Planting the safrinha corn crop in Brazil. Photo: SLE Farms

GLOBAL wheat stocks are now projected at a five-year low, with the wheat outlook for 2021-22 being lower supplies, higher consumption and increased trade, according to the USDA’s World Agricultural Supply and Demand Estimates February report released overnight.

This news, and cuts to production estimates for South America’s row crops, saw markets close higher in overnight trading.

In its commentary, Lachstock Consulting said the report did not throw out huge changes to numbers.

“The reductions in US wheat exports and the USDA not going as hard as expected on South American production cuts put a slightly bearish spin on this report,” Lachstock said.

Wheat prices mostly firm

Global wheat prices for most major exporters were up slightly over the past month as geopolitical tension in the Black Sea region fuelled concerns about availability.

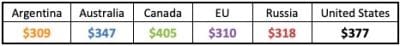

Figure 1. FOB wheat price at 8 February 2022. US$/t. Argentina 12.0pc protein, upriver; Australia average of APW; Kwinana, Newcastle and Port Adelaide; Russia Black Sea milling; EU France grade 1, Rouen; US HRW 11.5pc Gulf; Canada CWRS (13.5pc),Vancouver. Source IGC in USDA.

Canadian quotes had the largest increase, rising $22/t from the previous month. Australian quotes rose $5/t as the new crop merchandising began with strong international demand, particularly from China and Indonesia.

Argentine quotes rose $6/t, supported by strong purchases from Brazil.

Higher US wheat quotes were tied to the deteriorating condition of the US winter crop due to continued dry weather across much of the wheat growing regions, logistical challenges due to labour shortages and impact of tensions in the Black Sea region..

Hard Red Winter (HRW) rose $8/t to $377, reflecting persistent extreme drought conditions in Texas and Oklahoma. Soft Red Winter (SRW) settled at $339, up $8/t.

Hard Red Spring (HRS) rose $14/t from last month to $416, as poor rail performance and high bids for rail services support high export basis.

Similarly, Soft White Winter (SWW) climbed $12/t to $446/t due to tight supplies.

EU quotes were down $9/t as Algeria shifted purchases to suppliers in the Black Sea region.

Russian quotes were down $16/t, as importers eye alternative suppliers in advance of the implementation of the export quota.

Drought impact in Middle East

Global wheat supplies are projected to fall by 1.1Mt to 1.07Mt as reduced production more than offsets higher beginning stocks.

The majority of decreases are in the Middle East, where Iraq’s and Syria’s crop are down due to prolonged dry conditions.

Projected 2021-22 world wheat consumption has been raised 600,000t to 788.1Mt, as higher feed and residual use more than offsets lower food, seed, and industrial use.

The largest wheat feed and residual use changes are for Canada and China, with Canada up 1.7Mt to 4.5Mt as the Statistics Canada December 31 stocks report indicated greater August-December disappearance than previously expected.

China’s wheat use is down 1Mt from the January estimate to 35Mt because domestic wheat is no longer at a discount to corn, and wheat auctions have not been as active this year.

Projected 2021-22 global wheat trade is raised 2.3Mt to 206.7Mt, primarily on higher exports by India and Argentina.

The estimate for India’s wheat exports are up 1.5Mt from the January figure to 7Mt, which exceeds its record set in 2012-13.

“India’s export pace continues to be robust, and its prices are competitive in Asian markets,” the report said.

In its accompanying Grain: World Markets and Trade report, USDA said India has sustained its pace of large shipment to nearby markets, especially Bangladesh.

It also cut estimated US wheat exports for 2021-22 by 500,000t to 22.5Mt to reflect sluggish shipments of Hard Red Winter and White wheat.

WASDE said Argentina’s wheat exports are raised 500,000t to a record 14Mt on an early strong pace.

Projected 2021-22 world wheat ending stocks are lowered 1.7Mt to 278.2Mt with reductions for Canada and India partially offset by increases by the US and Ukraine.

USDA estimates for Australia’s 2021-22 wheat crop are unchanged at 25.5Mt in exports and production of 34Mt.

Cut to coarse grains

Global coarse grain production for 2021-22 is seen at 1497.4 Mt, down 2.7Mt from the January estimate, with lowered production and consumption, and smaller ending stocks in countries outside the US.

Brazil corn production is reduced based on lower yield expectations for first-crop corn, while Paraguay corn production is down as extreme heat and dryness sharply reduce yield prospects. However, the estimate for The Philippines corn crop has been lifted.

The estimate for non-US barley production has fallen, reflecting declines for Iraq and Syria.

For 2020-21, Argentina and Brazil’s exports for the 2021-22 (Mar-Feb) are raised based on observed shipments to date.

For 2021-22, estimated corn imports for Iran and Canada have been raised.

Barley exports are increased for the EU, with higher imports projected for China but lowered for Saudi Arabia.

Foreign corn ending stocks are down, mostly reflecting a forecast reduction for Brazil that is partly offset by an increase for Argentina.

Global corn stocks, at 302.2Mt, are down 900,000t from the January figure.

Soybeans shrink on dry weather

Global 2021-22 soybean S&D forecasts include lower production, crush, exports, and stocks.

USDA has cut its forecast for global soybean production by 8.7Mt to 363.9Mt on drought in South America, with the Brazil number down 5Mt to 134Mt, Argentina down 1.5Mt to 45Mt, and Paraguay down 2.2Mt to 6.3Mt.

Lower supplies and higher prices are expected to reduce global meal demand, particularly for China, where soybean crush and imports are both down 3Mt tons to 94Mt and 97Mt respectively.

The estimate for global soybean ending stocks has been cut 2.4Mt to 92.8Mt.

USDA has lifted its estimate for the Indian rapeseed crop by 1.3Mt increase to 10.8Mt, based on a faster-than-expected planting pace and higher yields.

Source: USDA, Lachstock

HAVE YOUR SAY