StoneX’s Nick Orssich with Will Martin from Moxey Farms, Gooloogong, NSW. Photo: Stefan Meyer

AS PLANTING time nears, climate indicators and preliminary forecasts suggest Australia is unlikely to produce its fourth record wheat crop in a row.

With an El Niño Watch in play, it means growers are looking at fewer tonnes selling into a softer world market as the Northern Hemisphere, bar parts of the US, enjoys a relatively kind season, and cargoes of Russian and Ukrainian wheat exit the Black Sea, despite turmoil caused by the Russian invasion.

In its latest Commodities Quarterly released March 7, ABARES forecast the price of new-crop US No. 2 Hard Red Winter wheat fob US Gulf in real terms at US$369/t, down from $405/t in 2022-23 and $423/t in 2021-22, and with a tumble to $319/t predicted for 2024-25.

According to StoneX Asia Pacific agriculture vice president Nick Orssich, this calls for more astute risk management than was needed when Australia’s three consecutive record crops hit a purple patch in global grain prices.

MATIF a Black Sea proxy

Legend has it that AWB was the biggest non-fund user of US wheat futures in the days when it was Australia’s single-desk exporter, and when protectionist policies made European exchanges a poor fit for hedging Australian production.

Now, international trading houses, as well as Western Australian grower co-operative CBH Group, the ASX-listed GrainCorp and others are selling single and optional-origin cargoes out of Australia which are increasingly being hedged against the European market.

“Those big global trading houses aren’t just using US futures,” Mr Orssich said.

Euronext’s milling wheat contract, as traded on the MATIF exchange, has shaped up as the big alternative, especially now that the Russia-Ukraine conflict has stymied confidence in CME Group’s Black Sea contract as cash settled by Platts.

“A lot of the Australian grain market did a good job of staying out of it.

“If you look at the Australian market, you’re seeing a transition from a US focus to more MATIF as a proxy for the Black Sea region.”

Mr Orssich said the Black Sea contract has been considered as a hedge for Australian grain, but the holdback in use of it has come from it being traded by voice rather than electronically.

“You had less liquidity than other markets, and the political risk of what Russia’s going to do.

“Now there’s no liquidity going through the CME Black Sea contract.”

The UN-brokered Black Sea Grain Initiative has managed to open channels to wheat and other commodities passing through the Bosporus, and Mr Orssich said this was where much of Australia’s competition could be found.

“There’s a significant amount of grain going out of Russia and Ukraine.

“As Russia has become a bigger exporter of wheat, Australia’s big competitor is Russia, so the spread between Australia and Russia delivered South-east Asia is one of the big ones to watch.

Tide turns on basis

Australia’s record wheat crops totalled 31.9 million tonnes (Mt) in 2020-21, followed by 36.3Mt in 2021-22 and 39.2Mt in 2022-23, and ABARES has issued its preliminary forecast for 2023-24 at 28.2Mt.

Big domestic carryouts and highly competitive elevator margins, made Australian grain the go-to for much of the past three years, especially when the Canadian-US drought of 2021 reduced off-season competition.

