in a multi-year rationalisation of operations in eastern states by Baiada Poultry and Ingham’s Enterprises, suppliers of around 70 per cent of Australia’s meat chickens.

In recent years, Ingham’s has expanded its footprint in Queensland, and Baiada has done the same in NSW.

Ingham’s has done its biggest ramp-up in South Australia, where its Murray Bridge feedmill, which opened in 2019, chews through more than 400,000t per annum of grain.

In Victoria, Baiada in 2017 closed its only processing plant at Laverton North in Melbourne, while Ingham’s continues to operate processing plants at Somerville and Thomastown.

Baiada’s biggest expansion nationally has occurred at Hanwood in the Riverina, where ready access to grain and water tick two of the poultry industry’s most important boxes.

In the 2019 ‘Invest in Griffith Prospectus’, the Griffith City Council Economic Development Unit said Baiada’s Hanwood operation was using around 5500t of grain per week, and plans were under way to double its processing capacity to 3M birds per week by 2021.

In its 2017 submission to the Australian Competition and Consumer Commission, the South Australian Baiada Growers Group said what now appears evident: the Tamworth region is being targeted as the next centre for Baiada’s expansion.

In 2018, Newcastle City Council granted Baiada permission to increase feed production at its Beresfield mill to 416,000t per annum from 250,000t; for grain use, that would increase to around 312,000t from 187,500t.

Rather than expand the mill, Baiada last year closed it, but still processes chicken at the adjacent facility.

Baiada’s poultry suppliers in the Hunter Valley and nearby coastal regions now get their feed from the Cardiff mill south of Newcastle Baiada bought in 2017 from Ingham’s.

That was made possible after 2016, when Ingham’s closed the adjacent Cardiff processing plant. It has not reopened, but Ingham’s other major NSW mill and processing plant on the Southern Highlands south of Sydney continue to operate.

In Queensland, Baiada closed its Ipswich processing facility west of Brisbane in 2017, and sold its feedmill at nearby Wacol to Ingham’s, leaving Mareeba near Cairns as Baiada’s only processing plant north of the NSW border.

Figure 1: Map showing selected assets of Baiada and Ingham’s in south-eastern Australia.

Baiada’s Tamworth expansion is expected to primarily service southern Queensland.

One industry source said its Tamworth location gave Baiada short freight distances on the input side of the production cycle — grain to mill, hatchery to farm, and farm to processing — with only the leg from processing to metropolitan markets being of considerable distance.

It mirrors the efficiencies Baiada appears to have achieved in its Hanwood cluster, and also what Ingham’s has achieved in South Australia, where major expansion is occurring outside metropolitan areas.

Wheat in demand

Broilers typically eat 3.6 kilograms of feed, 70pc of it grain, in their lifetime.

Wheat is the base grain, and barley and sorghum can also be included.

Around Hanwood and also Murray Bridge, expanded poultry demand has given grain growers a consumer of increased significance which provides competition to export and other domestic markets.

Baida’s Tamworth expansion is expected to do the same.

While wheat’s price remains historically high, it is down about 30 per cent from last year’s peak.

“Growth in poultry has been consistent over the long term, and that’s been good for domestic grain demand on top of what is required for cattle on feed,” Agracom managing director Joe Hallman said.

Mr Hallman said drought and COVID has affected grain supply and domestic demand in recent years, with lot-feeding of sheep as well as cattle bolstering the demand side during the drought.

“The overall trend in domestic consumption of grain has been extremely positive, and poultry is part of that.”

Drought hurdle cleared

Grain Central has found the earliest media report of Baiada’s planned expansion in Tamworth’s Northern Daily Leader newspaper in 2001, when the adjacent Tangaratta mill was said to produce 2600t per week of feed for poultry farmers as far south as Sydney.

Between then and 2018-19, ABARES data says Australia’s per-capita chicken-meat consumption rose from 39.9 kilograms to 47.4kg.

