FOLLOWING a positive start to the season with much of eastern Australia receiving above average rainfall, the outlook for the 2020-21 winter crop is expected to be average to above average, with a big upside if winter rainfall delivers.

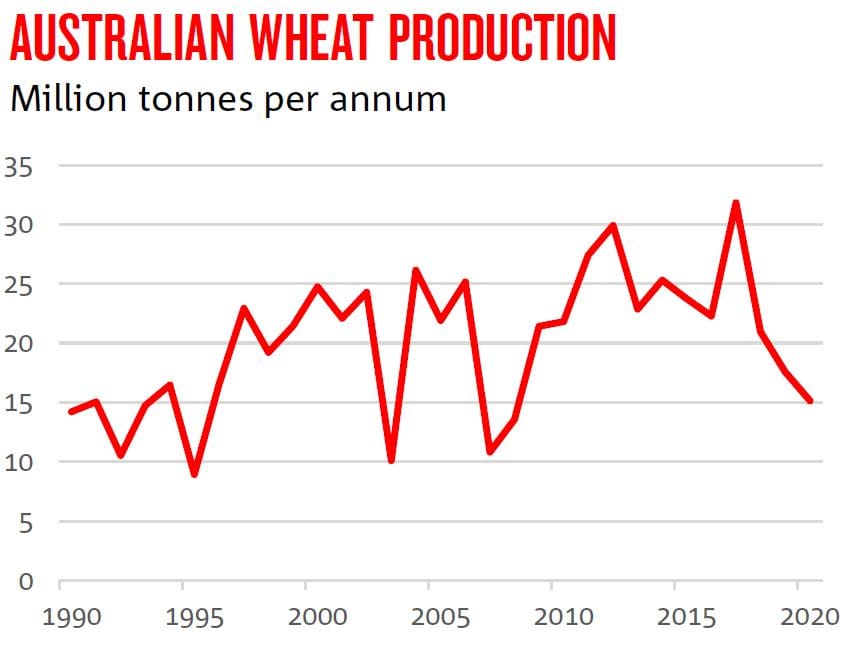

NAB’s latest ‘Winter Crop Update‘ report forecasts 2020-21 national wheat production to sit around the 25.9 million tonnes (Mt) range, based on average rainfall for the remainder of the season.

This could jump to 29Mt if there is 50 per cent above average rainfall for the remainder of the season.

NAB Agribusiness economist, Phin Ziebell, said NAB’s initial forecast of 25.9Mt was closer to average and in line with ABARES’ latest estimates of 26.7Mt.

“Rainfall across major cropping regions was generally above average earlier this year but tended to be below average in May, with the exception of Victoria and South Australia,” Mr Ziebell said.

“Rainfall across major cropping regions was generally above average earlier this year but tended to be below average in May, with the exception of Victoria and South Australia,” Mr Ziebell said.

“As such, seasonal conditions are very favourable in most of Victoria, New South Wales, South Australia and Tasmania, with most cropping regions experiencing above average soil moisture.

“However, Western Australia and Queensland are chasing rain, with the soil moisture deficit in Western Australia keeping the winter crop outlook dependant on forecast rainfall materialising.”

Wet winter forecast

The Bureau of Meteorology’s latest three-month outlook points to a wet winter and early spring across most of the country and all major grain-growing regions.

“Following what was a generally dismal 2019-20 winter cropping season in New South Wales and Queensland, the 2020-21 season is shaping up very well for grain growers,” Mr Ziebell said.

The combination of a low Australian Dollar (AUD), COVID-19-related buying activity and fears of global export restrictions saw AUD denominated wheat prices spike earlier in the year.

“These factors have since unwound and both domestic and global grain prices have fallen as a result,” Mr Ziebell said.

“While a historically large basis remains due to very limited carryout after two poor seasons, with the current season largely on track we expect this gap to close with new season crop availability at the end of this year, reflecting a downside for local prices.

“In addition, the Chinese Government’s decision to impose steep tariffs on Australian barley has hit prices, although with little carryout. We don’t expect the effects will be largely felt by producers until November.”

Dollar movements

The Australian dollar (AUD) has rallied relatively strongly recently from its lows in April and is now sitting around the high United States (USD) 0.60s, with NAB forecasting an increase to USD 0.72 and USD 0.75 by the end of 2020 and 2021, respectively.

“An increase in the AUD will help with input costs but limit local grain prices,” Mr Ziebell said.

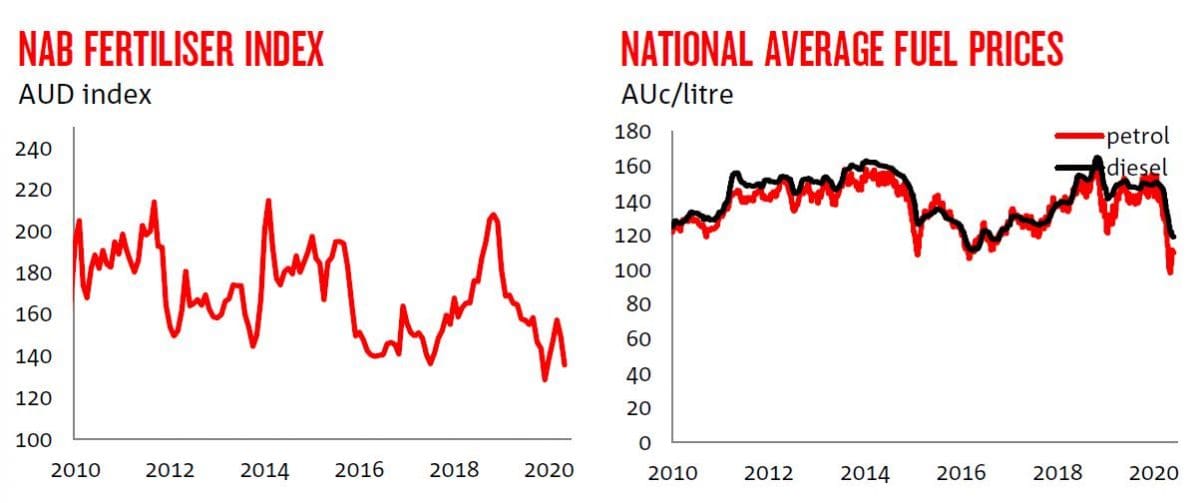

After the collapse in April, domestic petrol prices are recovering somewhat, yet diesel prices have fallen from around 150c/litre to around 120c/litre.

Fertiliser prices remain well below levels seen 18 months ago and forecasted concerns earlier in the year around fertiliser and agricultural chemical supply have stabilised.

Source: NAB

Full ‘Winter Crop Update’ report

HAVE YOUR SAY