AS THE Western Australian grain harvest marched south over the last month, grain yields for all crops have continued to exceed pre-harvest estimates, according to the latest report from the Grain Industry Association of WA (GIWA).

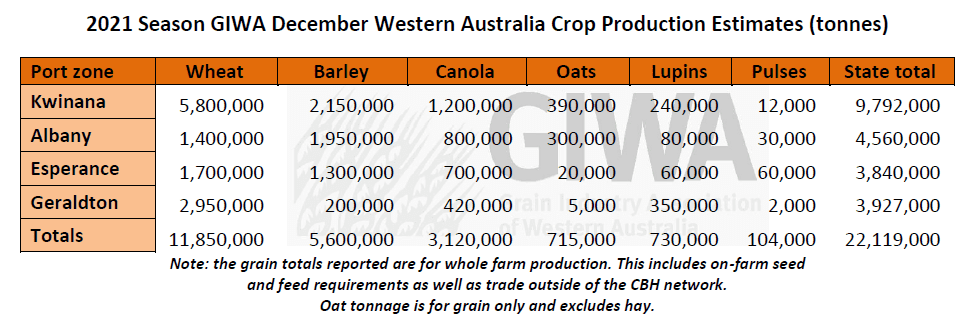

Records are being set for individual paddock averages, crop type averages and regional totals over most parts of the state. Total state production for all grains will exceed 22 million tonnes, around 17 per cent more than the previous record in 2018.

It has been obvious since the start of harvest in the north of the state where actual yields were mostly coming in around 10 to 20 per cent above estimates, if that held true for the rest of WA, it would be a record tonnage.

As harvest has moved south and grain yields continued to exceed estimates, the focus has shifted from “if we would hit 20 million tonnes” to “how are we going to deal with so much grain”.

There is more area to be harvested than is normally the case at this time of the year, with most of the country still to be harvested being in the higher rainfall regions where the very high yields are coming in.

There is a lot of grain in bags, particularly in the Esperance port zone and growers elsewhere are racing against the clock to finish before the local bins fill up.

Grain quality downgrades from weather have been isolated to those areas that received several rainfall events at the start of harvest and is not significant in the overall scheme of things.

Low protein from lack of nitrogen has mostly been confined to wet areas where growers were not able to top up during the winter.

However, the usual inverse relationship between grain yield and protein is resulting in low protein where grain yields have been well above average. The higher protein grades have mostly come off frosted areas.

Harvest has been frustratingly slow in the south of the state due to cool conditions and the time it has taken to dry down. Although this of course is one of the main reasons why WA is hitting a record tonnage.

The large area of crop that was sown in the low rainfall regions of the state has not produced the tonnage that was set up over winter due to the widespread frosts in September and the lack of spring rain. This has been devastating for those growers as it was looking so good up until the frost.

Soil moisture profiles are very dry in the medium and low rainfall regions due to the lack of spring rain and slow finish allowing crops to completely dry out the profiles.

It is a vastly different story in the higher rainfall regions where stored moisture is well above average for this time of the year.

The strategies for growers in these regions will be dictated by the potential or lack of potential this will imply depending on what happens with storms over the summer.

Looking ahead

As harvest winds up in the north and central regions of the state, focus is now shifting to 2022 and what that may hold.

There will certainly be a reduction in cropped area unless there is substitutional summer rain and an early break.

Even if this is the case, the high input costs will see growers pull back on area to concentrate on the better paddocks where less inputs are needed, which will see an increase in area to pasture and fallow in 2022.

The dilemma for the low rainfall growers that did not hit their hoped-for grain yields and where a lot of the extra hectares were sown this year, is how much residual nitrogen and other nutrients are going to be available in 2022 to grow a profitable crop with minimal inputs.

A big proportion of the extra hectares sown in 2021 were in the low rainfall regions with little fallow for 2022.

Canola hectares will likely keep rolling upwards as will legumes, and barley area will possibly come back a bit again from the record highs a few years ago.

Wheat variety choice will probably swing to those known protein accumulators following the price spreads seen this year.

Whilst no guarantee these will hold for 2022, learnings from previous years again held true for 2021 with specific varieties performing better than others at the same yield levels.

Growers will be looking at more “free” nitrogen from legumes and pastures in 2022 and the break crop area will certainly increase from the historical lows of recent years.

Wheat grain yields closed in on the yield advantage that barley normally holds even in the southern regions and made better use of the mild finish to the season due to being able to take more advantage of the longer grain fill period.

Growers usually contract back to wheat when things are tight and if there is little summer rain and a later break, a larger percentage of the state’s crop will be wheat than previous years, particularly in the medium and low rainfall areas.

Question over canola

The higher rainfall areas are maxed out with canola area, with little room to push the percentage higher.

Canola area in 2022 will be influenced by price, seed supply, timing of the break and subsoil moisture as well as the percentage already in the rotation.

With all these variables in play, canola area for 2022 is a big question mark.

Canola was the most profitable crop in 2021 for many, and due to the lower input cost structures in 2021, it beat all other crops in most regions.

With the higher input costs mostly set for 2022 for all crops, growers will be changing their strategy around production which has already created a lot more discussion than normal for this time of the year.

Oat grain yields were spectacular this year and combined with less area of hay cut due to the lack of market options, there are more oats around than earlier predicted.

Milling oat quality in Western Australia this year has been excellent.

Lupins have also been a star performer in 2021, and even with the lack of markets once supply hits certain quantities, the value to the rotation alone will probably mean more area planted in 2022.

Source: GIWA

Further detail on crop conditions in individual WA port zones can be found on the GIWA website.

HAVE YOUR SAY