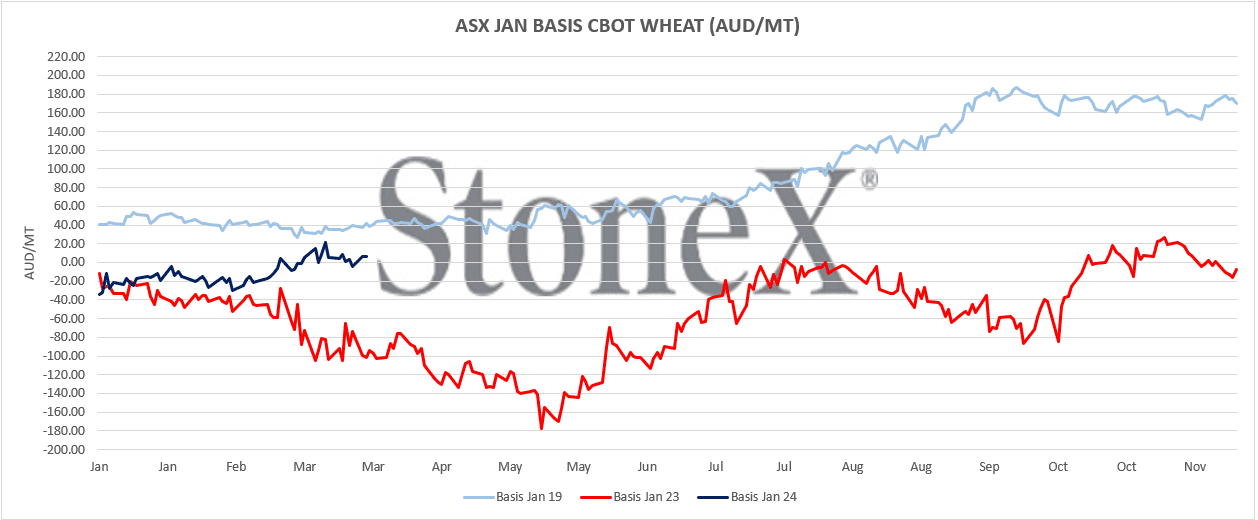

Graph 1: ASX Wheat rolling spot January basis in AUD/t vs rolling spot December Chicago Wheat Futures in AUD/t. Basis in May 2023 got to -$180/t, and currently sits roughly at evens. In the 2019 drought, basis went to +$180/t premium. StoneX commentary says with the next Australian drought around the corner, many consumers are currently trying to own cheap relative basis. Basis. Source: StoneX

In February last year, Russia’s invasion of Ukraine stymied supply from Australia’s major competitors in Asia, and rekindled long lost demand from Middle East and African nations that were regular buyers of Black Sea wheat.

Mr Orssich said the Russia-Ukraine conflict means optional origin at present means Australian, Canadian, European and US, as uncertainty has knocked Ukraine and Russia from the list.

“If you look at exportable surplus around the world, Australia has had three record crops at the perfect time when others were not having enough to export.”

Based on the difference between ASX wheat and the comparable Chicago contracts, Australian wheat has largely traded through that period on par or at a discount, or negative basis, throughout 2021 and 2022.

“Last year at around this time, basis got to negative A$200/t.

“If you’re looking at the market now, we’re around evens.”

Mr Orssich said the risk for hedges based solely on CME Group exchanges lies in dry conditions impacting the US, and possible short covering by funds.

“The worry you would have in a trade like that is the make-up of the US market and the drought not looking like it’s going to end any time soon.”

Chicago not forgotten as China rises

Even when the 2017-19 drought elevated Australian grain prices to well above export parity, the domestic market kept one eye on deliverable CME Group futures.

“Australia has always looked to Chicago for what to do every day.”

Despite expanding choices for global brokers like StoneX to use in arbitrage, that cultural pattern may stick.

“You’re delivering wheat halfway around the world…but it’s a global pricing tool.”

Spreads are therefore being traded globally between the US, European and Asian markets.

China as well as Australia offer agricultural commodities contracts based in the Asian time zone. Photo: Zhengzhou Commodity Exchange

Mr Orssich said China’s three exchanges — Dalian, Shanghai and Zhengzhou — were expanding their offering, with some contracts internationalised already, and others available to be traded through local entities engaged by companies include StoneX.

While wheat is yet to appear on a Chinese exchange, StoneX and others are trading Chinese contracts for soybeans and rapeseed, plus oils and meals.

In Australia, Mr Orssich said trading of the ASX wheat contract is dominated by local players, but had potential to gain regional traction.

“I think there’s opportunity for that contract to be built out.

“We have a lot of Asian consumers asking us how it can be used.”

He said the fact that the ASX contract is deliverable goes against it in the minds of offshore consumers who worry about being “short and caught” if Australia’s production prospects dwindle.

“Australia goes from massive to minimal production, and when we’re exporting a lot…that’s when they want to use it.”

Grain Central: Get our free news straight to your inbox – Click here

HAVE YOUR SAY