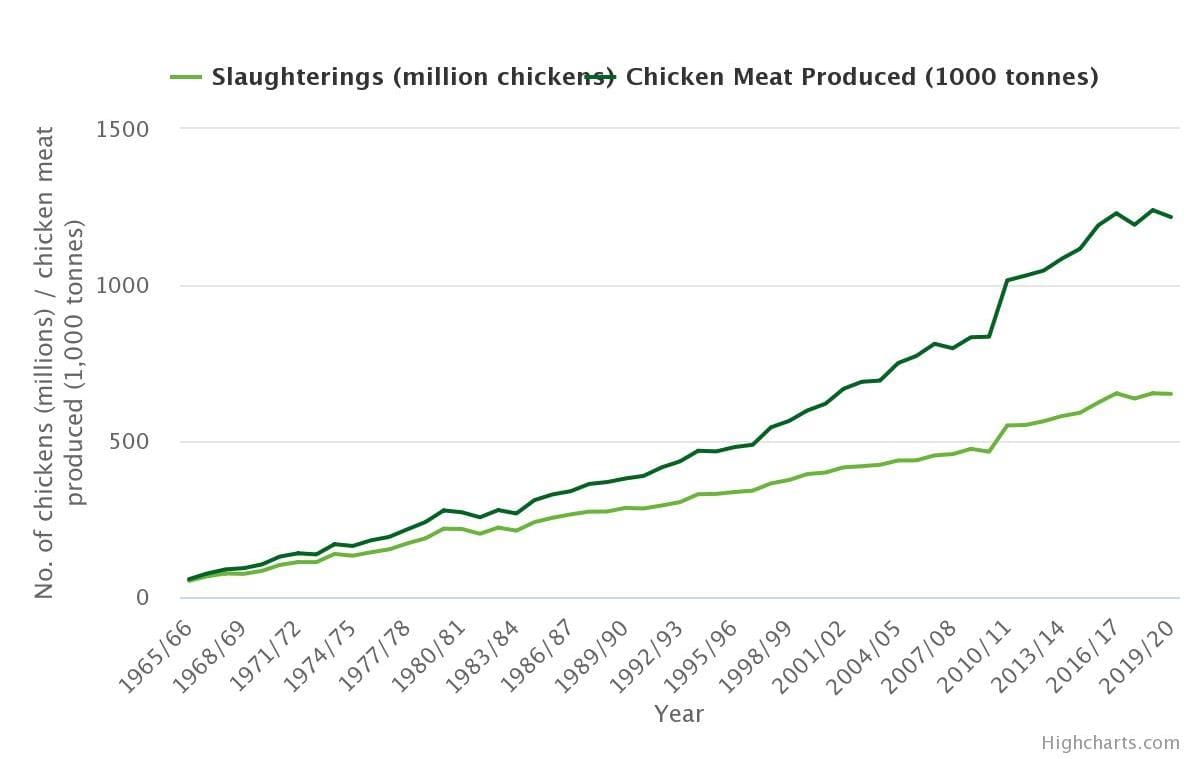

Mirroring that has been the rise in meat birds processed per annum, up from 398.9 million producing 619,400t of meat in 2000-01 to 651M birds producing 1.2Mt of meat in 2019-20.

Australian chicken production using ABARES data via the Australian Chicken Meat Federation.

East-coast droughts and resultant high grain prices have historically impacted chicken production.

This was seen during the 2017-19 drought which impacted prices into late 2020, and also in the millennium drought.

Two of the three years to 2019-20 saw a contraction in national bird numbers, but 2020-21 might be a different story.

Ingham’s reported its core poultry volume sold in Q1 FY21 at 110,900t was up 6.2pc on Q1 FY20, and 7.5pc on the previous quarter.

“For three years, the country was dealing with the effects of the drought and, for Ingham’s, this manifested in record-high feed prices,” Ingham’s chairman Peter Bush told the Ingham’s AGM in November.

Tamworth was one of regional cities hardest hit by the NSW drought, and its meat processors including Baiada were mindful of water limitations and in no situation to consider expansion.

Baiada’s planned build at Oakburn includes advanced water treatment and reuse to minimise its pull on Tamworth’s water supply, which will be bolstered by an upgrading of the Dungowan pipeline due to start later this year.

During the 2017-19 drought, some feedlots in northern NSW had to limit numbers because of a shortage of water, but the region’s intensive cattle feeders generally have sufficient water to operate at full capacity during drought.

They include Marubeni’s Rangers Valley at Glen Innes, JBS’s Caroona at Tamworth, and Elders’ Killara at Quirindi.

Baiada and Tamworth Regional Council were contacted for comment.

Grain Central: Get our free cropping news straight to your inbox – Click here

Good story Liz!

Also appreciated the on on the WA crop last week.

Hope all are keeping well in Toowoomba!

GHA

Thanks Guy. Hope you’re all keeping warm over there in the Midwest.